Excelling in Remote Mortgage Loan Processing: Career Opportunities and Tips

Introduction

In today’s dynamic financial landscape, mortgage loan processor roles are evolving to embrace remote work opportunities. As the housing market continues to thrive, the demand for skilled professionals who can navigate the intricate world of mortgage applications from the comfort of their homes is on the rise. This article delves into the exciting realm of remote mortgage loan processing, showcasing a variety of job opportunities that combine flexibility with the potential for a rewarding career. Whether you’re an experienced processor looking to transition to remote work or a newcomer intrigued by the mortgage industry, we’ll explore positions that cater to various skill levels and aspirations. Join us as we uncover the possibilities that await in the world of remote mortgage loan processing.

Remote Mortgage Loan Processor Job Opportunities

- Entry-Level Remote Mortgage Loan Processor

- Job Description: Process mortgage applications, verify documentation, and assist in loan origination from the comfort of your home.

- Requirements: High school diploma, basic computer skills, and strong attention to detail. No prior experience necessary; training provided.

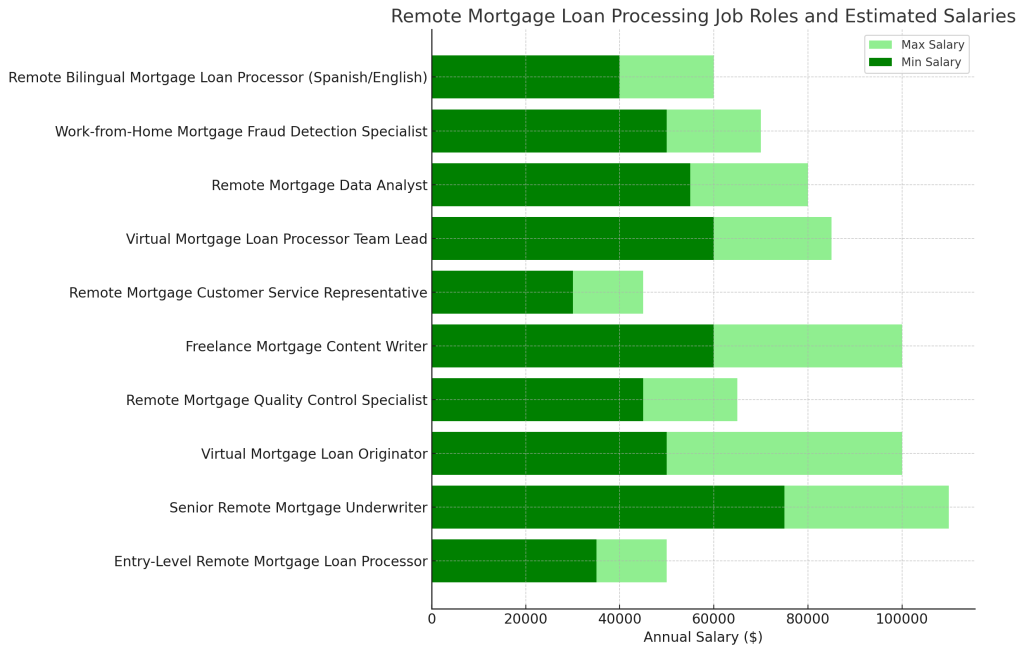

- Estimated Salary: $35,000-$50,000/year

- Benefits: Flexible schedule, health insurance, 401(k) matching

- Senior Remote Mortgage Underwriter

- Job Description: Review and analyze complex mortgage applications, assess risk, and make loan approval decisions for a leading financial institution.

- Requirements: Bachelor’s degree in Finance or related field, 5+ years of underwriting experience, and thorough knowledge of mortgage industry regulations.

- Estimated Salary: $75,000-$110,000/year

- Benefits: Performance bonuses, professional development opportunities, remote work stipend

- Virtual Mortgage Loan Originator

- Job Description: Generate new mortgage business, guide clients through the loan application process, and collaborate with processors and underwriters remotely.

- Requirements: Valid mortgage loan originator license, excellent communication skills, and sales experience. Self-motivation is key.

- Estimated Salary: $50,000-$100,000/year (base + commission)

- Benefits: Uncapped earning potential, flexible hours, comprehensive benefits package

- Remote Mortgage Quality Control Specialist

- Job Description: Conduct post-closing audits on mortgage files to ensure compliance with company policies and federal regulations.

- Requirements: Detail-oriented mindset, familiarity with mortgage documentation, and ability to work independently. Prior QC experience is a plus.

- Estimated Salary: $45,000-$65,000/year

- Benefits: Work-from-home setup allowance, paid time off, career advancement opportunities

- Freelance Mortgage Content Writer

- Job Description: Create engaging, informative content about mortgages, home buying, and real estate for various online platforms and financial institutions.

