Essential Financial Tools: A Freelancer’s Guide to Smart Money Management

Introduction

In the age of digital dominance, social media freelancers are the unsung architects behind many successful brands, campaigns, and online movements. These professionals, armed with creativity and digital savvy, help businesses navigate the ever-changing tides of platforms like Instagram, Twitter, and TikTok. However, while they might be experts at curating content and building online communities, managing finances—a crucial aspect of freelancing—can often be a daunting task.

Unlike traditional 9-to-5 roles, freelancers don’t have the luxury of a predictable paycheck, employer-handled taxes, or company-sponsored financial tools. Instead, they tread the waters of variable incomes, complex tax considerations, and the constant need to manage, invoice, and chase payments. This landscape, while rewarding, requires meticulous financial planning and management.

Thankfully, the digital era doesn’t just offer social media platforms; it also brings a suite of financial apps designed to make a freelancer’s life easier. From budgeting and invoicing to tax preparation and investments, there’s an app for every financial need. This article delves into these essential tools, ensuring that every social media freelancer is equipped not just to earn money, but also to manage, save, and grow it efficiently.

Why Financial Management is Crucial for Social Media Freelancers

In the dynamic world of social media, where algorithms shift and platforms evolve, freelancers are accustomed to adapting. Yet, amidst mastering the latest trends and tools, one aspect remains constant: the imperative nature of sound financial management. Let’s explore why every social media freelancer should prioritize their financial health.

The unpredictable nature of freelance income

Freelancing, by its very nature, is synonymous with variability. One month could see a freelancer juggling multiple high-paying projects, while the next might be quieter with fewer assignments.

- Monthly variations in earnings: Unlike salaried employees who can anticipate their monthly income, social media freelancers often grapple with income fluctuations. This unpredictability mandates a well-structured budget and a keen understanding of one’s financial commitments.

The necessity for budgeting and financial planning

With no guaranteed monthly paycheck, planning becomes paramount. It’s not just about tracking what’s earned, but also forecasting future earnings, understanding expenses, and ensuring there’s a safety net for leaner times.

- Projecting income, managing expenses, and saving for the future: A successful freelancer not only tracks current finances but also projects future earnings based on client commitments, potential leads, and industry trends. This forward-thinking approach, combined with disciplined saving, ensures long-term financial stability.

