Budgeting Mastery for the Modern Social Media Freelancer

Introduction

The allure of freelancing, particularly in the vibrant realm of social media, has never been stronger. With the freedom to choose projects, clients, and even work hours, many professionals are opting for this independent route, trading traditional 9-to-5 roles for a more flexible and personalized work-life balance. Yet, behind the enticing facade of autonomy and flexibility lies a critical aspect many new freelancers overlook: financial management.

Unlike salaried roles with predictable monthly incomes and employer-handled benefits, freelancers must navigate the often turbulent waters of irregular payments, direct tax obligations, and self-funded benefits. For social media freelancers, this challenge is further accentuated by the industry’s dynamic nature, where trends shift, platforms evolve, and client demands can vary dramatically. Consequently, effective budgeting isn’t just a recommended practice—it’s a lifeline.

Creating a budget as a social media freelancer is about more than just tracking earnings and expenses. It’s about forecasting trends, preparing for lean periods, investing in oneself, and ensuring that the freedom of freelancing doesn’t come at the cost of financial stability. In this guide, we’ll delve deep into crafting a budget that not only ensures fiscal health but also empowers social media freelancers to thrive and grow in their chosen domain.

Whether you’re a seasoned freelancer seeking to refine your financial strategies or are just embarking on this independent journey, this article promises actionable insights tailored for the unique challenges and opportunities of the social media freelance world.

1. Understanding the Freelance Financial Landscape

1.1. The Unpredictability of Freelance Income

For many transitioning into freelancing, the most jarring difference from traditional employment is the irregularity of income. Unlike fixed monthly salaries, freelance earnings can fluctuate widely based on project availability, client payment schedules, and market demand.

- Fluctuating income streams and their impact: Unlike a steady paycheck, freelancers might experience boom periods, with back-to-back projects followed by quieter times where gigs are sparse. This cyclic nature can lead to financial stress if not planned for, as bills and expenses remain consistent even if income doesn’t.

- The importance of financial cushioning: Due to the volatile nature of freelance income, having a financial buffer is not just advisable—it’s essential. This cushion can tide freelancers over during lean periods, ensuring they don’t dip into savings or resort to high-interest loans.

1.2. Expenses Unique to Social Media Freelancers

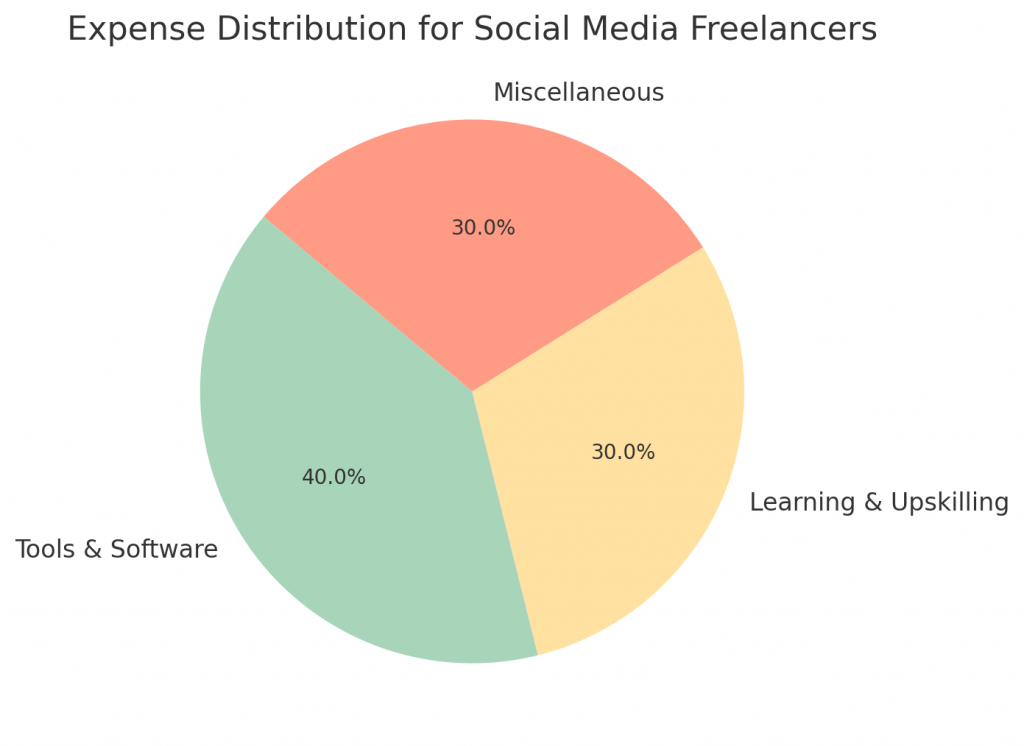

Being a social media freelancer often entails expenses that those in traditional roles might not encounter. Investing in oneself and one’s business is integral to staying competitive and delivering quality work.

