Exploring Freelancer Health Insurance: Making the Right Choice

Introduction

In today’s rapidly changing work landscape, more and more professionals are venturing into freelancing and self-employment. While this shift offers numerous benefits such as flexibility and autonomy, it also comes with its own set of challenges—one of the most significant being health insurance. Unlike traditional employees, who often receive health coverage as part of their benefits package, freelancers are left to navigate the complex world of health insurance on their own.

For many, the idea of securing health insurance as a freelancer can be daunting. The options can seem overwhelming, the terms confusing, and the costs, at times, prohibitive. However, health insurance is not just a legal requirement in many countries but also a critical safety net.

Medical emergencies can strike at any moment, and without proper coverage, the financial repercussions can be devastating. Moreover, regular check-ups and preventive care, which insurance often covers, are paramount for long-term health.

This article aims to demystify the process of choosing health insurance for freelancers. From understanding why it’s essential, to exploring the various options available, and offering tips on making an informed decision, we’ll cover it all. Whether you’re a seasoned freelancer or just starting out, this guide will provide valuable insights to help you secure the best health coverage for your needs.

Why Freelancers Need Health Insurance

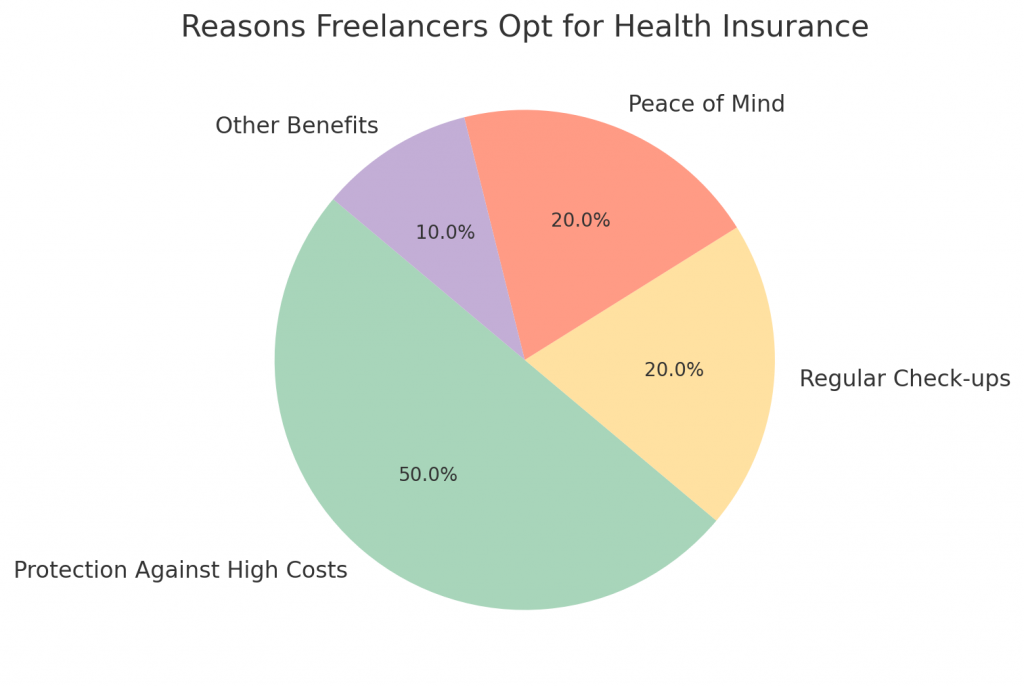

Health insurance is often seen as a luxury or a secondary need, especially for those just starting their freelance journey. With numerous expenses to consider—from marketing and business development to software subscriptions and office space—it’s easy to push health insurance to the bottom of the priority list. However, doing so can have serious consequences. Here’s why every freelancer should consider health insurance a non-negotiable:

Protection against high medical costs

Medical emergencies are unpredictable. A sudden accident or illness can lead to hospitalizations, surgeries, medications, and extended treatments. These can quickly rack up bills amounting to thousands, if not tens of thousands, of dollars. For a freelancer without a steady monthly income or substantial savings, such unexpected costs can be financially crippling.

Real-life example: Consider Jane, a freelance graphic designer, who unfortunately broke her leg during a hiking trip. Without health insurance, she faced medical bills totaling over $7,000. This sudden expense strained her finances, forcing her to dip into her savings meant for business investments.

