Financial Planning for Success: Budget Creation Tips for Social Media Freelancers

Navigating the world of freelancing can be daunting, especially when it comes to handling your finances. Did you know, as a social media freelancer, having a robust budget in place is crucial for long-term success? This article will provide clear guidelines on creating an efficient budget that incorporates all aspects of your income and expenses.

Keep reading to pave the way towards financial stability while pursuing a career you love!

Key Takeaways

- A well – structured budget is crucial for social media freelancers to maintain financial stability and plan for both peak earning periods and slower months.

- Different types of budgets, such as fixed, flexible, and zero – based budgets, offer control over expenditure and adaptability to changing circumstances.

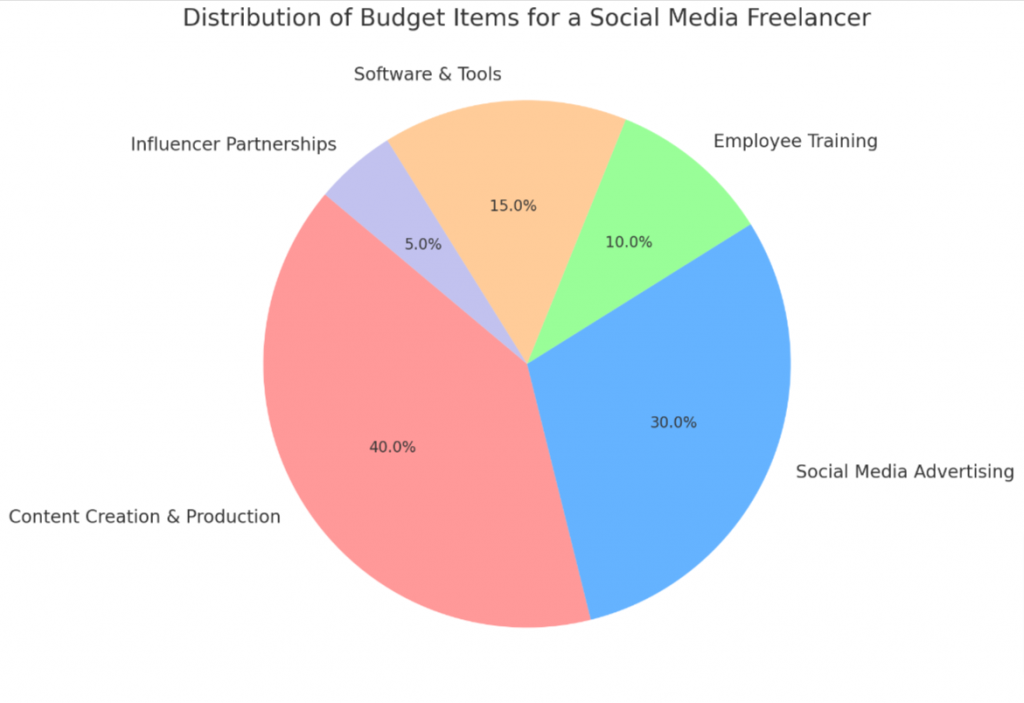

- Key aspects of a social media budget include content creation and production, social media advertising, employee training, software and tools, and influencer partnerships.

Understanding the Importance of Budgeting as a Social Media Freelancer

Budgeting plays a pivotal role for social media freelancers. Tracking income and expenses efficiently is critical in maintaining financial stability, and an organized budget provides this foundation.

Not only does it ensure fair payment but also serves as tangible proof of income during tax filing seasons.

In the world of freelance work, especially in social media services, your pay can often vary from one month to another. This inconsistency makes it even more essential to have a well-structured budget which allows you to plan for both peak earning periods and slower months.

Freelancers benefit immensely from understanding their average monthly income as it assists with mitigating potential financial risks and ensures business sustainability.

Furthermore, leveraging tax breaks and deducting business expenses are other forms of monetary relief that all HVAC technicians should explore. With proper organization into categories, such as content creation costs or advertising costs for social media channels – these can be effectively monitored while minimizing unnecessary overspending.

