Managing Finances Remotely: Tax Strategies for Social Media Experts

Are you a social media professional confused about how working from home affects your taxes? You’re not alone, and here’s an important fact to keep in mind: the IRS views content creators as self-employed.

This blog post will guide you through various tax tips and write-offs specific to your line of work that could help save money during tax season. Ready to navigate the world of taxes with less stress? Let’s dive right in!

Key Takeaways

- Social media professionals should report all their income earned through social media platforms and keep track of it throughout the year.

- Deductible expenses for influencers/content creators include website maintenance costs, marketing expenses, home office expenses, travel costs, insurance premiums, and certain business gifts or clothing purchases.

- Business losses can be deducted from tax returns to lower taxable income for self – employed social media professionals.

- Self-employed individuals are responsible for paying self-employment taxes and should set aside a portion of their income to cover these taxes. They may also be subject to investment taxes if they have other sources of income.

Tax Tips for Social Media Professionals

Social media professionals should be aware of reporting their taxable income and receiving tax forms, as well as understanding deductible expenses, handling business losses, self-employment taxes, and filing deadlines.

Reporting taxable income and receiving tax forms

In the world of social media influencers, reporting taxable income and receiving tax forms is crucial. Here are some essential points to consider:

- All income earned through social media platforms must be reported to the IRS.

- Forms like 1099s are important for self – employed content creators.

- Social media professionals can receive multiple tax forms from various sources.

- Income includes direct earnings such as brand deals and indirect earnings like advertising revenue.

- Influencers should always keep track of their income throughout the year.

- Taxable income might include free products or services received in exchange for exposure on a channel.

- The IRS considers these free goods and services as part of an influencer’s gross income.

- It’s essential to understand how foreign payment flow affects taxes for individuals working with international brands.

- Reporting accurate income helps avoid penalties or audits from the IRS in future.