Access to regular health check-ups and preventive care

Regular health screenings and check-ups are essential in detecting potential health issues early on. Catching diseases or conditions in their initial stages often leads to better outcomes and can prevent complications down the line. Health insurance plans often cover these preventive services, making it affordable for freelancers to prioritize their health.

The long-term benefits of preventive care: Studies consistently show that individuals who undergo regular health check-ups have a lower risk of developing chronic diseases. For instance, simple screenings like mammograms or colonoscopies can detect early signs of cancer, leading to timely interventions and better prognosis.

Peace of mind

The mental and emotional strain of not having health coverage can be significant. Freelancers already face uncertainties in their work, from fluctuating incomes to client-related challenges. Adding the constant worry of potential health issues and associated costs can lead to heightened stress and anxiety. Knowing that they are covered in case of medical emergencies provides freelancers with the peace of mind to focus on their work and personal well-being.

In conclusion, while the immediate costs of health insurance might seem like an added burden, the benefits far outweigh the risks. Having a safety net in place ensures that freelancers can tackle health challenges head-on without the added stress of financial implications. It’s an investment not just in one’s health, but also in the stability and success of their freelance career.

The Freelancer’s Health Insurance Dilemma

Navigating the intricacies of health insurance is a challenge for most individuals, but freelancers face unique hurdles that can make the journey even more complex. Understanding these specific challenges is the first step in addressing and eventually overcoming them. Here’s a deeper dive into the health insurance dilemmas that freelancers often encounter:

The instability of freelance income

Unlike salaried employees who receive a consistent paycheck, freelancers experience ebbs and flows in their earnings. Some months might be lucrative, with multiple projects and clients, while others might be lean, with little to no work. This income instability makes budgeting for a fixed monthly insurance premium challenging.

Monthly income fluctuations and their impact on budgeting: Take, for example, a freelance writer who earns $5,000 one month but only $2,000 the next. Budgeting for a consistent health insurance premium becomes challenging when there’s such a vast disparity in monthly earnings. This unpredictability might tempt freelancers to opt for lower-cost plans with minimal coverage or forgo insurance altogether.

Lack of employer-sponsored plans

Traditional employees often benefit from group health insurance plans sponsored by their employers. These plans are usually more comprehensive and cost-effective than individual plans. Freelancers, on the other hand, don’t have this advantage. They’re left to explore the individual market, which can be more expensive and less inclusive.

Differences between individual and group insurance plans: Group plans benefit from the power of numbers. With a larger pool of insured individuals, risks are spread out, leading to lower premiums. Individual plans don’t have this advantage, which can result in higher costs and less favorable terms for freelancers.

Navigating the marketplace alone

Choosing a health insurance plan is no easy feat. The myriad of options, each with its own set of benefits, exclusions, premiums, and deductibles, can be overwhelming. Traditional employees usually have the guidance of their HR departments to help them navigate these choices. Freelancers, in contrast, are on their own, often left feeling lost in a sea of jargon and fine print.

The challenges of understanding and comparing plans: Consider terms like “out-of-pocket maximum,” “coinsurance,” and “covered benefits.” Without prior knowledge or guidance, deciphering what these mean and how they impact one’s coverage can be daunting for freelancers. The risk of choosing an ill-suited plan or missing out on better options is high.

In essence, while the flexibility of freelancing offers many benefits, it also brings forth distinct challenges in the realm of health insurance. Recognizing these challenges is the first step. Armed with knowledge and determination, freelancers can find solutions that ensure they’re adequately covered without breaking the bank.

Types of Health Insurance Options Available

With the ever-evolving health insurance landscape, freelancers have a range of options at their disposal. Each type of plan comes with its own set of features, benefits, and considerations. Let’s delve into the most common health insurance options available to freelancers, helping you understand their nuances and make informed decisions.

Traditional Health Insurance Plans.

- HMOs (Health Maintenance Organizations):

- What they are: HMOs require members to select a primary care physician (PCP). Any required specialist visits or procedures generally need a referral from this PCP.

- Pros: Lower premiums and out-of-pocket costs compared to other plans.

- Cons: Limited freedom in choosing healthcare providers and necessity for referrals can be restrictive for some.

- PPOs (Preferred Provider Organizations):

- What they are: PPOs offer more flexibility in selecting healthcare providers and do not require referrals for specialists.

- Pros: Greater flexibility in choosing doctors and specialists. No need for referrals.

- Cons: Generally come with higher premiums. Out-of-network care can be expensive.

- POS (Point of Service) Plans:

- What they are: A mix between PPOs and HMOs. Requires a primary care physician but offers more flexibility in choosing other healthcare providers.

