Tax Efficiency 101: Work-from-Home Tax Tips for Social Media Pros

Navigating the tax landscape as a social media professional can be daunting, especially when you’re working from home. Did you know that as an influencer or content creator, the IRS considers you a sole proprietor? This article provides essential tips and strategies to help take the stress out of tax season for social media professionals.

Let’s dive in and find out how to make your taxes work for you!

Key Takeaways

- Social media professionals must report all income earned from social media activities and pay taxes on that income.

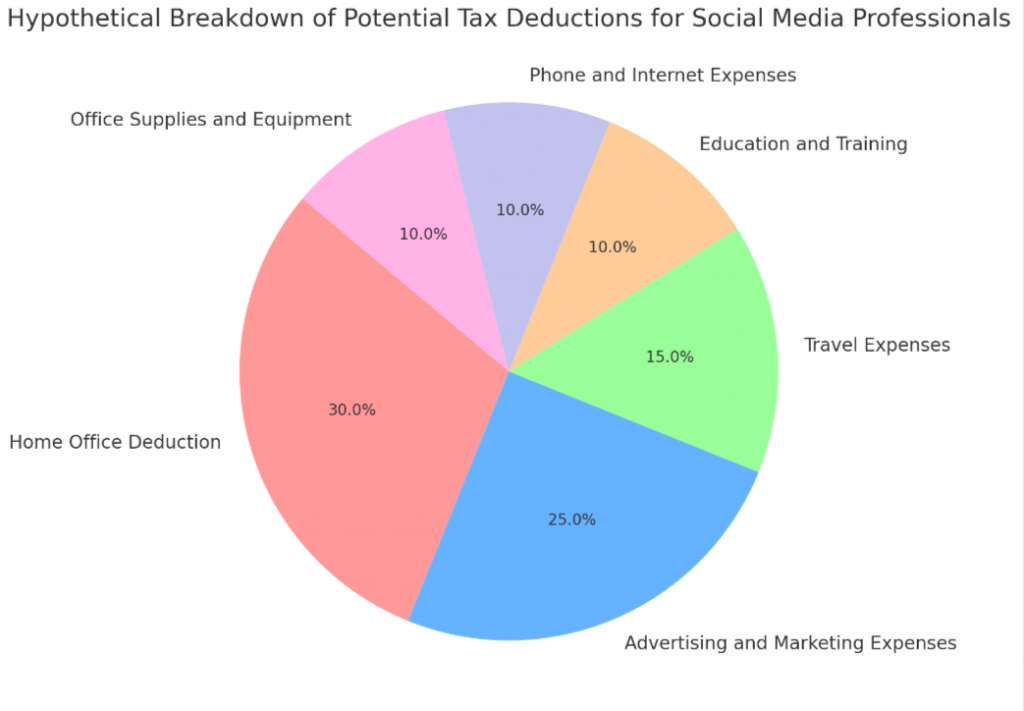

- Key tax deductions for social media professionals include the home office deduction, advertising and marketing expenses, travel expenses related to work, business-related education and training, phone and internet expenses, and office supplies and equipment.

- Remote workers in the social media profession need to understand state and local tax codes and navigate tax complications as digital nomads.

- Effective tax strategies for social media professionals include keeping track of work-related expenses, using tax software for easier filing, and paying taxes quarterly to avoid year-end surprises.

Understanding Tax Responsibilities as a Social Media Professional

Social media professionals must be aware of their tax responsibilities, including reporting income earned from social media and paying taxes on that income.

Reporting income from social media

All income generated from social media activities must be reported to the Internal Revenue Service (IRS). This includes money earned through advertising, sponsored posts, brand partnerships, and other revenue channels.

Simply put, if you’re a content creator or influencer making money online, this is taxable income. You’re required by law to report it on your tax return using Form 1099-NEC or Schedule C if you’re operating as a sole proprietor.

Not doing so may lead to penalties under tax evasion laws.

Paying taxes on social media income

Making money on social media platforms can be an exciting and creative endeavor. But it’s paramount to understand that this income is considered taxable by the Internal Revenue Service (IRS).

Whether you’re a content creator, influencer, or simply monetizing your Instagram account, reporting all earnings accurately is part of your tax responsibilities.

