Building Wealth for the Future: Proven Investment Strategies for Stability

Introduction

In an era where financial stability often seems like an elusive dream, navigating the intricacies of wealth accumulation becomes an indispensable skill. With the rise in living costs, the unpredictability of social security, and the shifting dynamics of the global economy, ensuring one’s financial security, especially in the latter years of life, requires more than just savings; it necessitates wise investing.

The art and science of investing stretch beyond mere financial transactions. It encapsulates the cultivation of a mindset that balances risk, reward, patience, and a keen understanding of the ever-fluctuating economic landscape.

Investing is not merely a task for the wealthy; it’s a fundamental practice that, when executed wisely, can pave the way to financial freedom and long-term security for everyone. Whether you’re a seasoned investor or a novice exploring how to safeguard your future, understanding investment principles, the varied avenues available, and the common pitfalls encountered is crucial. Investing isn’t just about accumulating wealth; it’s about strategically growing and preserving it, ensuring that your future self is catered for and that your financial legacy endures.

This article endeavors to unravel the complexities of investing, providing clear, actionable tips aimed at fortifying your financial future. From the grassroots of investment knowledge to strategic advice for those already on their investment journey, this comprehensive guide aims to be a valuable resource.

Through understanding the basic principles of investing, recognizing the importance of clear goal setting, appreciating the power of diversification, and adopting a disciplined and educated approach, you can navigate through the tumultuous seas of market volatility towards a future of financial security.

Embark on this journey through the realms of investment wisdom, absorbing insights that will not only illuminate the path to financial stability but also equip you with the tools needed to navigate it adeptly. The pursuit of long-term financial security is a journey, not a destination. Thus, let’s delve into the world of investing, exploring strategies, understanding nuances, and demystifying concepts, all aimed at equipping you to fortify your financial future with informed, strategic decisions.

Understanding the Basics of Investing

The world of investing, with its myriad of terms, trends, and tactics, can often seem intimidating. However, at its core, investing revolves around a few foundational principles. Grasping these basics can not only demystify the broader landscape but also provide a firm foundation upon which to build your investment journey.

What is investing?

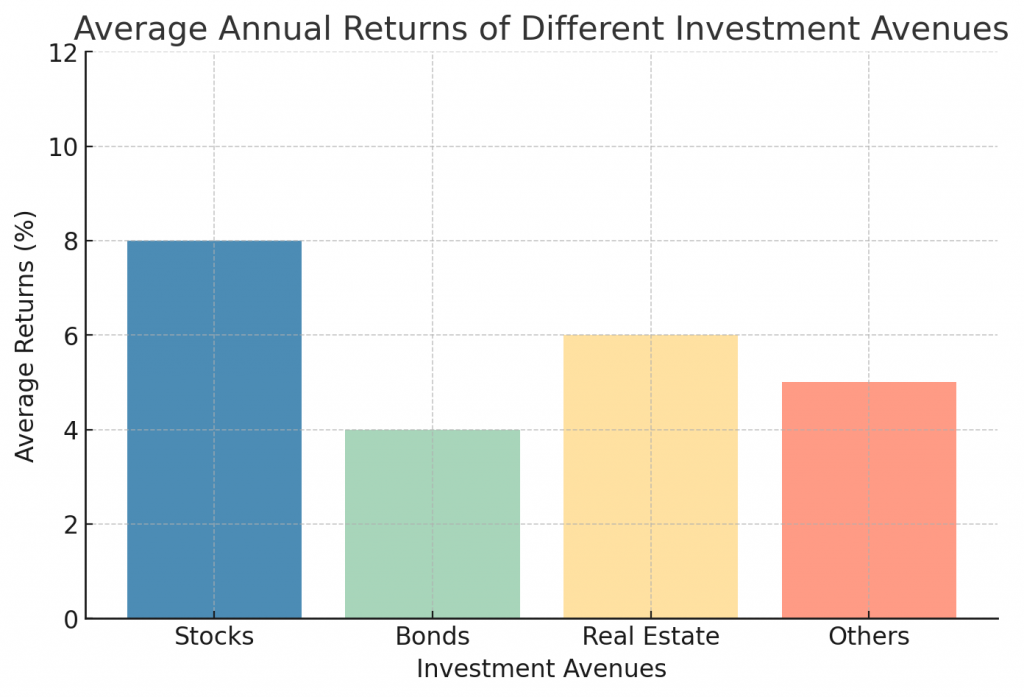

Investing, in its essence, involves allocating resources, typically money, with the expectation of generating an income or profit in the future. It’s the process of putting your money to work for you, leveraging assets that can potentially earn returns. Instead of letting money sit idle in a bank account, investing channels it into avenues that have the potential to grow, be it stocks, bonds, real estate, or myriad other opportunities.

