Navigating Loan Processor Jobs: Your Guide to Financial Success

Introduction

Loan processor jobs are transforming the financial industry, offering professionals the chance to build a rewarding career while enjoying the flexibility of working remotely. As a critical role in the lending process, loan processors are in high demand, and the opportunities for growth and financial success are abundant. In this article, we’ll explore the diverse array of remote loan processor jobs available, from entry-level positions to specialized roles. Whether you’re a seasoned financial professional looking for a career change or a recent graduate eager to break into the industry, loan processor jobs offer a path to success. Join us as we delve into how you can become part of this thriving field, contributing to the financial well-being of individuals and businesses while achieving your own professional goals.

Loan Processor Job Opportunities

- Remote Mortgage Loan Processor

- Job Description: Review and process mortgage loan applications, ensuring accuracy and completeness. Communicate with borrowers, lenders, and other stakeholders to facilitate the loan process.

- Requirements: Strong attention to detail, excellent communication skills, proficiency in Microsoft Office. Previous experience in the financial industry is a plus.

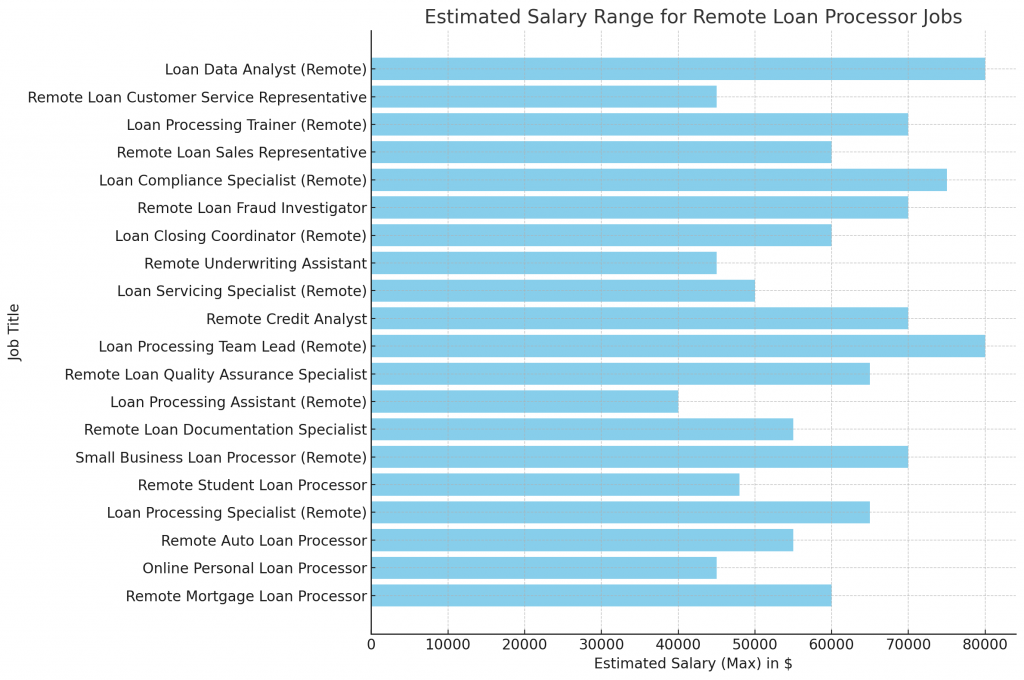

- Estimated Salary: $40,000-60,000/year

- Benefits: Competitive compensation, opportunities for advancement, flexible work schedule

- Online Personal Loan Processor

- Job Description: Evaluate personal loan applications, verify documentation, and make recommendations for loan approval. Provide exceptional customer service to borrowers throughout the loan process.

- Requirements: Excellent organizational skills, ability to multitask, strong customer service orientation. No prior experience required; training provided.

- Estimated Salary: $30,000-45,000/year

- Benefits: Comprehensive training, potential for bonuses, work-life balance

- Remote Auto Loan Processor

- Job Description: Process auto loan applications, review credit reports, and collaborate with dealerships and lenders to facilitate the loan approval process.

- Requirements: Familiarity with auto lending practices, strong problem-solving skills, ability to work independently. Previous experience in auto finance is preferred.

- Estimated Salary: $35,000-55,000/year

- Benefits: Competitive pay, opportunities for growth, flexible work arrangements

- Loan Processing Specialist (Remote)

- Job Description: Handle a variety of loan types, including personal, business, and home equity loans. Review applications, verify documentation, and ensure compliance with lending regulations.

- Requirements: Knowledge of lending practices, excellent attention to detail, ability to work in a fast-paced environment. Relevant experience or education in finance is a plus.

- Estimated Salary: $45,000-65,000/year

- Benefits: Competitive compensation, opportunities for advancement, remote work setup support

- Remote Student Loan Processor

- Job Description: Assist students and parents with the student loan application process. Review applications, verify eligibility, and provide guidance on loan options and repayment plans.

