Untangling Legal Requirements for Today’s Social Media Freelancers

Navigating the legal landscape as a remote social media freelancer can seem daunting. With the rise of the gig economy, understanding these laws has never been more critical. This article aims to demystify key legal requirements for remote freelancers in social media, such as tax obligations and privacy protection.

Let’s dive into creating a secure and successful freelance career!

Key Takeaways

- Remote social media freelancers must meet payroll requirements, including tracking earnings and tax withholdings, to ensure legal compliance.

- Freelancers working across international borders need to understand and comply with foreign qualification requirements.

- Obtaining necessary permits for remote employees is crucial for legal compliance in remote work scenarios.

Understanding Remote Social Media Freelancers

Remote Social Media Freelancers are a special breed of independent workers, who specialize in managing social media platforms for different businesses. They possess the freedom to choose their clients and projects while setting their own working hours.

Their work includes creating engaging posts, planning out strategic campaigns, tracking analytical reports and monitoring customer engagement on various platforms like Facebook, Instagram, LinkedIn or Twitter.

One must understand that these freelancers function just as any other remote workforce would but with added responsibilities related to online promotion. Unlike traditional office employees, they can operate from anywhere across the globe and often form crucial links between companies and their online audiences.

While operating remotely offers much-needed flexibility in terms of location and time management, it also requires strict self-discipline to meet deadlines without sacrificing quality.