The power of compounding: Often dubbed the ‘eighth wonder of the world,’ compounding is a powerful force in the realm of investing. It refers to the process where an investment earns interest, and then that interest earns interest on itself, leading to exponential growth over time. The magic of compounding underscores the importance of starting early and staying invested. Even small, consistent investments, when compounded over time, can lead to significant wealth accumulation.

Risk vs. reward: At the heart of investing lies the balance between risk and reward. Typically, higher potential returns are associated with higher risks. It’s essential to understand your personal risk tolerance, which is influenced by factors such as your financial situation, investment goals, and time horizon. Different investment avenues come with varied risk profiles, from the relative stability of bonds to the volatility of stocks. An informed investor recognizes these dynamics, making decisions that align with their risk appetite and investment objectives.

In summary, understanding the basics of investing is akin to laying the foundation of a building. With a strong, informed base, you can confidently explore the broader landscape, making decisions that align with your financial goals and risk tolerance. Investing is as much about mindset as it is about money. By grasping these foundational principles, you’re better equipped to navigate the complexities of the investment world, ensuring your decisions are rooted in knowledge and strategy.

Setting Clear Investment Goals

A journey without a destination can lead to aimless wandering. Similarly, investing without clear goals can result in haphazard decisions and missed opportunities. Setting well-defined investment objectives acts as a compass, guiding your decisions and providing clarity in times of market volatility.

Short-term vs. long-term investing: Investment horizons can vary widely, and it’s essential to differentiate between short-term and long-term goals.

- Short-term investing typically refers to objectives that are one to three years away, like saving for a vacation or a down payment on a car. These investments prioritize liquidity and tend to be less risky, as there’s less time to recover from potential market downturns.

- Long-term investing, on the other hand, focuses on goals that are more than three years away, such as retirement or purchasing a home. Given the extended time frame, investors can often afford to take on more risk, hoping for higher returns, as there’s more time to ride out market fluctuations.

Retirement planning: For many, retirement might seem like a distant horizon. However, with the power of compounding, starting early can have significant benefits. Investing with retirement in mind is crucial, as it’s often a time of reduced income. Creating a diversified portfolio, considering tax-advantaged retirement accounts, and regularly reviewing and adjusting your strategy can ensure a comfortable and financially secure retirement.

Other financial goals: Beyond retirement, everyone has unique financial objectives. It could be funding a child’s education, buying a dream home, or starting a business. By clearly defining these goals and attaching a timeline and cost to them, you can tailor your investment strategy accordingly. For instance, saving for a child’s education might involve investing in a balanced portfolio with a mix of equities and bonds, while saving for a near-term goal might focus more on fixed income assets to preserve capital.

In essence, clear investment goals act as a roadmap, guiding your decisions and strategies. They bring purpose to your investments, ensuring each decision aligns with a broader objective. By periodically reviewing these goals, adjusting for life changes, and monitoring progress, you ensure that your investment journey remains on track, steadily moving towards achieving your financial aspirations.

Diversifying Your Investment Portfolio

The adage “Don’t put all your eggs in one basket” resonates profoundly in the investment realm. Diversification, or the practice of spreading investments across various assets or asset classes, is a foundational principle that can mitigate risks and enhance the potential for returns. By ensuring that your investments are diversified, you’re better positioned to weather the storms of market volatility.

Understanding diversification: Diversification aims to smooth out unsystematic risks in a portfolio. In layman’s terms, by holding a variety of investments that might respond differently to the same market or economic event, the poor performance of some investments is potentially offset by the better performance of others. Diversification, however, doesn’t guarantee profits or protect against losses in declining markets. Its primary purpose is to limit the impact of volatile performers on the overall portfolio.

Different asset classes: When diversifying, it’s essential to understand the various asset classes available:

- Stocks (Equities): Represent ownership in a company and constitute a claim on part of the company’s assets and earnings.

- Bonds (Fixed income): Essentially loans given to companies or governments. They pay interest over a fixed term, and the principal is returned at the end of the term.

- Real Estate: Physical property, either residential or commercial.

- Commodities: Physical goods like gold, oil, or agricultural products.

- Alternative Investments: Hedge funds, private equity, or other non-traditional assets.

By mixing these asset classes in varying proportions based on risk tolerance, investment goals, and time horizon, an investor can create a diversified portfolio tailored to their needs.