- Pros: A balance of flexibility and cost-effectiveness.

- Cons: Referrals are typically needed for specialists. Out-of-network care can incur higher costs.

Health Savings Accounts (HSAs) and High Deductible Health Plans (HDHPs)

- The basics of HSAs and HDHPs: HSAs are tax-advantaged savings accounts, while HDHPs are insurance plans with higher than average deductibles. Together, they allow individuals to set aside pre-tax money for medical expenses.

- Pros: Tax benefits. Money in an HSA rolls over year to year, offering a way to save for future medical expenses.

- Cons: High deductibles mean you pay more out-of-pocket before insurance kicks in.

Short-term Health Insurance.

- When and why this might be an option: Short-term plans offer coverage for a limited period, often less than a year. They’re suitable for those in between jobs or waiting for other coverage to start.

- Pros: Typically cheaper and can be acquired quickly.

- Cons: Offers limited coverage. Might not cover pre-existing conditions or preventive care.

Healthcare Sharing Programs

- How these programs work: Members share medical expenses. Each member pays a monthly “share” amount, which is used to cover the medical bills of others in the program.

- Pros: Can be more affordable than traditional insurance. Offers a sense of community.

- Cons: Not insurance. Doesn’t guarantee payment of medical bills. May have restrictions based on lifestyle or beliefs.

Medicaid and State-Sponsored Programs.

- Eligibility criteria: Based on income levels, family size, and other factors.

- The application process and benefits: Offers comprehensive coverage, often with lower or no premiums.

- Pros: Affordable and extensive coverage.

- Cons: Not everyone qualifies. Can have longer wait times for certain services.

In summary, while the plethora of health insurance options can seem overwhelming, there’s likely a plan or program that aligns with every freelancer’s needs and budget. It’s essential to evaluate each option carefully, considering both the immediate costs and the long-term benefits and coverage.

Tips for Choosing the Right Plan

Choosing the right health insurance plan is more than just comparing monthly premiums. It’s about understanding your health needs, predicting potential costs, and ensuring you’re adequately covered in emergencies. Here are some tips to guide freelancers in their quest to find the perfect health insurance plan:

Assessing your healthcare needs

- Estimating annual medical expenses: Start by reviewing your medical expenses from the previous year. Include regular check-ups, medications, therapies, and any unforeseen medical events. This will give you a baseline for the kind of coverage you’ll need.

- Considering factors like age, health condition, and family size: A young, single freelancer’s needs will differ from someone with a family or with pre-existing conditions. Tailor your search based on your unique situation.

Understanding the terms and jargon

- Definitions of common terms:

- Premium: The monthly cost of the insurance plan.

- Deductible: The amount you pay out-of-pocket before insurance starts covering.

- Out-of-pocket maximum: The maximum amount you’ll pay in a year, after which insurance covers 100% of costs.

- Coinsurance: Your share of the costs of a covered service.

- Copayment: A fixed amount you pay for a covered health care service.

By understanding these terms, you’ll be better equipped to compare plans and determine potential annual costs.

Checking the network of providers.

- The importance of in-network vs. out-of-network care: Plans often have a list of in-network providers, which are more affordable than out-of-network ones. Ensure your primary care doctor, specialists, or any preferred hospital are in-network to avoid higher costs.

Considering additional benefits

- Vision, dental, and other supplementary insurances: While your primary focus might be on general health insurance, don’t neglect other aspects of your health. Some plans offer bundled packages, while others might require separate policies for vision or dental care.

Reading reviews and getting recommendations

- Using freelance communities and forums for insights: Other freelancers can be invaluable sources of information. They can provide feedback on specific plans or insurance companies, share their experiences, and offer recommendations tailored to freelance needs.

In essence, selecting the right health insurance is a meticulous process that demands time and research. By understanding your needs, familiarizing yourself with industry jargon, and leveraging the experiences of fellow freelancers, you can find a plan that offers both peace of mind and comprehensive coverage.

The Financial Aspect: Budgeting for Health Insurance

For freelancers, managing finances is a continuous juggling act. With fluctuating incomes, it’s crucial to budget effectively, ensuring that all essentials, including health insurance, are accounted for. Here’s a guide to help freelancers budget for health insurance without compromising on coverage:

Determining what you can afford

- Calculating monthly and annual costs: Begin by setting a clear budget for health insurance. Factor in the monthly premium, potential out-of-pocket expenses, and any other costs like copayments. Remember, the cheapest plan isn’t always the best. Weigh the costs against the benefits provided.