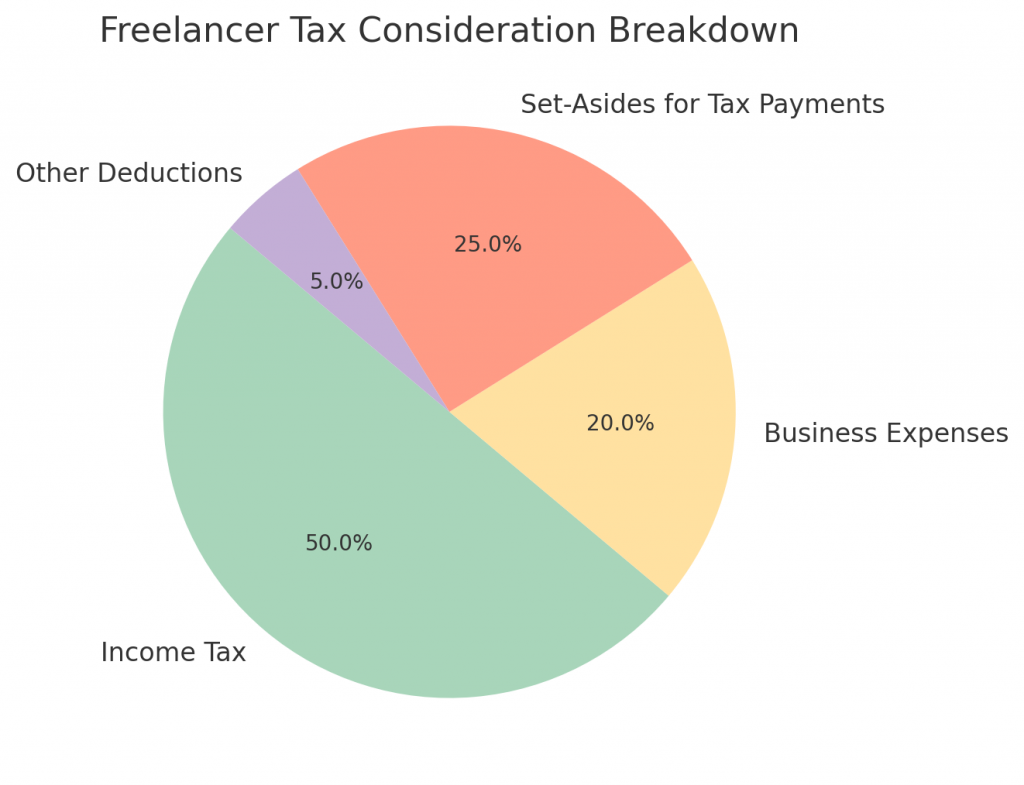

Tax considerations for freelancers

Taxes can be complex for anyone, but freelancers face unique challenges. With multiple income sources, deductible expenses, and the absence of an employer withholding taxes, freelancers need to be proactive and informed.

- Understanding deductions, setting aside money for tax payments, and navigating freelancer-specific tax nuances: Freelancers can often deduct business expenses, from software subscriptions to home office costs. However, they also need to ensure they’re setting aside sufficient funds for tax payments. Missteps or oversights can lead to hefty fines or a stressful tax season.

In essence, while social media freelancers excel in the digital space, grounding themselves in the fundamentals of financial management ensures they can sustain and grow their careers. After all, financial stability isn’t just about peace of mind; it’s the foundation upon which creativity and innovation thrive.

Budgeting and Expense Tracking Apps

In the digital age, freelancers have an array of tools at their fingertips to simplify and streamline their financial management. Budgeting, often perceived as a tedious task, can be transformed with the right app. These tools not only help track income and expenses but also provide insights into spending habits, enabling better financial decisions. Let’s explore some of the top apps tailored for the needs of social media freelancers.

Overview of the importance of budgeting

Budgeting is the backbone of sound financial health. For freelancers, it provides a clear picture of their financial landscape, highlighting where money is coming from and where it’s being spent. A well-structured budget enables freelancers to set aside funds for taxes, save for future goals, and ensure they’re prepared for lean periods.