Deductible expenses for influencers/content creators

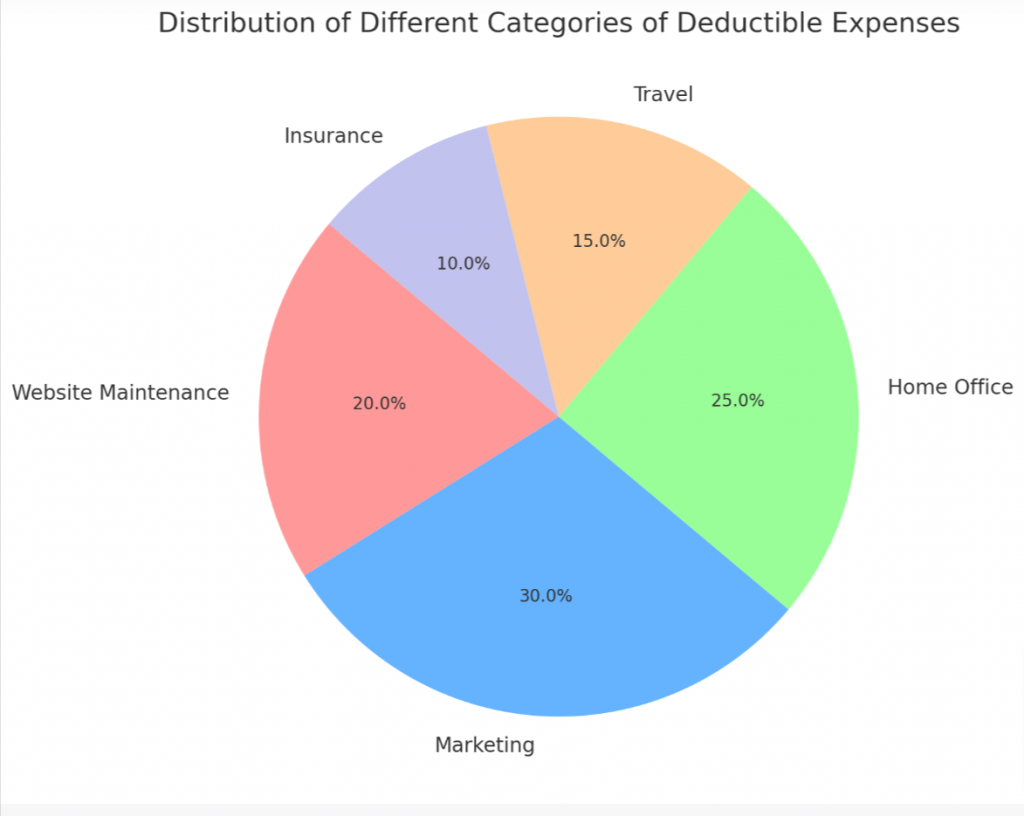

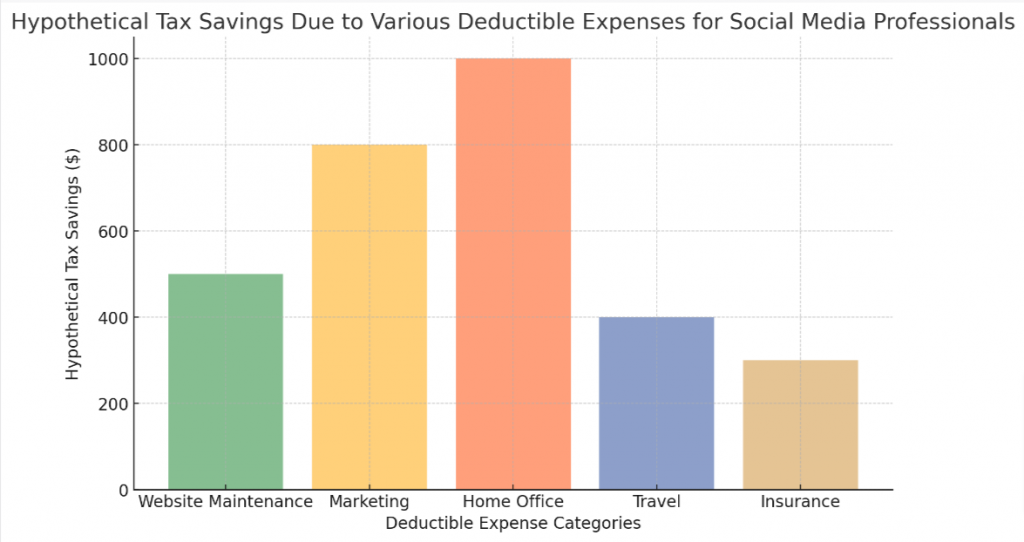

Social media professionals should take note of the wide array of deductible expenses available to them. These deductions aim to reduce tax burdens for self-employed content creators and influencers.

- Website set-up and maintenance costs: As an online professional, you likely spend a significant amount on website maintenance. This can be a great potential deduction.

- Marketing and advertising costs: Money spent on promoting your personal brand, ads, or sponsored posts also counts as deductible expenses.

- Home office expenses: Social media influencers who work from their home office can generally deduct these costs on Schedule C.

- Travel expenses: If you’re traveling for business purposes, such as meeting with brands or attending influencer events, you may be able to write-off some travel costs.

- Insurance costs: If you have insurance specifically related to your work like professional indemnity insurance, this may also be a valid deduction.

- Gifts given for business purposes: Influencers often give gifts to clients or potential sponsors which can qualify for tax deductions.

- Clothing deductions: Apparel purchased explicitly for your social media content could be considered a tax write-off in certain situations.

Handling business losses

Business losses can affect social media professionals just like any other entrepreneur. The IRS allows you to deduct these losses from your tax returns, offsetting taxable income and potentially lowering your tax bill.

By classifying certain expenses as costs of doing business, you reduce the overall income on which you are taxed. In a year where expenditures outweigh revenue, these deductions make it possible for freelancers and independent contractors to stay in operation despite financial challenges.

If investing in new equipment or ad campaigns doesn’t yield expected returns right away, remembering that such ventures can count as deductible expenses might offer some relief.

Self-employment and Social Security/Medicare taxes

Social media professionals who are considered self-employed by the IRS must be aware of their tax obligations, including self-employment and Social Security/Medicare taxes. As a self-employed individual, you are responsible for paying these taxes on your own since you don’t have an employer withholding them from your paycheck.

It’s important to set aside a portion of your income to cover these taxes and make estimated quarterly payments to the IRS. Failure to do so can result in penalties and interest charges.

Keep accurate records of your earnings and expenses throughout the year, as this information will be used to calculate your taxable income and determine how much you owe in self-employment taxes.

When it comes to Social Security and Medicare taxes, as a self-employed professional, you’re required to pay both the employer’s and employee’s share of these taxes. For 2021, that means you’ll need to contribute 12.4% for Social Security on earnings up to $142,800 and 2.9% for Medicare on all earnings (no cap).

Filing deadlines for content creators

Content creators must be aware of the filing deadlines for their taxes. As self-employed individuals, they are required to file their tax returns by April 15th each year. It’s important to note that if they need more time, they can request an extension until October 15th.

However, it’s crucial to remember that this extension only applies to filing the return, not paying any taxes owed. Content creators should make sure to keep track of all their income and expenses throughout the year so they can accurately report them on their tax return and meet these deadlines.

Investment and Self-Employment Taxes

Social media professionals who are self-employed need to be aware of the investment and self-employment taxes they may have to pay. As a self-employed individual, you are responsible for paying both the employer and employee portions of Social Security and Medicare taxes.

This means that you will need to set aside a certain percentage of your income to cover these taxes. Additionally, if you make investments or earn income from sources other than your social media work, such as dividends or capital gains, you may also be subject to investment taxes.

It’s important to understand the tax implications of your investments and consult with a tax professional if needed to ensure that you are accurately reporting and paying any required taxes on your investment earnings.

In conclusion, being aware of the investment and self-employment taxes is essential for social media professionals who work from home. By understanding these tax obligations and seeking guidance when necessary, content creators can effectively manage their finances while staying compliant with IRS regulations.

Insurance Tax Write-Offs for Social Media Professionals

Social media professionals can take advantage of various insurance tax write-offs to reduce their taxable income. Here are some insurance-related deductions to consider:

- Health Insurance Premiums: Self-employed social media professionals can deduct the cost of health insurance premiums for themselves, their spouse, and dependents.

- Liability Insurance: If social media professionals have liability insurance to protect themselves from potential lawsuits or claims, they can deduct the premiums paid.

- Business Property Insurance: Insurance policies that cover business equipment, furniture, or inventory used in the course of work can be deducted as a business expense.

- Cybersecurity Insurance: With the increasing risk of cyberattacks and data breaches, social media professionals who invest in cybersecurity insurance can claim those costs as deductions.

Conclusion

In conclusion, social media professionals who work from home should be aware of the tax deductions available to them. By properly reporting their taxable income, deducting eligible expenses, and understanding self-employment taxes, they can maximize their savings.

It’s important for influencers and content creators to stay informed about the IRS guidelines and take advantage of all relevant write-offs to minimize their tax liability.