- Requirements: Strong communication skills, empathy, familiarity with student loan programs. No prior experience necessary; comprehensive training provided.

- Estimated Salary: $32,000-48,000/year

- Benefits: Meaningful work, professional development, flexible schedule

- Small Business Loan Processor (Remote)

- Job Description: Evaluate loan applications from small businesses, analyze financial statements, and make recommendations for loan approval. Collaborate with underwriters and loan officers to facilitate the lending process.

- Requirements: Understanding of small business financials, strong analytical skills, ability to work independently. Previous experience in business lending is a plus.

- Estimated Salary: $50,000-70,000/year

- Benefits: Competitive pay, opportunities for growth, remote work flexibility

- Remote Loan Documentation Specialist

- Job Description: Prepare and review loan documents, ensure accuracy and completeness, and communicate with borrowers and lenders to facilitate timely loan closings.

- Requirements: Excellent attention to detail, strong organizational skills, proficiency in loan documentation software. Previous experience in loan processing or documentation is preferred.

- Estimated Salary: $38,000-55,000/year

- Benefits: Competitive compensation, professional development, supportive team environment

- Loan Processing Assistant (Remote)

- Job Description: Provide administrative support to loan processors, assist with data entry, document preparation, and customer communication. Opportunity to learn and grow within the loan processing field.

- Requirements: Strong organizational skills, attention to detail, proficiency in Microsoft Office. No prior experience required; training provided.

- Estimated Salary: $28,000-40,000/year

- Benefits: Entry-level opportunity, potential for advancement, flexible work schedule

- Remote Loan Quality Assurance Specialist

- Job Description: Review processed loans to ensure accuracy, completeness, and compliance with lending regulations. Identify areas for improvement and provide feedback to loan processing teams.

- Requirements: Knowledge of lending practices, strong attention to detail, excellent problem-solving skills. Previous experience in loan processing or quality assurance is a plus.

- Estimated Salary: $45,000-65,000/year

- Benefits: Competitive pay, opportunities for growth, remote work flexibility

- Loan Processing Team Lead (Remote)

- Job Description: Manage a team of remote loan processors, oversee the loan processing workflow, and ensure timely and accurate processing of loan applications. Provide training and support to team members.

- Requirements: Strong leadership skills, experience in loan processing, ability to motivate and mentor others. Relevant education or certification in finance is a plus.

- Estimated Salary: $60,000-80,000/year

- Benefits: Leadership opportunity, competitive compensation, remote work flexibility

To apply for any of these jobs or similar positions, click here.

What People Say

“Working as a remote mortgage loan processor has been a game-changer for my career. The flexibility to work from home allows me to balance my professional and personal life effectively. The company provides comprehensive training and support, ensuring that I have the tools and knowledge to succeed in my role. The salary is competitive, and the opportunities for growth are abundant. While the workload can be demanding at times, the satisfaction of helping people achieve their homeownership dreams makes it all worthwhile.”

Jenny Goodin, Mystic, Connecticut

“Being an online personal loan processor has been an incredibly rewarding experience. The company’s commitment to customer service and employee development is exceptional. The training provided has equipped me with the skills to excel in my role, even without prior experience in the financial industry. The work-life balance is unbeatable, and the supportive team environment fosters a sense of camaraderie, even in a remote setting. The only challenge is the occasional difficult customer interaction, but the joy of helping people access the funds they need outweighs those moments.”

Emily Wheeler, Carefree, Arizona

“Working remotely as a loan processing specialist has been a fantastic opportunity for professional growth. The company values its employees and provides a supportive environment for learning and development. The salary is competitive, and the benefits package, including health insurance and retirement plans, is comprehensive. The work can be fast-paced and detail-oriented, but the satisfaction of contributing to the smooth functioning of the lending process is gratifying. The remote work setup allows for a better work-life balance, and the company’s trust in its employees is empowering.”

Marco Dogert, Eureka Springs, Arkansas

“Being a remote auto loan processor has been an exciting journey. The company’s focus on innovation and customer satisfaction is inspiring. The competitive pay and opportunities for advancement have kept me motivated to excel in my role. The flexible work arrangements have allowed me to balance my work and personal life effectively. The only drawback is the occasional long hours during peak lending periods, but the supportive team and the sense of accomplishment make it worthwhile. The company’s investment in cutting-edge technology has made the remote work experience seamless.”

Tessa Wang, Moonstone Beach, California

“Working as a remote loan documentation specialist has been a fulfilling experience. The company’s emphasis on accuracy and attention to detail aligns with my own work ethic. The salary is competitive, and the benefits package demonstrates the company’s commitment to its employees’ well-being. The remote work setup has been seamless, with regular team meetings and collaboration tools that keep everyone connected. The only challenge is the occasional tight deadlines, but the supportive team and clear communication channels make it manageable. The opportunity to play a crucial role in the lending process is truly rewarding.”