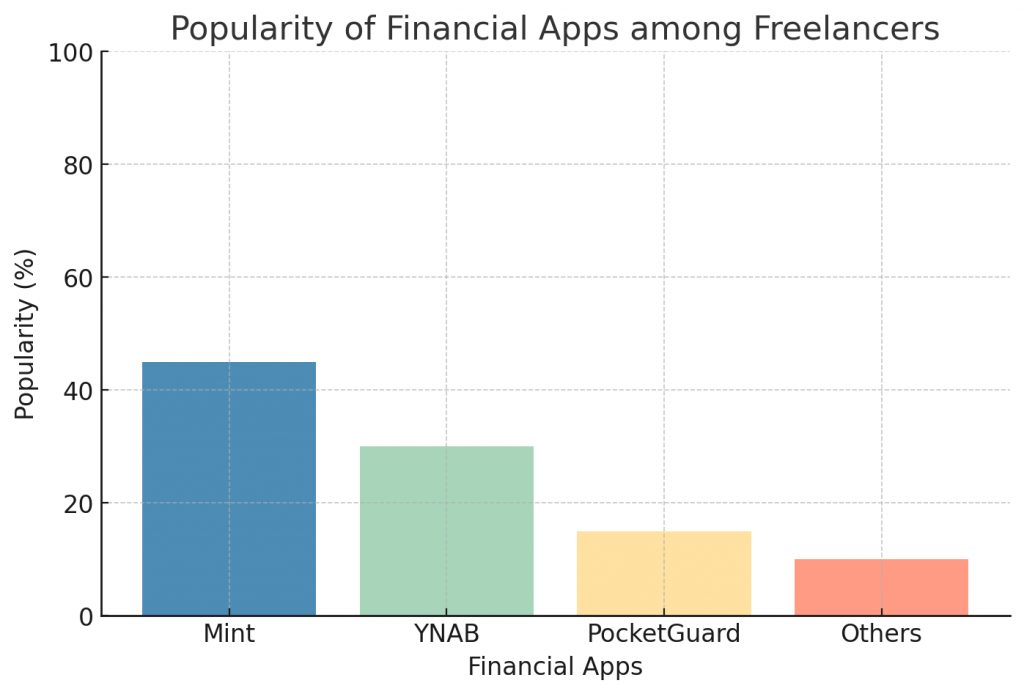

Mint: One of the pioneers in the budgeting app space, Mint offers a holistic view of one’s finances.

- Features and benefits: Mint automatically categorizes and tracks expenses, sets up bill reminders to avoid late fees, and provides customized budgeting suggestions. Its intuitive dashboard offers a snapshot of your financial health, from net worth to credit score.

- How it’s tailored for freelancers: With the ability to link multiple bank accounts, credit cards, and even investment portfolios, freelancers can get a consolidated view of their diverse income streams and expenses.

You Need a Budget (YNAB): YNAB’s philosophy revolves around giving every dollar a job, ensuring clarity and purpose in budgeting.

- How YNAB’s approach is different: Instead of just tracking expenses, YNAB encourages proactive budgeting. Users allocate funds to specific categories, ensuring they live within their means and prioritize their spending.

- Advantages for freelancers: The app’s focus on forward-planning aligns perfectly with the unpredictable nature of freelance income. It helps users prepare for larger, infrequent expenses, ensuring they’re never caught off guard.

PocketGuard: For those who find budgeting overwhelming, PocketGuard offers a simplified approach.

- Simplifying expense tracking: By linking bank accounts and cards, the app automatically categorizes and tracks spending. It then provides insights into where money is going, highlighting potential savings.

- Identifying spending habits: PocketGuard’s “In My Pocket” feature shows how much money is available for discretionary spending, ensuring freelancers don’t inadvertently overspend.

In summary, with the myriad of budgeting apps available, managing finances no longer has to be a daunting task. By choosing a tool that aligns with their needs and preferences, social media freelancers can transform budgeting from a chore into a strategic tool for financial success.

Invoicing and Payment Apps

For freelancers, getting paid is not as straightforward as waiting for a monthly paycheck. It involves creating invoices, tracking payments, and sometimes, following up with clients to ensure timely compensation. Fortunately, a slew of invoicing and payment apps have emerged to simplify this process, allowing freelancers to focus on their work rather than administrative tasks.

The need for timely and professional invoicing. First impressions matter, and a professional, clear invoice not only conveys expertise but also sets the tone for prompt payment. Beyond aesthetics, invoicing tools help manage cash flow, ensuring freelancers have a clear picture of expected income.

FreshBooks: A favorite among freelancers, FreshBooks offers more than just invoicing.

- In-depth features: Beyond creating professional invoices, the platform provides time tracking, expense management, and project collaboration tools. Its automated features, like recurring invoices and payment reminders, save freelancers precious time.

- Tailored for freelancers: With features like the ability to accept online payments and a mobile app that allows invoicing on-the-go, FreshBooks understands the dynamic nature of freelance work and caters to its unique demands.

QuickBooks Self-Employed: This platform combines Intuit’s accounting prowess with features tailored for freelancers and independent contractors.

- Tailored solutions: Beyond invoicing, QuickBooks Self-Employed offers mileage tracking, expense categorization, and quarterly tax estimation. Its dashboard provides a snapshot of financial health, from profit and loss statements to upcoming tax obligations.

- Streamlining tax preparation: The app’s ability to categorize expenses and track deductions simplifies tax season, ensuring freelancers maximize their deductions and stay compliant.

Wave: For freelancers just starting or those on a tight budget, Wave offers a suite of free tools.

- Free invoicing and accounting: Wave allows users to create professional invoices, manage expenses, and even handle basic accounting without a subscription fee.

- Additional features: While invoicing and accounting are free, Wave also offers affordable payroll services and the ability to accept online payments for a fee.