The role of mutual funds and ETFs: For many individual investors, building a diversified portfolio from scratch can be daunting. This is where mutual funds and Exchange Traded Funds (ETFs) come into play:

- Mutual Funds: These pool together money from multiple investors to invest in a diversified portfolio managed by professionals. Investors own shares of the mutual fund, which in turn represents a portion of the holdings of the fund.

- ETFs: Similar to mutual funds but traded like individual stocks on stock exchanges. They offer a convenient way to diversify across an entire index or sector with a single investment.

In conclusion, diversification is a cornerstone of prudent investment strategy. While it can’t eliminate risk entirely, it can provide a measure of protection against severe losses. By understanding the various asset classes and leveraging tools like mutual funds and ETFs, investors can build portfolios that align with their goals while managing potential risks. As markets evolve and personal circumstances change, it’s crucial to revisit and rebalance your portfolio periodically, ensuring it remains aligned with your investment objectives.

Embracing a Disciplined Approach

Investing is as much a test of character as it is of financial acumen. The ebbs and flows of the market, the allure of trending stocks, or the panic during downturns can all evoke strong emotional responses. However, successful investors often distinguish themselves by adopting a disciplined, consistent approach, unaffected by the market’s short-term noise.

Avoiding emotional investing: One of the greatest pitfalls in investing is allowing emotions to dictate decisions. Two of the most dominant emotions in the investment world are fear and greed.

- Fear: During market downturns, a natural instinct might be to sell out of fear of further losses. However, making impulsive decisions during such times can lock in losses and prevent participation in potential recoveries.

- Greed: In booming markets, the lure of rapidly rising stocks can be intoxicating. However, chasing after such trends without proper research or understanding can lead to significant losses if the trend reverses.

To counteract these emotional impulses, it’s essential to have a clear investment strategy in place and stick to it, regardless of market conditions.

The value of consistency: Regular, consistent investments can benefit from a strategy known as dollar-cost averaging. By investing a fixed amount at regular intervals, you purchase more shares when prices are low and fewer shares when prices are high. Over time, this can potentially lower the average cost per share. While this strategy doesn’t guarantee a profit or protect against losses, it does remove the guesswork of trying to time the market and can reduce the impact of market volatility.

Periodic portfolio review: A disciplined approach to investing also involves periodically reviewing your portfolio. This doesn’t mean reacting to every market fluctuation but rather assessing whether your portfolio aligns with your investment goals and risk tolerance. Factors like changes in personal circumstances, major life events, or shifts in financial goals can all warrant a portfolio review. Additionally, over time, due to varying returns on assets, your portfolio’s asset allocation might drift from its original configuration. Regularly rebalancing it ensures it stays aligned with your strategy.

In essence, embracing a disciplined approach means staying the course, even when the journey gets turbulent. It’s about making informed decisions, grounded in research and strategy, rather than reacting impulsively to market events.

This discipline, combined with patience and consistency, can be a powerful formula for long-term financial success. Remember, while markets might be unpredictable in the short term, historically, they have shown an upward trend in the long run. By remaining disciplined, investors can navigate market uncertainties and steer their investment ship towards their desired financial horizons.

Staying Informed and Educated

In the dynamic realm of investing, knowledge is power. The financial world is in a constant state of flux, influenced by geopolitical events, economic shifts, technological innovations, and more. For investors, staying informed and continuously educating themselves isn’t just beneficial—it’s crucial. An informed investor is better equipped to make decisions that align with their goals, adapt to market changes, and seize emerging opportunities.

The evolving nature of markets: Markets are living entities, reacting to a plethora of global events. Economic policies, geopolitical tensions, technological breakthroughs, and even unforeseen events like pandemics can all impact market trajectories.

- Global interconnectedness: In today’s interconnected world, an event in one corner of the globe can ripple through markets worldwide. Understanding these interconnections can offer insights into potential market movements.

- Emerging trends and sectors: Every era witnesses the rise of new sectors and trends. From the tech boom of the late 20th century to the rise of sustainable and ESG (Environmental, Social, and Governance) investing in recent years, being attuned to such trends can open doors to lucrative opportunities.

Resources for continuous learning: The digital age offers a treasure trove of resources for those keen on expanding their investment knowledge.

- Books: Time-tested classics like “The Intelligent Investor” by Benjamin Graham or contemporary insights from books like “The Little Book of Common Sense Investing” by John C. Bogle can offer valuable perspectives.