Planning for unexpected health expenses

- The importance of an emergency fund: While insurance will cover a significant portion of medical expenses, it’s essential to have savings set aside for unforeseen health emergencies. This fund will be particularly beneficial in cases where you need to meet high deductibles or cover treatments that aren’t included in your plan.

Taking advantage of tax deductions

- How health insurance costs can be written off for freelancers: In many countries, freelancers can deduct their health insurance premiums from their taxable income, leading to potential tax savings. It’s advisable to consult with a tax professional to understand the specifics and ensure that all deductions are correctly claimed.

Seeking discounts and special programs

- Group rates through professional organizations: Many freelancing platforms, unions, or associations offer group health insurance rates, which can be more affordable than individual plans.

- Exploring subsidies: Depending on your income level, you might qualify for subsidies or tax credits that reduce the cost of health insurance premiums. Check local regulations or use online tools to see if you’re eligible.

Regularly reviewing and adjusting your budget

- The dynamic nature of freelancing: As your freelancing career evolves, so will your income and potentially your health needs. It’s essential to review your health insurance budget annually or whenever there’s a significant change in your financial situation.

In summary, while health insurance is an added expense for freelancers, it’s a crucial one that shouldn’t be overlooked or minimized. By budgeting effectively, seeking available discounts, and leveraging tax benefits, freelancers can ensure they’re well-covered without straining their finances.

Where to Find and Compare Health Insurance Plans

With the decision to invest in health insurance made, the next step for freelancers is to find and compare potential plans. The marketplace offers a plethora of choices, but knowing where to look and how to compare options can streamline the process. Here’s a guide to help freelancers navigate this journey:

Online marketplaces

- Overview of platforms like Healthcare.gov: Many countries have established online marketplaces or exchanges where individuals can compare and purchase insurance plans. These platforms often provide detailed information about each plan, including coverage, costs, and provider networks. They might also offer tools to determine eligibility for subsidies or tax credits.

Independent insurance agents

- The benefits of working with a broker: Independent agents or brokers can provide personalized guidance based on your needs. They have access to multiple insurance providers and can offer a range of options that might not be readily available on public marketplaces. Additionally, their expertise can simplify the process of comparing and understanding the nuances of different plans.

Freelancer organizations and unions

- Groups that offer group rates or resources for health insurance: Some professional organizations, freelancer unions, or even coworking spaces offer health insurance as part of their membership benefits. These group rates can often be more competitive than individual plans. Joining such organizations can also provide networking opportunities and other resources beneficial for your freelance career.

Directly from insurance companies

- Pros and cons of bypassing brokers and marketplaces: Some freelancers prefer to purchase insurance directly from insurance companies. Doing so can sometimes result in quicker approvals and potentially better customer service. However, it might limit the ability to compare multiple plans side by side. It’s essential to thoroughly research any company before purchasing directly.

Leveraging word of mouth and community insights

- The value of peer recommendations: Fellow freelancers can be invaluable sources of information. Whether it’s through online forums, social media groups, or local meetups, connecting with peers can provide firsthand insights into the best insurance providers and plans tailored to freelance needs.

In essence, while finding the right health insurance plan requires effort, the resources available today make it easier than ever for freelancers. Whether you prefer the autonomy of online platforms, the guidance of brokers, or the recommendations of fellow freelancers, there’s a path that suits every preference. The key is to research diligently, ask questions, and ensure the chosen plan aligns with both your health and financial needs.

The Future of Health Insurance for Freelancers

The realm of freelancing and self-employment is ever-evolving, as are the needs and solutions associated with health insurance. As the freelance economy continues to grow, it’s important to understand the potential shifts and innovations that might shape the future of health insurance for independent workers. Here’s a glimpse into what lies ahead:

The impact of legislation

- How changes in healthcare laws could affect freelancers: Governments worldwide are increasingly recognizing the unique needs of the freelance population. As such, new legislations or amendments to existing healthcare laws might be introduced to offer better protection and more affordable options for freelancers. Staying informed about these changes is crucial for freelancers to ensure they’re leveraging any new benefits or adapting to new requirements.

The rise of telemedicine

- How virtual healthcare is changing the insurance landscape: The global pandemic accelerated the adoption of telemedicine, allowing patients to consult with healthcare professionals virtually. As this trend continues, insurance providers might offer plans tailored to this mode of healthcare, potentially leading to cost savings and increased convenience for freelancers.