Lastly, considering future necessities like retirement plans is crucial too. Options like traditional IRAs, SEP IRAs or solo 401(k)s not only provide security during golden years but they also help reduce taxable income now – giving yet another reason why budgeting stands indispensable for any freelancer operating on various social media tools!

Calculating Your Average Monthly Income as a Social Media Freelancer

As a social media freelancer, the first step to budgeting is accurately figuring out your average monthly income. Start by reviewing past invoices and payments received over the last year.

Total your income from all sources including pay-per-click campaigns, sponsored posts, content creation services, and influencer partnerships. Divide this total by 12 to determine your average monthly income.

You may encounter months where you earn more than others due to seasonal demand or number of projects taken on. Keep a diligent record of these fluctuations as they can give an indication of earnings patterns throughout the year.

Having a clear understanding of your cash flow prepares you for leaner months and helps in effective financial planning.

To maintain financial stability, consider diversifying revenue streams beyond just clients’ contracts. This could include working with social media marketing agencies as consultants or selling creative tools like Canva designs or copy templates online.

Regular updating of these records ensures that they accurately reflect current earnings levels enabling more efficient management of finances and business resources.

Types of Budgets

Learn about the different types of budgets that can help you effectively manage your finances as a social media freelancer.

Fixed Budget

A fixed budget in social media marketing remains the same each month. It’s a popular choice for many companies; small businesses, for example, allocate around $30,000 annually for their social media presence under this type of budget.

Furthermore, medium-sized entities often double this amount to improve brand awareness and boost conversions. Large-scale organizations can pour over $100,000 into their fixed budgets to ensure optimal reach across different social media channels using various content types like sponsored posts or influencer campaigns.

A fixed budget offers robust control over expenditure and provides straightforward expense tracking with analytics and reporting tools regularly used by freelancers and agencies alike.

Flexible Budget

A flexible budget shapes up according to the changes in revenue and expenses. Unlike a fixed one, it doesn’t remain static but shifts with variances in income or unforeseen costs. This gives social media freelancers room for unpredictability, as unexpected client projects or last-minute ad campaigns can inflate expenses from initial estimates.

With a flexible budget, you can realign your financial resources based on these unplanned occurrences without disrupting other areas of spending. Thus, a flexible approach helps adapt spending strategies according to the evolving needs of a freelancer’s business operations while ensuring that critical goals are not sidetracked by monetary constraints.

Zero-based Budget

A zero-based budget is an effective tool for social media freelancers to manage their finances. With this type of budget, you allocate your income to specific expenses and savings goals, ensuring that every dollar has a purpose.

It helps prioritize your spending and identify areas where you can save money. In a zero-based budget, fixed expenses like rent and insurance should be included, as well as variable expenses such as groceries and equipment purchases.

It’s also important to set aside savings each month, especially for emergencies or slower months in the freelance business. By using a zero-based budget, you can have better control over your finances and work towards achieving your financial goals.

Key Aspects of a Social Media Budget

The key aspects of a social media budget include content creation and production, social media advertising, employee training, software and tools, and influencer partnerships.

Content creation and production

Content creation and production are crucial elements of a social media budget for freelancers. This includes expenses related to graphic design, copywriting, and video production. By allocating funds for these activities, freelancers can ensure the consistent creation of high-quality content that resonates with their target audience.

Setting specific goals, expectations, and key performance indicators (KPIs) for content creation and production is also essential in order to track the success of social media campaigns.

According to industry data, small companies typically allocate around $30,000 for content creation and production in their social media budgets, while medium-sized businesses double that amount and large enterprises spend over $100,000.

Social media advertising

Social media advertising is an essential component of a social media freelancer’s budget. Allocating a specific budget for advertising allows freelancers to reach their target audience effectively and promote their services or products.