Invoicing and payments are integral to a freelancer’s financial ecosystem. With these apps, the process becomes seamless, efficient, and professional, ensuring social media freelancers are compensated fairly and promptly for their expertise.

Tax Preparation and Deduction Tracking Apps

Tax season can be a source of anxiety for many freelancers. Unlike traditional employees, freelancers must actively manage their tax obligations, from setting aside funds to understanding eligible deductions. However, with the right tools, this seemingly daunting task can be simplified, ensuring compliance without the stress.

The complexities of freelancer taxes

Freelancers face a unique set of challenges during tax season. With varied income sources and the absence of automatic tax withholdings, they need to be proactive to avoid surprises. Additionally, understanding which expenses qualify as deductions can significantly impact the amount owed.

TurboTax Self-Employed: TurboTax is a household name in tax preparation, and its self-employed version is tailored for freelancers.

- Features aiding freelancers: TurboTax Self-Employed assists users in identifying industry-specific deductions, ensuring they don’t miss out on potential savings. The platform also provides a year-round income and expense tracker, making tax season preparation smoother.

- Guided support: With its intuitive interface, the app guides users step-by-step through the tax filing process, offering explanations for each section. For additional peace of mind, users can opt for a review from a certified tax professional before filing.

Stride Tax: Designed specifically for the needs of independent workers, Stride Tax offers robust tax support without the hefty price tag.

- Tracking deductions in real-time: The app allows users to track expenses, mileage, and other potential deductions in real-time, ensuring nothing is overlooked.

- Estimating tax payments: For those required to make quarterly estimated tax payments, Stride Tax provides clear estimates, ensuring freelancers set aside sufficient funds.

H&R Block: A hybrid between traditional tax services and digital platforms, H&R Block offers a range of options suitable for freelancers.

- Advantages of combining app with in-person consultation: Freelancers can begin their tax process using the H&R Block app, which offers features similar to other tax preparation platforms. However, if they encounter complexities or need additional assurance, they can easily transition to in-person consultation at an H&R Block office.

- Tailored freelancer support: The platform recognizes the unique challenges faced by freelancers, offering guidance on topics like self-employment tax, deductions, and credits.

In conclusion, while taxes are inevitable, the stress and uncertainty associated with them don’t have to be. With the right app, social media freelancers can navigate tax season with confidence, ensuring they remain compliant while maximizing their financial benefits.

Time Management and Project Tracking Apps

In the world of freelancing, time is money. Efficiently managing one’s hours not only ensures deadlines are met but also directly impacts income. For social media freelancers, where tasks can range from content creation to client consultations, effective time management is paramount. Furthermore, tracking time accurately aids in invoicing, ensuring every minute spent on a project is accounted for. Let’s explore apps that assist freelancers in managing their most valuable resource: time.

The link between time management and financial success

Efficiency and productivity are the cornerstones of a successful freelance career. By effectively managing time, freelancers can take on more projects, ensure client satisfaction, and maintain a work-life balance. Moreover, accurate time tracking ensures that freelancers are compensated fairly for the hours they’ve dedicated to a project.

Toggl: A favorite among freelancers, Toggl offers a simple yet powerful solution to time tracking.

- Tracking time across multiple projects and clients: With a user-friendly interface, Toggl allows freelancers to switch between tasks effortlessly, ensuring every minute is logged.

- Reports and insights: Beyond mere tracking, Toggl provides detailed reports, helping freelancers understand where their time is spent and identify areas for efficiency improvement.

Harvest: Merging time tracking with invoicing, Harvest is a comprehensive tool for freelancers.

- Combining time tracking with invoicing: After logging hours on a project, freelancers can directly create invoices within the app, ensuring no billable hours are missed.

- Integrations: Harvest integrates with a plethora of other tools, from project management apps like Trello and Asana to payment platforms like PayPal and Stripe, offering a seamless workflow.

Asana: While primarily a project management tool, Asana’s features can greatly aid social media freelancers in time management.

- Managing projects, tasks, and deadlines: Asana allows freelancers to break projects into tasks, set deadlines, and even collaborate with clients or other freelancers.