Quinten Harkey, Luck, Wisconsin

More Remote Jobs

- Remote Credit Analyst

- Job Description: Analyze credit reports, financial statements, and other relevant data to assess the creditworthiness of loan applicants. Provide recommendations to loan processors and underwriters.

- Requirements: Strong analytical skills, understanding of credit risk assessment, proficiency in financial analysis tools.

- Estimated Salary: $50,000-70,000/year

- Benefits: Competitive compensation, professional growth, remote work flexibility

- Loan Servicing Specialist (Remote)

- Job Description: Handle loan servicing tasks, including payment processing, customer inquiries, and account maintenance. Ensure accurate and timely servicing of loan accounts.

- Requirements: Excellent customer service skills, attention to detail, proficiency in loan servicing software.

- Estimated Salary: $35,000-50,000/year

- Benefits: Competitive pay, opportunities for advancement, flexible work schedule

- Remote Underwriting Assistant

- Job Description: Assist underwriters in reviewing loan applications, verifying documentation, and preparing loan approval recommendations. Learn and grow within the underwriting field.

- Requirements: Strong organizational skills, attention to detail, ability to work independently.

- Estimated Salary: $30,000-45,000/year

- Benefits: Entry-level opportunity, potential for growth, remote work flexibility

- Loan Closing Coordinator (Remote)

- Job Description: Coordinate the loan closing process, ensuring all necessary documents are prepared, signed, and properly filed. Communicate with borrowers, lenders, and title companies to facilitate smooth closings.

- Requirements: Excellent organizational skills, attention to detail, proficiency in loan closing software.

- Estimated Salary: $40,000-60,000/year

- Benefits: Competitive compensation, opportunities for advancement, flexible work arrangements

- Remote Loan Fraud Investigator

- Job Description: Investigate potential fraud in loan applications, conduct research, and gather evidence. Collaborate with legal and compliance teams to prevent and mitigate fraudulent activities.

- Requirements: Strong investigative skills, attention to detail, knowledge of fraud detection techniques.

- Estimated Salary: $50,000-70,000/year

- Benefits: Competitive pay, opportunities for growth, remote work flexibility

- Loan Compliance Specialist (Remote)

- Job Description: Ensure loan processing activities comply with federal and state regulations. Review loan files, identify potential compliance issues, and recommend corrective actions.

- Requirements: Knowledge of lending regulations, strong attention to detail, excellent problem-solving skills.

- Estimated Salary: $55,000-75,000/year

- Benefits: Competitive compensation, professional development, remote work flexibility

- Remote Loan Sales Representative

- Job Description: Generate leads, cultivate relationships with potential borrowers, and guide them through the loan application process. Work closely with loan processors to ensure smooth loan origination.

- Requirements: Excellent communication skills, sales experience, knowledge of loan products.

- Estimated Salary: $40,000-60,000/year (plus commissions)

- Benefits: Competitive base salary, uncapped earning potential, flexible work schedule

- Loan Processing Trainer (Remote)

- Job Description: Develop and deliver training programs for loan processing staff. Create training materials, conduct virtual training sessions, and provide ongoing support to ensure team success.

- Requirements: Experience in loan processing, excellent communication skills, ability to create engaging training content.

- Estimated Salary: $50,000-70,000/year

- Benefits: Competitive compensation, opportunity to shape team development, remote work flexibility

- Remote Loan Customer Service Representative

- Job Description: Provide exceptional customer service to borrowers throughout the loan process. Answer inquiries, resolve issues, and maintain customer satisfaction.

- Requirements: Excellent communication skills, problem-solving abilities, customer service experience.

- Estimated Salary: $30,000-45,000/year

- Benefits: Competitive pay, opportunities for growth, flexible work schedule

- Loan Data Analyst (Remote)

- Job Description: Analyze loan processing data to identify trends, inefficiencies, and opportunities for improvement. Provide insights and recommendations to enhance loan processing operations.

- Requirements: Strong analytical skills, proficiency in data analysis tools, ability to communicate insights effectively.

- Estimated Salary: $60,000-80,000/year

- Benefits: Competitive compensation, opportunity to drive process improvements, remote work flexibility

To apply for any of these jobs or similar positions, click here.

Embrace the Opportunity

As we’ve explored the diverse range of loan processor jobs and related remote opportunities, it’s clear that the financial industry is embracing the future of work. The flexibility, competitive salaries, and potential for growth offered by these roles are attracting professionals from various backgrounds. Whether you’re a seasoned financial expert or a newcomer to the field, loan processor jobs provide a pathway to success and financial stability.

Staying informed about the latest job openings and industry trends is crucial to seizing these exciting opportunities. By opting in to our email list, you’ll gain exclusive access to job alerts, expert insights, and resources to help you navigate the loan processing job market with confidence. Our mission is to empower you to find the perfect role that aligns with your skills, experience, and career aspirations.

Take the first step towards your dream loan processor job by joining our community of job seekers. Together, let’s unlock the door to a brighter financial future and a rewarding career. Your journey to success starts here!