Investing in social media advertising provides an opportunity to connect with potential clients and increase brand awareness. By considering the cost of social media advertising when creating their budget, freelancers can make strategic decisions to maximize the return on investment (ROI) from their ad campaigns.

It enables them to utilize various platforms like TikTok, Instagram, and LinkedIn to showcase their expertise and attract new clients. Social media advertising is a valuable tool that helps freelancers expand their reach and grow their business.

Employee training

Employee training is a crucial aspect of social media budgeting. It ensures that you and your team stay updated on the latest trends and best practices in social media marketing. By investing in training programs, workshops, or online courses, you can enhance your skills and expertise in areas such as content creation, advertising strategies, analytics tools, and platform updates.

This ongoing education helps you optimize your social media campaigns and stay ahead of the competition. Additionally, staying informed about industry changes allows you to adapt your strategies to meet the ever-evolving needs of your target audience and maximize the impact of your social media efforts.

Software & tools

Software and tools play a crucial role in the success of social media freelancers. These resources are essential for measuring the impact of social media activities and proving return on investment (ROI).

By investing in planning, posting, industry research, and influencer research software and tools, freelancers can enhance their ability to create effective strategies and manage their budgets efficiently.

Additionally, these software and tools allow freelancers to track their income and expenses, providing valuable insights for better financial planning. With the help of budgeting software, freelancers can identify spending patterns and discover areas where expenses can be reduced.

Overall, incorporating software and tools into their workflow is an integral part of achieving financial success as a social media freelancer.

Influencer partnerships

Influencer partnerships play a crucial role in the social media strategy of freelancers. By collaborating with influencers, freelancers can reach a wider audience and increase brand awareness.

The cost of influencer partnerships can vary depending on factors such as the size of the influencer’s following and the type of content collaboration. Including these partnerships in your social media budget is essential for setting goals, tracking performance, and maximizing the impact of paid social media advertising.

Influencers can help enhance the overall success of your social media efforts by providing authentic endorsements and engaging content that resonates with their followers.

Planning for Taxes

Planning for taxes is an essential part of budgeting as a social media freelancer. Here are some key points to consider:.

- Take advantage of tax breaks and deductions for business expenses.

- Explore retirement plans like traditional IRAs, SEP IRAs, and solo 401(k)s to decrease taxable income.

- Prioritize building an emergency fund to cover expenses during cash flow crunches.

- Maintain separate bank and credit accounts for work and personal expenses.

That’s it!

Factoring in Business Expenses

Factoring in business expenses is a crucial step in creating a budget as a social media freelancer. It allows you to understand and allocate funds for the costs associated with running your business effectively.

Here are some key business expenses to consider:.

- Internet and phone bills

- Website hosting and maintenance

- Insurance

- Computers and other equipment

- Office supplies

- Education, certification, and training

- Licensing fees

- Office or other leasing expenses

By accounting for these expenses in your budget, you can ensure that you have enough funds set aside to cover them without impacting your personal finances. This will help you maintain financial stability while growing your social media freelance business effectively.

Incorporating an Emergency Fund and Savings into Your Budget

Creating an emergency fund and incorporating savings into your budget is essential for financial stability and peace of mind as a social media freelancer. Here are key steps to take:

- Set a savings goal: Determine how much you want to save each month and set a specific target for your emergency fund.

- Automate your savings: Set up automatic transfers from your checking account to a separate savings account designated for emergencies.

- Prioritize saving: Treat saving as an expense in your budget, just like paying bills or buying groceries.

- Cut back on non-essential expenses: Identify areas where you can reduce spending to free up more money for saving, such as eating out less or canceling subscription services.

- Start small if necessary: Even if you can only save a small amount at first, it’s still important to get into the habit of saving regularly.

- Build an emergency fund buffer: Aim to save three to six months’ worth of living expenses as your emergency fund cushion.

- Consider high-yield savings accounts: Look for accounts that offer higher interest rates to help grow your emergency fund faster.