- Visualizing workload: With boards, lists, and calendar views, freelancers can get a visual overview of their commitments, ensuring they allocate their time efficiently.

In essence, managing one’s time is not just about punctuality; it’s intricately linked to a freelancer’s financial success. By leveraging these apps, social media freelancers can ensure they’re making the most of their hours, leading to increased income, client satisfaction, and overall career growth.

Investment and Savings Apps for Freelancers

The financial journey of a freelancer doesn’t end with earning and spending. Building a secure future involves actively saving and investing a portion of one’s income. Unlike traditional employees who might have employer-sponsored retirement plans or benefits, freelancers must pave their own path to financial security.

Fortunately, a range of apps cater to these needs, making savings and investments accessible and straightforward.

The importance of savings and investments for future financial security

While freelancing offers many perks, it also comes with uncertainties—fluctuating incomes, potential dry spells, and the absence of employer-sponsored retirement benefits. This landscape underscores the need for freelancers to be proactive about their savings and investments, ensuring they’re prepared for both short-term challenges and long-term goals.

Acorns: Demystifying the world of investing, Acorns offers a beginner-friendly approach.

- How micro-investing can benefit freelancers: Acorns rounds up everyday purchases to the nearest dollar and invests the difference. Over time, these small amounts accumulate, offering an effortless way for freelancers to begin their investment journey.

- Diverse portfolios: Users can choose from portfolios tailored to their risk tolerance, ensuring investments align with their financial goals and comfort levels.

Stash: Empowering users to start investing with as little as $5, Stash aims to make investments accessible to everyone.

- Personalized investment guidance: Stash offers recommendations based on a user’s financial profile and goals, guiding them through the investment process.

- Flexibility: Beyond traditional stocks and bonds, users can invest in thematic portfolios, reflecting sectors or trends they believe in.

Digit: While not strictly an investment app, Digit’s primary goal is to simplify savings, a crucial first step before delving into investments.

- Automated savings based on spending patterns: Digit analyzes a user’s income and spending habits, automatically setting aside a suitable amount into savings. This ensures freelancers save consistently without straining their finances.

- Earning interest: Over time, the savings accumulated in Digit earn a bonus, further incentivizing users to save.

In summary, the world of savings and investments might seem daunting, especially for freelancers juggling multiple roles. However, with the right tools, it becomes manageable and even rewarding. By actively saving and investing, social media freelancers can ensure they’re not just thriving in the present, but also securing their future.

Key Features to Look for in a Financial App for Freelancers

With the myriad of financial apps available, choosing the right one can be overwhelming. However, by understanding the essential features tailored to a freelancer’s needs, this decision becomes more straightforward. Whether it’s for budgeting, invoicing, or investing, here are key features freelancers should consider when evaluating a financial app.

User-friendly interface: For an app to be effective, it must be easy to use. A cluttered or complicated interface can deter freelancers from fully utilizing the tool.

- The importance of intuitive design: An app should simplify a freelancer’s life, not complicate it. Clean designs, clear navigation, and intuitive layouts ensure users can manage their finances efficiently.

Integration capabilities: In the interconnected world of digital tools, an app’s ability to integrate with other platforms can significantly enhance its utility.

- Syncing with other apps and bank accounts: Whether it’s importing transactions from bank accounts, integrating with project management tools, or connecting with tax platforms, integrations can streamline various financial processes, ensuring consistency and reducing manual inputs.

Data security: Financial apps handle sensitive data, from bank account details to personal identification information. Ensuring this data remains secure is paramount.

- Ensuring financial details are safe and encrypted: Look for apps that employ end-to-end encryption, two-factor authentication, and other security measures. Trusting an app with financial data is a significant step, and it should not be taken lightly.

Cost-effectiveness: While many apps offer free versions, others come with subscription fees. Balancing the app’s features with its cost ensures freelancers get value for their money.

- Balancing app features with subscription costs: Before committing to a paid app, freelancers should evaluate if the features offered justify the cost. Often, free apps or platforms with nominal fees provide sufficient tools for a freelancer’s needs.

Customization and flexibility: Every freelancer’s financial journey is unique. Hence, an app that offers customization ensures that the tool aligns with individual needs and preferences.