- Requirements: Strong writing skills, basic understanding of mortgage concepts, and ability to explain complex topics simply. No formal qualifications needed.

- Estimated Salary: $30-$50/hour

- Benefits: Project-based work, flexible schedule, potential for long-term contracts

- Remote Mortgage Customer Service Representative

- Job Description: Provide exceptional support to mortgage applicants and existing borrowers, answering queries and resolving issues via phone and email.

- Requirements: Excellent communication skills, patience, and basic knowledge of mortgage products. Previous customer service experience preferred but not mandatory.

- Estimated Salary: $30,000-$45,000/year

- Benefits: Paid training, performance incentives, employee assistance program

- Virtual Mortgage Loan Processor Team Lead

- Job Description: Oversee a team of remote mortgage loan processors, ensuring efficiency, accuracy, and compliance in loan processing operations.

- Requirements: Proven experience in mortgage loan processing, leadership skills, and ability to manage remote teams effectively.

- Estimated Salary: $60,000-$85,000/year

- Benefits: Leadership development programs, health and wellness benefits, profit sharing

- Remote Mortgage Data Analyst

- Job Description: Analyze mortgage trends, loan performance data, and market conditions to support decision-making and strategy development for a mortgage lender.

- Requirements: Strong analytical skills, proficiency in data analysis tools, and understanding of mortgage industry metrics. Degree in statistics or related field preferred.

- Estimated Salary: $55,000-$80,000/year

- Benefits: Tuition reimbursement, flexible work hours, regular team-building events

- Work-from-Home Mortgage Fraud Detection Specialist

- Job Description: Utilize advanced software and analytical skills to identify potential fraud in mortgage applications and protect the company from financial risks.

- Requirements: Sharp attention to detail, investigative mindset, and familiarity with mortgage documentation. Background in finance or law enforcement is beneficial.

- Estimated Salary: $50,000-$70,000/year

- Benefits: Comprehensive health insurance, retirement plans, professional development opportunities

- Remote Bilingual Mortgage Loan Processor (Spanish/English)

- Job Description: Process mortgage applications for Spanish-speaking clients, ensuring clear communication and smooth loan processing in both languages.

- Requirements: Fluency in Spanish and English, basic understanding of mortgage processes, and cultural sensitivity. Prior experience in financial services is a plus.

- Estimated Salary: $40,000-$60,000/year

- Benefits: Language differential pay, cultural diversity initiatives, remote work equipment provided

To apply for any of these jobs or similar positions, click here.

What People Say

“Working as a remote mortgage loan processor has given me the flexibility I’ve always wanted in my career. The company provides excellent training and support, which has helped me grow professionally. While the workload can be heavy during peak seasons, the ability to manage my own schedule and the competitive salary make it worthwhile.”

Zara Cunningham, Hilo, Hawaii

“I appreciate the stability and growth opportunities in my role as a remote mortgage underwriter. The company offers a comprehensive benefits package and invests in our professional development. However, staying up-to-date with constantly changing regulations can be challenging at times.”

Ivy Calhoun, Taos, New Mexico

“Transitioning to a remote mortgage loan originator position has been a game-changer for my work-life balance. The uncapped commission structure allows me to earn based on my efforts, and I love helping people achieve their homeownership dreams. The main drawback is the occasional feeling of isolation, but regular team video calls help maintain connections.”

Carter Pembrooke, Astoria, Oregon

“As a remote mortgage quality control specialist, I find my work both challenging and rewarding. The company provides all the necessary tools for effective remote work, and the salary is competitive for the industry. Sometimes the repetitive nature of the job can be monotonous, but knowing that I’m contributing to maintaining high standards in mortgage lending keeps me motivated.”

Ezra Broadmoor, Bayfield, Wisconsin

“My experience as a work-from-home mortgage customer service representative has been mostly positive. The flexible hours allow me to balance my personal life with work, and the company offers great benefits. The job can be stressful when dealing with upset clients, but the satisfaction of resolving issues and helping people navigate the mortgage process makes it worthwhile.”

Lyra Castillo, Lunenburg, Massachusetts

“Being a remote bilingual mortgage loan processor has opened up exciting opportunities for me. The company values my language skills, offering a generous language differential on top of a competitive base salary. While juggling applications in two languages can be demanding, the cultural diversity in our client base keeps the work interesting and fulfilling.”

Diego Fuentes, Bruges, Belgium

More Remote Jobs

- Virtual Financial Advisor

- Job Description: Provide personalized financial guidance to clients remotely, helping them achieve their financial goals through investment strategies and financial planning.

- Requirements: Bachelor’s degree in Finance or related field, relevant certifications (e.g., CFP, CFA), excellent communication skills.

- Estimated Salary: $60,000-$100,000/year (plus commissions)

- Benefits: Flexible schedule, performance bonuses, ongoing professional development

- Remote Software Developer for FinTech

- Job Description: Develop and maintain financial software applications, focusing on mortgage and lending technologies.