- Investment in tools and software: From graphic design tools like Canva Pro to social media management suites like Buffer or Hootsuite, professionals often need subscriptions to various platforms to streamline their tasks and enhance deliverables.

- Continuous learning and upskilling: The digital landscape, especially social media, is ever-evolving. To stay relevant, freelancers often invest in courses, webinars, or certifications, ensuring they’re abreast of the latest trends and platform updates.

1.3. Long-Term Financial Goals and Planning

While dealing with immediate expenses and income is paramount, it’s equally crucial to look ahead. Freelancers don’t have the luxury of employer-provided benefits, making proactive long-term planning essential.

- Retirement, health benefits, and other long-term considerations: Without the cushion of company-sponsored retirement funds or health insurance, freelancers need to proactively set aside portions of their income for these eventualities. Ignoring these aspects can lead to financial vulnerabilities in the future.

- The lack of employer-sponsored benefits: Traditional roles often come with perks like health insurance, paid leave, and retirement fund contributions. Freelancers must budget for these necessities independently, ensuring they’re not left in a lurch during emergencies or as they age.

To truly thrive as a social media freelancer, one must grasp the unique financial landscape they operate within. By understanding the challenges and intricacies of freelance income and expenses, professionals can make informed decisions, ensuring they’re not just surviving but prospering in their chosen domain.

2. Steps to Creating an Effective Budget

2.1. Tracking All Income Sources

Every project, every gig, and every client contributes to a freelancer’s financial health. Keeping a meticulous record of all income sources is the first step towards a robust budget.

- Cataloging different clients and projects: Freelancers often juggle multiple clients, each with their own payment terms and schedules. By maintaining a detailed log, it becomes easier to predict cash flow, identify reliable income sources, and spot potential payment delays.

- Accounting for one-off gigs and recurring contracts: While long-term contracts provide a semblance of stability, one-off projects can offer lucrative payouts. Both need to be factored into the budget, ensuring comprehensive financial planning.

2.2. Detailing Fixed and Variable Expenses

To manage finances effectively, freelancers must have a clear understanding of their outgoings. This involves distinguishing between fixed costs, like monthly subscriptions, and variable expenses, such as ad-hoc software purchases.

- Understanding recurring monthly costs: These are predictable expenses, like rent, utility bills, and software subscriptions. Allocating funds for these ensures that the freelancer’s operational base remains uncompromised.

- Accounting for unpredictable expenses: These can range from sudden equipment replacements to unexpected course fees. While they’re harder to predict, having a miscellaneous fund can absorb such costs without derailing the budget.

2.3. Setting Aside Funds for Taxes

Freelancers don’t have the convenience of employer-handled tax deductions. Instead, they must be proactive in setting aside a portion of their earnings to meet tax obligations.

- Understanding freelance tax obligations: Depending on their location, freelancers might have to handle income tax, sales tax, or even self-employment tax. Familiarizing oneself with local tax regulations is paramount to avoid legal complications.

- Strategies for efficient tax planning: This involves setting aside a fixed percentage of earnings for taxes, exploring tax deductions applicable to freelancers, and considering quarterly tax payments to avoid year-end financial burdens.

Crafting a budget is akin to plotting a roadmap for financial success. By detailing income sources, accounting for all expenses, and planning for inevitable tax obligations, social media freelancers can navigate their financial journey with confidence, ensuring stability, growth, and peace of mind.

3. Tools and Resources for Budget Management

3.1. Digital Budgeting Tools

In today’s digital age, technology offers a plethora of tools designed to simplify and enhance budget management for freelancers.

- Overview of software like Mint, YNAB, and QuickBooks Self-Employed:

- Mint: A free tool that aggregates financial accounts, tracks expenses, and sets budgets. Its intuitive interface categorizes expenses automatically, offering insights into spending patterns.

- YNAB (You Need A Budget): Designed with the philosophy of giving every dollar a job, YNAB emphasizes proactive budgeting, helping users allocate funds towards specific goals or expenses.

- QuickBooks Self-Employed: Tailored for freelancers, this tool offers expense tracking, invoicing, and tax calculations in one platform, simplifying financial management.