- Online courses: Platforms like Coursera, Udemy, and Khan Academy offer courses on everything from investment basics to advanced financial strategies.

- Financial news outlets: Staying updated with reputed financial news sources like Bloomberg, CNBC, or The Wall Street Journal can provide real-time insights into market movements and economic events.

Seeking professional advice: While self-education is vital, there’s undeniable value in seeking expert counsel, especially when dealing with complex financial decisions.

- Financial advisors: These professionals can offer personalized advice, tailor-made to an individual’s financial situation, goals, and risk tolerance.

- Robo-advisors: A modern alternative to traditional advisors, robo-advisors use algorithms to offer investment advice and manage portfolios, often at a fraction of the cost.

In summary, in the ever-evolving world of investing, continuous learning is the cornerstone of success. By staying informed, keeping abreast of global events, and seeking knowledge from varied sources, investors can cultivate a holistic understanding of the financial landscape. This knowledge, combined with a disciplined approach and clear goals, paves the way for informed decisions, adaptability in the face of market changes, and a journey towards long-term financial security.

Common Investment Pitfalls to Avoid

Even the most seasoned investors are not immune to mistakes. However, being aware of common pitfalls can significantly reduce the likelihood of falling into them. While the allure of high returns or the panic during market downturns can be overwhelming, recognizing and avoiding these traps can be the difference between investment success and setbacks.

Chasing past performance: It’s a common inclination to invest in assets or funds that have recently outperformed, assuming that past success indicates future results. However, this can be misleading.

- Market cycles: Just as markets have ups, they also have downs. A high-flying stock or sector might be nearing the end of its run, and investing at its peak can result in losses.

- The importance of research: Instead of solely relying on past performance, thorough research, understanding the asset’s fundamentals, and considering broader market conditions is essential.

Overconfidence bias: Overestimating one’s investment skills can lead to rash decisions. Overconfidence can result in neglecting research, ignoring warning signs, or taking undue risks.

- Stay humble: No matter how experienced, always approach investing with humility. The markets are vast and unpredictable, and there’s always more to learn.

- Diversify: Avoid the temptation to heavily invest in a single asset or sector, no matter how confident you feel. Diversification can offer a safety net.

Neglecting fees and costs: Investment returns can be significantly eroded by fees and costs, something many investors overlook.

- Understand the costs: From brokerage fees to mutual fund expense ratios, be aware of all costs associated with your investments.

- Consider low-cost alternatives: Especially for passive investors, low-cost index funds or ETFs can offer exposure to markets without the high fees associated with actively managed funds.

Falling for investment fads: The investment world is not immune to trends and fads. New, exciting sectors or innovative financial products can attract a flurry of attention and investment.

- Do your due diligence: Before jumping on the bandwagon, understand the fundamentals behind the trend. Is it sustainable, or is it a bubble waiting to burst?

- Balance enthusiasm with caution: While it’s okay to allocate a portion of your portfolio to emerging trends, avoid putting a significant chunk of your investments into unproven or speculative assets.

In essence, while the world of investing offers myriad opportunities, it’s also riddled with potential pitfalls. By being aware of these common traps, conducting thorough research, maintaining a diversified portfolio, and approaching decisions with humility and caution, investors can navigate the investment landscape more adeptly.

Remember, while seeking returns is a primary goal, preserving capital and avoiding significant losses is equally, if not more, crucial.

Preparing for Market Volatility

The only constant in the investment world is change. Markets, by their very nature, are volatile. They rise and fall, influenced by a myriad of factors, from economic data and corporate earnings to geopolitical events and natural disasters. For investors, this volatility can be both an opportunity and a challenge. Being prepared for market fluctuations and having strategies in place to navigate them is crucial for long-term investment success.

Accepting volatility as a market norm: It’s essential to understand and accept that market volatility is a given, not an anomaly. Historical data shows that markets have always experienced periods of ups and downs.

- Perspective on downturns: Instead of viewing downturns as catastrophic events, consider them a natural part of the market cycle. Historically, after every significant downturn, markets have recovered and often reached new highs.

- Opportunities in volatility: Market declines can present buying opportunities. Quality assets that were previously considered overpriced might become attractive during downturns.

Strategies to weather market downturns: Having a game plan for periods of market unrest can instill confidence and prevent rash decisions.

- Diversification: As previously discussed, diversifying across asset classes can cushion the impact of a decline in any one sector.

- Emergency funds: Having a liquid fund for emergencies ensures that you don’t have to liquidate investments during market downturns to cover immediate expenses.