- Review and adjust regularly: Revisit your budget periodically to ensure you’re staying on track with your savings goals and make adjustments as needed.

Choosing a Budgeting Method That Works for You

Evaluate the 50/30/20 Method, Cash Envelopes, and Pay-Yourself-First approach to determine which budgeting method aligns best with your financial goals as a social media freelancer.

50/30/20 Method

The 50/30/20 method is a popular budgeting approach that can be beneficial for social media freelancers. With this method, you allocate 50% of your income towards needs, 30% towards wants, and 20% towards savings.

This provides a balanced approach to managing your finances. The 50% allocated to needs covers essential expenses like rent, utilities, groceries, and transportation. Meanwhile, the 30% allocated to wants allows for discretionary spending on non-essential items and leisure activities.

Lastly, the 20% allocated to savings helps you build an emergency fund and work towards financial goals. By following the 50/30/20 method, you can ensure that you’re taking care of necessary expenses while also allowing yourself some flexibility for personal enjoyment and saving for the future.

Cash Envelopes

Cash envelopes are a simple yet effective budgeting method for freelancers. This approach involves dividing your expenses into different categories and allocating a specific amount of cash to each category.

For example, you can have envelopes for rent, groceries, transportation, and other variable expenses. By using cash envelopes, freelancers can visually see how much money is left in each category and adjust their spending accordingly.

This method encourages budgeting and helps freelancers prioritize their spending by limiting overspending in certain areas. Whether it’s fixed expenses like rent or flexible expenses like dining out, cash envelopes can provide the discipline needed to stay on track with your budget and financial goals.

Pay-Yourself-First

A recommended budgeting method for social media freelancers is the pay-yourself-first approach. This means that before allocating money to any other expenses, such as bills or business costs, freelancers should prioritize paying themselves first.

Prudential Financial suggests that freelancers should earn more than what is needed to cover personal expenses in order to create a cushion for unexpected costs. By following this method, freelancers can ensure that they are consistently setting aside money for their own financial goals and building an emergency fund.

It also helps in avoiding overspending and allows for better financial planning. Consulting with an accountant is highly recommended to properly plan and manage taxes, as well as avoid penalties associated with improper tax filing.

Freelancers need to have a clear understanding of their average monthly income in order to effectively implement the pay-yourself-first strategy. To calculate this, freelancers can divide the total amount earned over the past year by 12.

Importance of Separating Personal and Business Budgets

Separating personal and business budgets is crucial for social media freelancers. By keeping these budgets separate, freelancers can effectively track their income and expenses related to their business activities.

This allows for better financial management and ensures that personal expenses do not interfere with the finances of the business. Additionally, separating these budgets provides a clear picture of the profitability or financial health of the freelance business, enabling freelancers to make informed decisions regarding pricing, expenses, and growth strategies.

Furthermore, having distinct personal and business budgets helps during tax time. Freelancers can easily identify deductible business expenses when they are clearly separated from personal expenses.

It also simplifies record-keeping by providing accurate documentation of income earned solely from the freelance work.

Lastly, separating personal and business budgets promotes professionalism in managing finances as a freelancer. It demonstrates a commitment to treating freelance work as a legitimate business venture rather than just a side gig or hobby.

By adopting good financial practices like maintaining separate accounts and budgeting diligently, freelancers establish credibility with clients and financial institutions while building a solid foundation for long-term success in their independent career.

Overall, separating personal and business budgets is essential for social media freelancers to maintain control over their finances while ensuring compliance with tax regulations and fostering professional growth in their freelance endeavors.

Conclusion

Creating a budget as a social media freelancer is crucial for managing your finances and achieving your financial goals. By understanding the importance of budgeting, calculating your average monthly income, and choosing the right budgeting method that works for you, you can effectively plan for taxes, factor in business expenses, and incorporate an emergency fund and savings into your budget.

Remember to separate personal and business budgets to ensure financial clarity and success as a freelancer in the ever-evolving world of social media.