3.2. Freelancer-Focused Financial Platforms

Certain platforms are crafted keeping the unique challenges and needs of freelancers in mind, offering comprehensive financial solutions.

- Platforms like AND.CO and HoneyBook:

- AND.CO: This all-in-one platform aids freelancers in sending proposals, drafting contracts, tracking time, invoicing clients, and managing expenses. Its integrated approach ensures that every financial aspect is interconnected and easily accessible.

- HoneyBook: More than just a budgeting tool, HoneyBook offers client management, project tracking, and automated workflows. Its financial features include invoicing, expense tracking, and financial reporting.

3.3. Traditional Budgeting Methods

While digital tools offer convenience, some traditional budgeting methods have stood the test of time, proving effective even in today’s tech-driven landscape.

- The envelope system and its digital counterparts: A tried and tested method, the envelope system involves allocating cash to different envelopes designated for specific expenses. While physical envelopes might seem outdated, many digital tools emulate this approach, ensuring funds are allocated effectively.

- Pros and cons of traditional methods in the digital age: While these methods instill discipline and are tangible, they might not offer the flexibility and analytics that digital tools provide. However, for those who prefer tactile engagement with their finances, these methods can be invaluable.

Navigating the financial landscape as a social media freelancer can be challenging, but with the right tools and resources, the journey becomes structured and manageable. By leveraging these platforms, freelancers can gain real-time insights into their financial health, make informed decisions, and ensure they’re on track to achieve both their immediate and long-term financial goals.

4. Tips for Managing Irregular Income

4.1. Building an Emergency Fund

In the realm of freelancing, where income can be unpredictable, an emergency fund isn’t just a safety net—it’s a lifeline.

- The importance of financial cushioning: An emergency fund can cover unexpected expenses, whether they’re personal, like medical emergencies, or professional, like equipment breakdowns. It also offers peace of mind during lean periods, ensuring that even if projects are sparse, essential expenses are covered.

- Tips on how much to save and where to store emergency funds: A general guideline is to have three to six months’ worth of expenses saved up. This fund should be easily accessible, making high-yield savings accounts an ideal choice. While investments can offer higher returns, they might not provide the liquidity required during emergencies.

4.2. Diversifying Income Streams

Placing all eggs in one basket can be risky, especially in the freelance world. Diversification not only offers multiple revenue channels but also safeguards against the failure of one income source.

- Seeking multiple clients or parallel freelancing avenues: Instead of relying solely on one major client, aim to have a portfolio of clients. This reduces dependency and ensures that even if one project ends abruptly, others can sustain you. Parallel avenues, such as blogging or consultancy, can also supplement income.

- The benefits of income diversification for stability: Multiple income streams can smoothen out the financial peaks and troughs inherent in freelancing. They also offer varied experiences, enriching your professional journey and enhancing your skill set.

4.3. Periodic Financial Reviews

The dynamic nature of freelancing means that what worked six months ago might not be optimal today. Regular financial check-ins ensure you’re aligned with your goals and can adapt to changing circumstances.

- The importance of revisiting and adjusting the budget: As income sources change, expenses rise or fall, and financial goals evolve, the budget should reflect these shifts. Regular reviews ensure that you’re not overspending in certain categories or under-allocating funds to others.

- Setting regular intervals for financial check-ins: Monthly reviews can track short-term changes, while quarterly or bi-annual reviews can offer a broader perspective, allowing for more significant budgetary adjustments.

Freelancing offers unparalleled freedom, but it also presents unique financial challenges. By building safety nets, diversifying income sources, and ensuring regular financial assessments, social media freelancers can navigate the uncertainties of irregular income. These strategies not only ensure stability during volatile periods but also empower freelancers to pursue opportunities with confidence, knowing they’re financially secure.

5. Planning for Future Financial Goals

5.1. Retirement Planning for Freelancers

Unlike traditional roles with employer-sponsored retirement plans, freelancers must take the initiative to secure their future.

- Tools like IRAs and solo 401(k)s: Individual Retirement Accounts (IRAs) and solo 401(k)s are instruments tailored for self-employed individuals or those without employer-sponsored plans. They allow freelancers to set aside money, often with tax advantages, ensuring a comfortable post-working life.

- Setting aside consistent contributions despite irregular income: While it might be tempting to skip retirement contributions during lean periods, consistency is key. Even small, regular contributions can compound over time, leading to significant savings in the long run.

5.2. Investing in Professional Growth

The dynamic world of social media requires professionals to be on their toes, adapting to new trends and mastering emerging platforms.