- Maintaining a long-term perspective: Investing should always align with long-term goals. Short-term market movements, while unsettling, should not deter an investor from their long-term objectives.

Avoiding panic selling: One of the most common reactions during significant market declines is panic selling, or selling assets impulsively due to fear of further losses.

- Locking in losses: Panic selling often results in selling assets at a loss, and once sold, you won’t benefit from potential recoveries.

- Stay informed: Understand the reasons behind market declines. Is it a broader economic issue, or is it a short-term reaction to specific news? Being informed can prevent knee-jerk reactions.

- Seek counsel: If in doubt, consult with financial advisors or trusted investment professionals. They can offer a broader perspective and might prevent impulsive decisions.

In summary, while market volatility can be unsettling, it’s an inherent aspect of investing. Being prepared, maintaining a diversified portfolio, keeping a long-term perspective, and resisting the urge to make impulsive decisions are all crucial in navigating market fluctuations.

Remember, successful investing is not about timing the market perfectly but about time in the market. By staying invested through the highs and lows, and by making informed, strategic decisions, you position yourself for long-term financial success.

Conclusion

The journey to long-term financial security, while rewarding, is laden with challenges, choices, and opportunities. The world of investing, with its myriad assets, strategies, and variables, is a reflection of the broader, ever-evolving global landscape. However, amidst the complexities, certain principles stand the test of time: the importance of knowledge, the value of discipline, and the power of patience.

Investing is not a mere transaction of buying and selling assets. It’s a continuous process of learning, adapting, and growing. It’s about making informed decisions today that pave the way for a secure tomorrow. It’s about recognizing opportunities, mitigating risks, and most importantly, staying committed to one’s financial goals.

The tips and insights shared in this guide are not just strategies but foundational pillars upon which successful investing is built. From understanding the basics, setting clear goals, diversifying portfolios, to navigating market volatilities, each aspect is a crucial step in the investment journey. However, the most potent tool an investor possesses is a mindset—a mindset that seeks knowledge, remains disciplined during market tumults, and views investing as a long-term commitment.

As you move forward in your investment journey, remember that the path to financial security is not always linear. There will be highs and lows, triumphs and setbacks. But with each decision, with each step, you’re not just building a portfolio; you’re crafting a legacy—a legacy of financial freedom, security, and prosperity.

To all investors, whether you’re just starting or are deep into your investment journey, let this guide serve as a reminder of the principles that underpin investment success. May your journey be informed, intentional, and inspired, leading you towards the pinnacle of long-term financial security.

Additional Resources

In the ever-evolving world of investing, continuous learning and staying updated with the latest trends, strategies, and insights is paramount. While this guide offers a comprehensive overview of investing for long-term financial security, the quest for knowledge is unending. To further assist in your investment journey, here are some additional resources that promise to deepen your understanding and enhance your investment acumen.

- Websites:

- Investopedia: A comprehensive online resource offering articles, tutorials, and educational content on a wide array of financial and investment topics.

- Morningstar: Renowned for its in-depth analysis of mutual funds, stocks, and ETFs, offering insights, ratings, and research tools for investors.

- Books:

- “A Random Walk Down Wall Street” by Burton G. Malkiel: An insightful exploration of various investment techniques, highlighting the randomness of market movements.

- “Common Stocks and Uncommon Profits” by Philip A. Fisher: A classic that delves into the author’s investment philosophies and strategies.

- Online Courses and Webinars:

- MIT OpenCourseWare’s “Investments” course: A free course that covers the fundamentals of investment management.

- Yale’s Financial Markets with Robert Shiller on Coursera: Dive into the workings of financial markets, risk management, and financial derivatives.

- Podcasts:

- “The Investors Podcast” with Preston Pysh and Stig Brodersen: A deep dive into the stock market, financial news, and renowned investment books.

- “InvestED” with Phil Town and Danielle Town: Discussions around value investing, principles of Warren Buffett, and personal finance.

- Financial Forums and Communities:

- Bogleheads Forum: Inspired by the investment philosophy of Vanguard’s founder, John Bogle, this community is a treasure trove of discussions on investment topics.

- Seeking Alpha: A platform where stock market insights, research, and analysis from investors and industry experts converge.

By leveraging these resources, you can continue to expand your investment knowledge, refine your strategies, and stay abreast of the latest trends and insights. Remember, the most successful investors are perennial learners, always seeking to enhance their understanding and adapt to the ever-changing financial landscape.

As you progress on your investment journey, may these resources serve as valuable companions, guiding you towards informed decisions and long-term financial success.