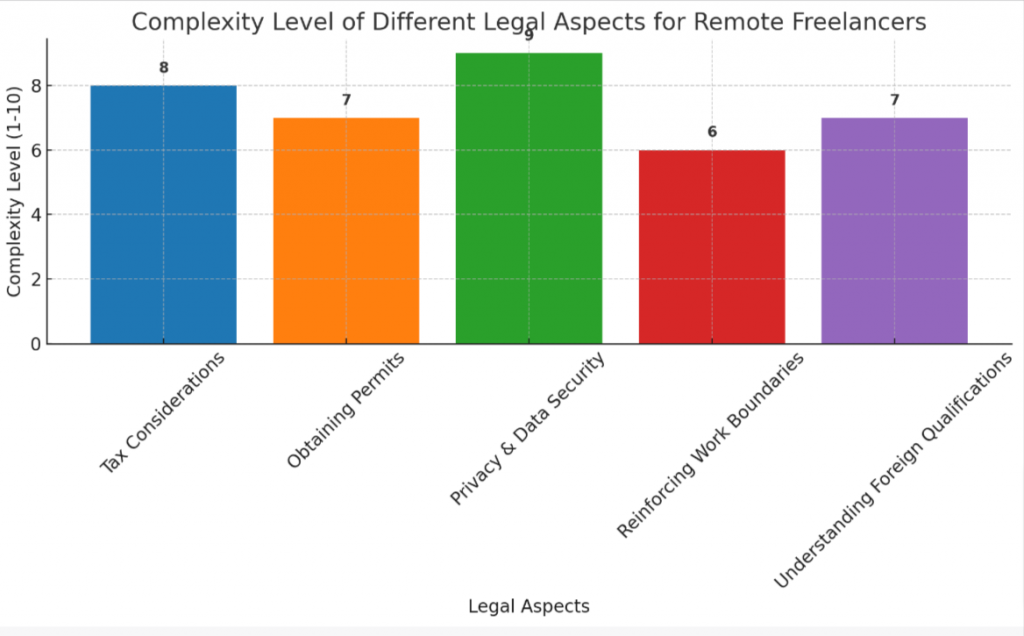

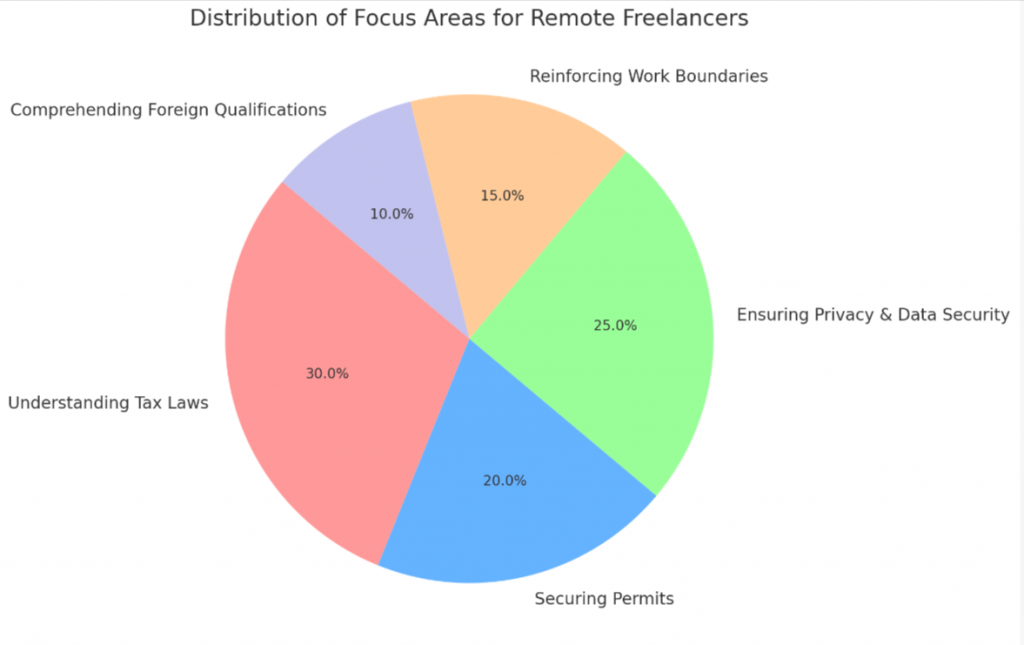

Legal Aspects of Remote Freelance Work

Remote freelance work entails several legal considerations, such as payroll requirements, foreign qualification, and permits for remote employees.

Payroll Requirements

Meeting your payroll requirements as an employer of a freelance social media manager is essential. You need to keep accurate records of their earnings and tax withholdings. This task involves diligent tracking, reporting, and making timely payments to the freelancer.

Engaging with freelancers means you are not obligated to deduct taxes from their pay or offer employee benefits; instead, they are accountable for handling their own tax obligations independently.

Furthermore, it’s crucial to be aware that misclassifying employees can lead to legal consequences. Make sure you understand the difference between remote workers who qualify as traditional employees versus self-employed individuals such as freelance social media managers.

Taking the time to classify correctly will save on unnecessary complications down the line while ensuring compliance with all relevant employment laws and state-specific regulations.

Foreign Qualification

Foreign qualification is a legal requirement that remote social media freelancers have to consider. It generally refers to the process by which a company, LLC or corporation in one state obtains permission to do business in another state.

Freelancers working across international borders need to understand and comply with these requirements. For instance, if you’re doing substantial business in other states as an out-of-state remote worker, even from your home office, foreign qualification laws may apply to you too.

Not meeting these regulations can leave both parties open to potential legal consequences and financial burdens because every state has its own unique rules about when and why companies must qualify.

Therefore proper documentation of working arrangements for ensuring everyone’s understanding of their obligations related to foreign qualification is crucial for maintaining legal compliance.

Permits for Remote Employees

Obtaining necessary permits for remote employees forms a crucial part of legal compliance in remote work scenarios. This process involves understanding and adhering to different employment laws, including those specific to the state or country where the employee resides.

Such permits ensure that businesses can legally hire out-of-state or overseas freelancers without violating any law related to payroll, foreign qualification, tax nexus laws and more.

Violating these regulations expose companies to potential legal risks – hence the indispensability of proper documentation for each remote worker. In essence, obtaining permits underpins not just conformity with current legislations but also protection against avoidable financial burdens stemming from non-compliance-related litigations.

Tax Considerations for Remote Freelancers

Remote freelancers need to carefully consider tax obligations and expense reimbursement, making it essential to understand tax nexus laws and how to handle taxes for out-of-state remote workers.

Read on to ensure you remain compliant with tax regulations and protect your business financially.

Tax Nexus Considerations

Remote freelancers need to be aware of tax nexus considerations, which refer to the connection between a business and a jurisdiction for tax purposes. As remote freelancers often work with clients in different locations, they may have tax nexus in multiple jurisdictions. This means they need to understand the tax laws and regulations in each location where they have tax nexus.

One important aspect of tax nexus for remote freelancers is sales tax. If a freelancer meets certain sales thresholds in specific states, they may be required to register for and collect sales tax from their customers in those states.