- Budgeting for courses, certifications, and conferences: Setting aside a portion of earnings for continuous learning ensures you remain competitive and updated. Whether it’s a new course on algorithm changes or a conference featuring industry leaders, these investments can significantly boost your value proposition.

- The ROI of continuous learning in freelancing: Beyond the immediate knowledge gain, upskilling can lead to higher-paying projects, expanded service offerings, and a reputation as an industry expert. The initial investment in learning often yields manifold returns in the long run.

5.3. Health and Insurance Considerations

Without the safety net of employer-provided insurance, freelancers must prioritize their health and safeguard against potential liabilities.

- Exploring health insurance options for freelancers: Various providers offer plans tailored for self-employed individuals or those without traditional employment benefits. It’s crucial to compare plans, considering factors like coverage, premiums, and deductibles, to find the best fit.

- The importance of other insurances like disability or professional liability: Beyond health, freelancers should consider insurances that protect against loss of income due to disability or potential legal claims from unsatisfied clients. These insurances provide peace of mind, ensuring external factors don’t derail your freelance journey.

As the saying goes, failing to plan is planning to fail. For social media freelancers, long-term financial planning is the bedrock upon which a stable and prosperous career is built. By prioritizing future goals, investing in growth, and safeguarding against uncertainties, freelancers can ensure that their present efforts lay the foundation for a secure and fulfilling future.

Conclusion

The world of freelancing, especially in the realm of social media, offers unparalleled opportunities to craft a career on one’s own terms. It promises the allure of autonomy, the thrill of diverse projects, and the joy of direct client interactions.

However, this world also presents its unique set of challenges, predominantly in managing finances effectively. Without the structured financial environment of traditional employment, social media freelancers are entrusted with the dual responsibility of generating income and managing it prudently.

Creating a budget, as detailed in this guide, is not merely an administrative task. It’s an empowering process that grants freelancers the confidence to make informed decisions, seize opportunities, and navigate challenges. By understanding the intricate balance of irregular incomes and varied expenses, by harnessing modern tools and time-tested strategies, and by planning for both immediate needs and future aspirations, freelancers can build a robust financial foundation.

In essence, the journey of a social media freelancer is a blend of creativity and strategy, of crafting compelling narratives for clients while weaving a personal story of financial stability and growth. As the digital landscape continues to evolve, those equipped with a clear financial roadmap will not only survive but thrive, turning their freelance dreams into sustainable and rewarding realities.

Additional Resources

To further empower social media freelancers in their financial journey, a wealth of resources is available, tailored to address the unique challenges and capitalize on the opportunities of the freelance landscape. Here’s a curated list of platforms, tools, books, and communities that can offer invaluable insights and assistance.

Platforms and Tools Tailored for Freelancer Financial Management:

- Wave: A free, intuitive platform designed for freelancers and small businesses, Wave offers invoicing, accounting, and receipt scanning, ensuring a holistic approach to financial management.

- FreshBooks: Tailored for service-based freelancers, this platform offers time tracking, expense management, invoicing, and insightful financial reports, all under one roof.

Recommended Books on Financial Literacy for Freelancers:

- “The Money Book for Freelancers, Part-Timers, and the Self-Employed” by Joseph D’Agnese and Denise Kiernan: This comprehensive guide delves deep into the nuances of freelance finances, offering actionable strategies to save, spend, and plan effectively.

- “Financial Planning for the Savvy Freelancer” by Lise Cartwright: A roadmap for freelancers to navigate the financial challenges of self-employment, this book covers everything from budgeting and taxes to retirement planning.

Online Courses on Freelance Finances:

- Udemy’s “Freelance Financial Planning”: A course tailored to equip freelancers with the tools and knowledge needed to manage irregular incomes, plan for taxes, and set long-term financial goals.

- Skillshare’s “Finance for Freelancers: How to Manage Your Money”: This course offers insights into budgeting, saving, and investing, ensuring freelancers can build a financially secure future.

Freelance Communities and Forums:

- Freelancers Union: A community dedicated to the needs of freelancers, offering resources, advocacy, and networking opportunities tailored for the freelance world.

- Reddit’s r/freelance: A vibrant community where freelancers from diverse domains share experiences, seek advice, and discuss challenges, offering peer insights into managing freelance finances.

In the ever-evolving world of freelancing, continuous learning and adaptability are key. These resources, spanning platforms, literature, courses, and communities, aim to empower social media freelancers with the knowledge, tools, and networks they need to carve a successful, financially stable path in their chosen domain.

With the right resources at their disposal, freelancers can confidently face the financial challenges of self-employment, turning them into opportunities for growth and prosperity.