- Tailoring the app to personal needs: Whether it’s setting specific budget categories, customizing invoice templates, or choosing investment preferences, an app’s ability to adapt to a user’s requirements enhances its effectiveness.

In conclusion, while the perfect app might vary based on individual preferences and needs, understanding these key features provides a solid foundation for evaluation. By prioritizing user-friendliness, security, integration capabilities, cost-effectiveness, and customization, social media freelancers can select financial tools that truly align with their goals and streamline their financial journey.

Conclusion

Navigating the intricate world of finances as a social media freelancer can feel like a balancing act. On one hand, the allure of flexibility, autonomy, and pursuing one’s passion provides unparalleled satisfaction. On the other, the complexities of fluctuating incomes, self-directed tax obligations, and the need for proactive financial planning can seem daunting. However, in this digital age, equipped with the right tools, managing these challenges becomes not only feasible but also empowering.

Financial apps, specifically tailored for freelancers, act as invaluable allies. They simplify budgeting, making sense of varied income streams. They professionalize invoicing, ensuring timely and fair compensation. They demystify taxes, guiding freelancers through deductions and obligations. And importantly, they pave the way for a secure financial future, assisting in savings and investments.

For the modern social media freelancer, these tools are more than just digital platforms; they’re enablers of dreams. By leveraging these apps, freelancers can focus on what they do best—creating, innovating, and influencing the digital realm—secure in the knowledge that their financial foundations are robust and resilient.

As the freelance landscape continues to evolve, so will the tools that support it. But the core principle remains the same: proactive financial management is the cornerstone of sustained success. Whether you’re a seasoned freelancer or just starting your journey, embracing these tools ensures not just financial stability but also the freedom to pursue your passion without constraints.

Additional Resources

While the apps highlighted in this article serve as powerful tools in a freelancer’s financial toolkit, continuous learning and staying updated is essential. The world of finance, much like social media, is ever-evolving. To further assist social media freelancers in their financial journey, here are some additional resources that offer valuable insights, guidance, and education.

- Websites:

- Freelancers Union: A comprehensive platform dedicated to the needs of independent workers, offering resources, advocacy, and community support.

- Bonsai Finance Blog: Tailored content for freelancers, discussing topics ranging from invoicing best practices to navigating tax season.

- Books:

- “The Money Book for Freelancers, Part-Timers, and the Self-Employed” by Joseph D’Agnese and Denise Kiernan: A practical guide addressing the unique financial challenges faced by freelancers.

- “Financial Planning for the Savvy Freelancer” by Lise Cartwright: Insights into budgeting, saving, and investing specifically tailored for the freelance community.

- Online Courses and Webinars:

- Coursera’s “Personal & Family Financial Planning” course: While not freelancer-specific, this course provides foundational knowledge beneficial for anyone looking to strengthen their financial planning skills.

- Udemy’s “Freelance Bootcamp – The Comprehensive Guide to Freelancing”: Covers a range of topics, including financial management, for those embarking on a freelance career.

- Podcasts:

- “The Freelance Friday Podcast” by Latasha James: Episodes cover a range of topics relevant to freelancers, including episodes dedicated to financial management.

- “Being Freelance” with Steve Folland: Conversations with freelancers from diverse fields, often touching upon the financial challenges and triumphs of the freelance life.

- Financial Advisors and Consultants:

- Seeking personalized advice from certified financial planners or consultants can be invaluable. They can offer tailor-made strategies, ensuring a freelancer’s unique financial circumstances and goals are addressed.

- Freelancer Communities and Forums:

- Platforms like Reddit’s r/freelance or Stack Exchange’s Freelancing community offer spaces for freelancers to share experiences, ask questions, and learn from peers navigating similar challenges.

Embarking on a freelance journey, especially in the dynamic realm of social media, is an exciting endeavor. With passion and creativity at the forefront, it’s essential not to neglect the financial underpinnings that sustain this journey. By leveraging the right tools and continuously seeking knowledge, social media freelancers can ensure they’re not just thriving in the digital realm but also building a secure and prosperous financial future.