Expense Reimbursement for Remote Workers

Some states have regulations that require employers to reimburse certain expenses for remote workers. Failure to comply with these laws can lead to legal consequences and strain the employer-employee relationship.

It is important for both employers and employees to keep accurate records of reimbursements in order to track financial commitments and ensure appropriate compensation. These records also make tax filings easier by providing proof of legitimate business-related expenses.

Establishing clear expense reimbursement policies promotes transparency and builds trust between remote workers and their employers.

Privacy and Data Security for Remote Workers

Remote workers, including freelance social media managers, must prioritize privacy protection and data security. It is essential for freelancers to be aware of the legal requirements and regulations related to privacy and data security to ensure they are in compliance.

Handling sensitive client information requires diligent protection measures. Remote workers should implement security practices such as using strong passwords, utilizing two-factor authentication, and encrypting data.

Additionally, freelancers may need to comply with data protection laws like the General Data Protection Regulation (GDPR) depending on their clients’ locations. To further enhance security, remote workers should use secure internet connections like virtual private networks (VPNs) and establish protocols for securely storing and disposing of client data.

By taking these precautions, remote workers can mitigate risks associated with privacy breaches and protect both their own reputation as well as their clients’ confidential information.

Classification of Remote Freelancers

Remote freelancers may need to consider worker’s compensation coverage and unemployment insurance, as their classification may affect their eligibility for these benefits.

Worker’s Compensation for Remote Employees

Remote employees are entitled to worker’s compensation in the event of work-related injuries or illnesses. This means that if a remote employee gets injured while performing work duties, they have the right to receive medical treatment and financial compensation for any resulting disabilities.

It is important for businesses to understand their legal obligations regarding worker’s compensation coverage for remote workers. Hiring out-of-state remote workers can present additional challenges as different states may have varying laws and requirements related to worker’s compensation.

Therefore, it is crucial for employers to ensure that they provide proper worker’s compensation coverage and follow all applicable regulations to protect both their business and their remote employees.

Unemployment Insurance Considerations

Unemployment insurance considerations are an important aspect of managing remote freelancers. Each state has its own regulations regarding unemployment insurance, so it’s crucial for employers to understand the specific requirements in their jurisdiction.

The classification of freelancers also plays a role in determining their eligibility for unemployment insurance coverage. Misclassifying freelancers can result in legal consequences and potential liability for employers.

It is essential to navigate this aspect correctly to ensure compliance with employment laws and protect both parties involved.

The Importance of a Freelance Social Media Manager Contract

A freelance social media manager contract is essential for protecting both parties involved and establishing clear expectations and responsibilities.

Why you need a contract

Having a contract is essential for freelance social media managers due to its ability to protect your time and interests as a business owner. A contract clearly outlines the expectations and responsibilities of both parties involved in social media management, providing you with the legal protection you need.

Without a contract in place, you open yourself up to potential lawsuits that can be costly and hazardous. Fortunately, there are contract templates available that can save you the hassle and expense of hiring a lawyer.

By having a social media manager agreement in place, you can ensure that your rights and interests are guaranteed throughout the duration of your freelance work.

How to create a contract

To create a contract for your freelance social media management services, follow these steps:

- Start with a clear and concise statement of the basic information: Include the names of both parties, the effective date, and a brief description of the services to be provided.

- Define the scope of work: Detail what exactly you will be responsible for as the social media manager. Be specific about the platforms you will use, the type of content you will create, and any other services included.

- Specify deliverables: Outline what specific deliverables or milestones are expected from both parties throughout the duration of the contract. This could include weekly reports, content calendars, or campaign performance metrics.

- Set payment terms: Clearly state how you expect to be compensated for your services. Include details such as hourly rates, project fees, payment due dates, and accepted forms of payment.

- Address platform glitches: Clarify how technical issues or platform glitches will be handled in terms of delays or disruptions to service delivery. This helps manage client expectations and avoids disputes over unforeseen circumstances.

- Establish copyright and intellectual property rights: Clearly define who owns the content created during the course of your work. Specify whether you retain ownership or if it transfers to the client.

- Incorporate confidentiality clauses: Protect sensitive information by including non-disclosure agreements (NDAs) or non-compete clauses that prevent clients from sharing confidential information or hiring competitors during and after your contract term.