Innovative insurance models

- Startups and new approaches to health coverage for the self-employed: The digital age has ushered in a wave of startups aiming to disrupt traditional industries, including health insurance. These companies might introduce flexible, pay-as-you-go models, group pooling options, or AI-driven personalized plans that cater specifically to freelancers’ dynamic needs.

Globalization and cross-border insurance

- Health coverage for the global nomad: As technology enables freelancers to work from anywhere, the need for health insurance that offers international coverage becomes paramount. We might see the emergence of plans catering to digital nomads, offering protection across borders and catering to the unique challenges of a mobile lifestyle.

Integration with holistic health services

- Beyond traditional medical care: The broader understanding of health is leading to an increased focus on mental well-being, nutrition, and preventive holistic practices. Future insurance models might integrate these services, offering comprehensive coverage that addresses all facets of a freelancer’s health.

In conclusion, while the current landscape offers a range of options for freelancers, the future promises even more tailored, flexible, and comprehensive solutions. By staying informed and adaptable, freelancers can ensure they’re always at the forefront of leveraging the best health insurance options available.

Conclusion

The world of freelancing offers unparalleled freedom, autonomy, and the opportunity to pursue one’s passions. Yet, with these perks come responsibilities, one of the most crucial being the need to secure reliable health insurance. The journey to finding the right coverage can be intricate, filled with jargon, multiple options, and financial considerations. But as we’ve explored, it’s not an insurmountable challenge.

Understanding the importance of health insurance is the first step. Beyond the legal mandates in many countries, it’s the peace of mind, protection against unforeseen medical expenses, and access to preventive care that truly underscores its significance. The challenges, from fluctuating incomes to the absence of employer-sponsored benefits, are real but not undefeatable. With a plethora of options available—from traditional plans to innovative healthcare sharing models—every freelancer can find a solution tailored to their needs.

The process requires research, a clear assessment of one’s health needs, and meticulous financial planning. But the effort is a worthy investment. In an occupation marked by uncertainties, having the assurance that one’s health is covered can provide stability and focus, allowing freelancers to concentrate on what they do best.

As the freelance economy continues to expand and evolve, so will the world of health insurance. Staying informed, adaptable, and proactive will ensure that freelancers are always equipped with the best coverage, safeguarding their health and well-being in the years to come.

Additional Resources

Navigating the world of health insurance as a freelancer can be complex, but fortunately, there are numerous resources available to guide and support you on this journey. Whether you’re looking for detailed information, reviews, or community support, these resources can provide valuable insights and assistance:

- Websites:

- Healthcare.gov: The official health insurance marketplace for the U.S., providing a comprehensive platform to compare and purchase plans. It also offers tools to determine eligibility for subsidies.

- NAHU (National Association of Health Underwriters): Offers a “Find an Agent” tool to connect with licensed health insurance brokers in your area.

- World Nomads: For digital nomads and freelancers working abroad, this site provides information on international health insurance options.

- Books:

- “The Health Insurance Primer” by Catherine E. Thompson: A comprehensive guide that breaks down the complexities of health insurance, making it accessible for everyone.

- “Freelance Financially Free” by Joe Appleton: While not exclusively about health insurance, this book covers the financial aspects of freelancing, including budgeting for insurance.

- Freelancer Communities and Forums:

- Freelancers Union: An organization dedicated to the needs of independent workers, offering resources, advocacy, and even health insurance options in certain states.

- Reddit’s r/freelance and r/HealthInsurance: Online forums where freelancers from around the world share experiences, advice, and resources related to health insurance and freelancing in general.

- Organizations and Associations:

- AHP (Association Health Plans): Offers information on health plans tailored for members of professional associations.

- Chamber of Commerce: Local chambers often provide resources or group insurance rates for small businesses and independent contractors.

- Financial Planners and Tax Professionals:

- Consulting with a financial planner or tax professional can provide personalized guidance, especially when considering tax deductions related to health insurance or budgeting for premiums.

- Apps and Digital Tools:

- Stride Health: Tailored for freelancers and gig workers, this app helps users find the best insurance plans based on their needs and budget.

- Policygenius: An online insurance marketplace that allows users to compare multiple insurance options, including health, life, and disability insurance.

Embarking on the journey to secure health insurance as a freelancer might seem daunting, but remember: you’re not alone. The resources listed above, combined with the insights and experiences of the vast global freelance community, ensure that you’re well-supported every step of the way.