- Requirements: Proficiency in programming languages (e.g., Java, Python), understanding of financial systems, problem-solving skills.

- Estimated Salary: $70,000-$120,000/year

- Benefits: Stock options, health insurance, remote work equipment allowance

- Online Personal Finance Coach

- Job Description: Guide individuals in managing their personal finances, budgeting, and achieving financial independence through virtual coaching sessions.

- Requirements: Strong knowledge of personal finance, coaching skills, patience. Certification in financial coaching is a plus.

- Estimated Salary: $40-$100/hour

- Benefits: Flexible work hours, potential for building your own brand, rewarding client relationships

- Remote Real Estate Appraiser

- Job Description: Conduct property valuations using online tools and databases, prepare appraisal reports for mortgage lenders and other clients.

- Requirements: Appraiser certification, familiarity with valuation software, attention to detail.

- Estimated Salary: $50,000-$80,000/year

- Benefits: Independence in work, potential for high earnings in busy markets, flexible schedule

- Virtual Mortgage Marketing Specialist

- Job Description: Develop and implement digital marketing strategies to promote mortgage products and services, manage social media presence, and generate leads.

- Requirements: Marketing experience, knowledge of digital marketing tools, creativity. Familiarity with the mortgage industry is a plus.

- Estimated Salary: $45,000-$70,000/year

- Benefits: Performance-based bonuses, creative work environment, professional growth opportunities

- Remote Financial Data Entry Specialist

- Job Description: Input and manage financial data for mortgage applications and other lending products, ensuring accuracy and completeness of information.

- Requirements: Fast and accurate typing skills, attention to detail, basic understanding of financial terms.

- Estimated Salary: $30,000-$45,000/year

- Benefits: Steady workload, potential for overtime pay, work-from-home setup provided

- Online Mortgage Education Instructor

- Job Description: Develop and deliver online courses for aspiring mortgage professionals, covering topics such as loan processing, underwriting, and industry regulations.

- Requirements: Extensive experience in the mortgage industry, teaching skills, ability to create engaging online content.

- Estimated Salary: $50,000-$80,000/year

- Benefits: Influence on industry education, royalties from course sales, flexible teaching schedule

- Remote Compliance Officer for Mortgage Lenders

- Job Description: Ensure the company’s mortgage lending practices comply with federal and state regulations, conduct internal audits, and develop compliance policies.

- Requirements: In-depth knowledge of mortgage industry regulations, attention to detail, strong analytical skills.

- Estimated Salary: $70,000-$110,000/year

- Benefits: Critical role in company operations, opportunities for advanced certifications, comprehensive health benefits

- Virtual Mortgage Loan Closer

- Job Description: Prepare and review closing documents, coordinate with title companies and attorneys, and ensure smooth completion of mortgage transactions.

- Requirements: Knowledge of mortgage closing procedures, excellent organizational skills, ability to work under pressure.

- Estimated Salary: $40,000-$60,000/year

- Benefits: Satisfaction of helping people finalize home purchases, potential for bonuses, work-life balance

- Remote AI Specialist for Mortgage Technology

- Job Description: Develop and implement AI and machine learning solutions to streamline mortgage processes, improve risk assessment, and enhance customer experiences.

- Requirements: Strong background in AI and machine learning, programming skills, understanding of mortgage industry challenges.

- Estimated Salary: $90,000-$140,000/year

- Benefits: Cutting-edge work environment, opportunities to innovate, competitive tech industry benefits

To apply for any of these jobs or similar positions, click here.

Conclusion

As we’ve explored the diverse landscape of remote mortgage loan processor jobs and related opportunities in the financial sector, it’s clear that the industry offers a wealth of possibilities for professionals at all levels. From entry-level positions to specialized roles in underwriting, quality control, and beyond, the mortgage industry continues to evolve, embracing remote work and technological advancements.

Whether you’re drawn to the flexibility of loan processing, the analytical challenges of underwriting, or the innovative realm of fintech development, there’s a remote position that can align with your skills and career aspirations. The mortgage industry offers not just jobs, but pathways to fulfilling careers with competitive salaries, comprehensive benefits, and opportunities for growth.

To stay ahead in this dynamic field and never miss out on exciting remote opportunities in mortgage loan processing and related areas, we invite you to join our email list. By subscribing, you’ll receive regular updates on the latest job openings, industry trends, and valuable insights to help you navigate your career in the mortgage and financial services sector. From loan origination to compliance, from customer service to cutting-edge AI applications in lending, we’ll keep you informed about the most promising remote positions available.

Take the first step towards your ideal remote career in the mortgage industry. Sign up for our newsletter today and open the door to a world of opportunities that combine the flexibility of remote work with the stability and growth potential of the financial sector. Your next career move in mortgage loan processing or a related field could be just an email away!