- Include cancellation terms: Establish guidelines on how either party can terminate the contract before its agreed-upon end date. This protects both parties in case unforeseen circumstances arise.

- Provide options for dispute resolution: Decide in advance how potential conflicts will be resolved between you and your clients. Common methods include mediation, arbitration, or litigation if necessary.

- Include an indemnification clause: Specify that clients hold you harmless in case legal consequences arise due to their requests, instructions, or actions related to the social media management services.

- Obtain signatures: Lastly, make sure both parties sign and date the contract. This provides legal validity and demonstrates mutual agreement and understanding of the terms.

What should be included in a contract?

A freelance social media manager contract should include the following:

- Scope of Work: Clearly define the tasks and responsibilities that the freelancer is expected to perform for the business owner.

- Deliverables: Specify the specific outcomes or results that the freelancer is required to produce within a given timeframe.

- Payment Terms: Outline the payment structure, including rates, invoicing details, and any late payment penalties or terms.

- Ownership of Work: Clarify who will own the intellectual property rights to the content created by the freelancer during their engagement with the business owner.

- Confidentiality: Include a confidentiality clause to protect sensitive information shared between the business owner and freelancer from unauthorized disclosure.

- Cancellation Terms: Set forth guidelines on how either party can terminate the agreement, including notice periods and any applicable cancellation fees.

- Dispute Resolution: Specify how disputes will be resolved if they arise, whether through mediation, arbitration, or litigation.

- Indemnification: Define who will be responsible for any legal consequences or financial burdens resulting from a breach of contract or negligence during the engagement.

- Signature: Provide space for both parties to sign and date the contract as a commitment to abide by its terms and conditions.

- A contract is important for protecting the time and interests of a business owner when hiring a freelance social media manager.

- The contract ensures legal protection for both the business owner and the freelancer.

- Without a contract, there is a risk of being involved in costly lawsuits.

- Contract templates are available online to save on expenses of hiring lawyers.

- A freelance social media manager contract establishes a legal framework that guarantees rights and interests of managers in any project or employment.

Intellectual Property and Confidentiality Considerations

In this section, we will discuss the importance of addressing intellectual property rights and confidentiality in a freelance social media manager contract.

Copyright and IP (intellectual property)

Remote social media freelancers must be aware of copyright and intellectual property (IP) issues. This is because the content they create or use for social media marketing could be subject to copyright protection.

It’s important for freelancers to ensure they have the necessary rights or permissions to use copyrighted material. Understanding and respecting copyright and IP laws can help freelancers avoid legal disputes.

Registering their original content or creations for copyright protection is also recommended to provide additional legal safeguards.

Confidentiality

Freelance social media managers often handle sensitive and confidential information for their clients. It is essential for these professionals to prioritize confidentiality to protect the interests of both parties.

As part of their legal obligations, freelance social media managers must handle this information with care and maintain strict confidentiality. This includes client data, business strategies, marketing plans, and any other proprietary or sensitive material shared during the course of their work.

Freelancers should ensure they have a clear understanding of any non-disclosure agreements or confidentiality clauses in their contracts to uphold these important responsibilities.

Properly categorizing remote and freelance workers is crucial for legal compliance in many areas – including protection of valuable intellectual property (IP) assets developed by freelancers on behalf of clients.

Copyright laws provide automatic protection for original works created by individuals, which can include written content, designs, photographs, videos, and more. Freelance social media managers should be aware that any content they create as part of their work may be subject to copyright laws unless stated otherwise in an agreement with the client.

Cancellation Terms and Dispute Resolution

Include clear cancellation terms in the freelance social media manager contract to outline the process and any associated fees, while also establishing a dispute resolution method such as mediation, arbitration, or litigation to address potential conflicts.

Cancellation terms

Cancellation terms are an essential aspect of contracts for remote social media freelancers. These terms outline the conditions under which either party can terminate the agreement.

It is crucial for freelancers to include clear and comprehensive cancellation terms in their contracts to protect their financial interests and avoid any disputes or misunderstandings with clients.

By having well-drafted cancellation terms, remote social media freelancers can minimize the risk of financial loss and ensure that they have a solid legal foundation in case of contract termination.

Dispute resolution

Dispute resolution is a critical aspect when it comes to legal requirements for remote social media freelancers. It involves the process of resolving conflicts and disagreements between freelancers and their clients in an efficient and fair manner.

Effective dispute resolution processes can help prevent misunderstandings, protect both parties’ interests, and ensure a positive working relationship. This includes establishing clear cancellation terms in contracts and including dispute resolution clauses that outline the steps involved in resolving disputes.

Negotiation, mediation, or arbitration may be used depending on the agreed-upon terms. By including these provisions in contracts, both freelancers and clients can have peace of mind knowing that there are established procedures to address any potential issues that may arise.

The Importance of Indemnification in a Freelance Social Media Manager Contract

Indemnification is crucial in a freelance social media manager contract as it provides legal protection and ensures that any financial burdens arising from legal consequences are borne by the responsible party.

Indemnification

Indemnification is a crucial aspect of a freelance social media manager contract that protects both the business owner and the freelancer. By including indemnification clauses in the contract, parties can establish expectations and responsibilities, ensuring legal protection for all involved.

Without proper indemnification provisions, there is a risk of costly lawsuits and disputes arising. A well-drafted contract with clear definitions of responsibilities offers peace of mind and safeguards against potential legal consequences.

Online contract templates designed specifically for social media managers provide a comprehensive framework to create an effective agreement that includes necessary indemnification provisions.

Best Practices for Managing Remote Freelance Workers

Manage remote freelance workers effectively by obtaining important information upfront, creating healthy working conditions, investing in cybersecurity, reinforcing work boundaries, and codifying rules in the employee handbook.

Get important information upfront

Remote social media freelancers should prioritize obtaining important information upfront when starting a new project or working with a new client. This includes gathering details about the scope of work, deliverables, payment terms, and any specific requirements or expectations.

By ensuring clear and open communication from the beginning, freelancers can avoid misunderstandings and conflicts down the line. Additionally, getting important information upfront allows freelancers to assess whether they have the necessary skills and resources to meet the client’s needs effectively.

It also helps in setting realistic timelines and managing expectations on both sides. Being proactive about gathering essential information at the start of a project will contribute to smoother collaborations and successful outcomes for remote social media freelancers.

Create healthy working conditions

Employers play a crucial role in creating healthy working conditions for their remote freelance social media managers. This includes providing the necessary equipment and resources to perform their job effectively, such as laptops, software tools, and high-speed internet connection.

Moreover, employers should encourage regular breaks, exercise routines, and promote work-life balance to prevent burnout and boost productivity. Establishing open lines of communication and offering support when needed can also contribute to a positive work environment for remote workers.

By prioritizing the physical and mental well-being of freelancers, businesses can ensure a successful partnership while minimizing legal risks.

Invest in cybersecurity

Employers cannot afford to overlook the importance of investing in cybersecurity when it comes to remote workers. With sensitive data being transmitted online, businesses must take proactive measures to protect against unauthorized access and data breaches.

This includes using secure communication channels and implementing strong security protocols. By prioritizing cybersecurity, employers can ensure the safety and integrity of their information, as well as maintain the trust of their clients and customers.

Reinforce work boundaries

Clear boundaries are essential when managing remote freelance workers. By reinforcing work boundaries, employers can establish expectations around working hours and response times.

This not only promotes employee well-being but also ensures productivity. When employees have a clear understanding of when they should be available for work and when they can disconnect, it helps them maintain a healthy work-life balance.

Additionally, setting these boundaries allows remote workers to protect their personal time and prevents burnout. It is crucial for employers to communicate these boundaries effectively and encourage their remote freelancers to adhere to them consistently.

Codify rules in the employee handbook

Clear and well-documented rules are essential in managing remote freelancers. Including these rules in the employee handbook provides a comprehensive guide for both employers and employees, ensuring that everyone is on the same page regarding expectations, responsibilities, and workplace policies.

By codifying these rules, employers can establish consistent procedures for communication, work hours, deliverables, confidentiality agreements, and any other important aspects of the freelancer’s role.

This not only promotes a productive work environment but also helps protect both parties legally by ensuring compliance with employment laws and regulations.

Conclusion

To ensure legal compliance and protect both employers and remote social media freelancers, it is crucial to understand the various legal requirements involved. This includes properly categorizing workers, addressing tax considerations, prioritizing privacy and data security, and establishing clear contractual agreements.

By adhering to these legal guidelines, businesses can navigate the world of remote work successfully while safeguarding their operations and relationships with freelance social media managers.