Even if payments are received through unconventional means such as gifts or free products, they still need to be reported. Platforms may send influencers a Form 1099-NEC highlighting their annual earnings.

If not provided, individuals should keep track of their income independently to ensure accuracy when filing taxes.

Money made from sponsored posts, affiliate marketing partnerships, ad revenue from YouTube videos or any other source counts as self-employed income. You’ll owe both income tax and self-employment tax on these earnings.

You can offset some of this burden by taking advantage of IRS permitted sole proprietor deductions listed in Schedule C like home office deduction or costs related to advertising and marketing among others.

Using a reliable tax software package simplifies the process for many social media professionals while decreasing the chance for errors during calculations and filings. For complex situations engaging with a knowledgeable tax/financial/legal professional specializing in managing influencer taxes greatly optimizes your returns ensuring all possible deductibles are accounted for without skipping on mandatory taxable items.

Key Tax Deductions for Social Media Professionals

Social media professionals can take advantage of key tax deductions such as the home office deduction, advertising and marketing expenses, travel expenses related to work, business-related education and training, phone and internet expenses, and office supplies and equipment.

Home office deduction

The home office deduction is a significant advantage for social media professionals who work from home. It allows influencers to lower their taxable income by deducting a portion of their rent or mortgage interest, as well as related expenses such as property taxes and insurance.

However, this benefit only applies if you use your home office exclusively and regularly for your business activities. As part of qualifying costs, the phone bills and internet expenses can also be partially deducted since these are necessary operating fees.

For maximum deductions, it’s wise to collaborate with a tax advisor who specializes in this area; they possess in-depth knowledge that could help optimize the benefits from using this tax-saving mechanism.

Advertising and marketing expenses

Expenses related to advertising and marketing present significant tax deductions for influencers. If you’re investing in sponsored posts, Facebook ads, or Google Adwords, these costs are considered necessary business operations expenses.

It’s notable that even the phone bills or internet expenses involved in crafting your online presence can be partly deducted as operating fees when they directly contribute to your social media activities.

Furthermore, other necessities like office supplies tied directly to your content creation and website costs for maintaining a professional web presence can also serve as potential write-offs under IRS rules.

By optimizing such advertising and marketing-related deductions with the help of a tax advisor, influencers can significantly reduce their taxable income.

Travel expenses related to work

Travel expenses are an important consideration for social media professionals. The good news is that influencers can claim tax deductions on various travel-related expenses, including transportation, lodging, meals, and entertainment.

This means that when you’re traveling for work purposes like attending conferences or meeting with clients, you can potentially reduce your taxable income by deducting these costs.

It’s important to keep detailed records and receipts of all your travel expenses so you can accurately claim them on your taxes. By taking advantage of these deductions, you can minimize the impact of travel costs on your overall tax bill while still growing your social media business effectively.

Business-related education and training

Social media professionals can benefit from business-related education and training, which can be deducted as a tax write-off. By investing in courses, seminars, workshops, or conferences that enhance their skills and knowledge in social media marketing and content creation, influencers can improve the success of their businesses while also reducing their taxable income.

Hiring a tax advisor is recommended to help influencers optimize their deductions strategy and stay compliant with tax laws.

Phone and internet expenses

Social media professionals can deduct their phone and internet expenses as operating fees for their business. This means that the costs incurred for phone plans, data usage, and internet service can be claimed as tax deductions.

By including these expenses in their tax filings, social media influencers and content creators can reduce their taxable income and potentially lower their overall tax bill. So, whether it’s taking client calls or managing social media accounts online, remember to keep track of your phone and internet expenses so you can maximize your deductions come tax time.

Office supplies and equipment

Social media professionals can deduct office supplies and equipment as business expenses. This includes items like computers, printers, writing utensils, notepads, and printer ink cartridges.

The specific tax deductions for office supplies and equipment may vary depending on the influencer’s niche and work-related expenses. Keeping itemized receipts and detailed records of work-related expenses is essential to support deduction claims in case of an audit.

Seeking help from a tax professional can save money and provide peace of mind when dealing with the complications of remote work.

Special Considerations for Remote Workers

Remote workers, including social media professionals, need to understand state and local tax codes when reporting their income and paying taxes. They also face unique challenges when it comes to navigating tax complications as digital nomads.

Understanding state and local tax codes

State and local tax codes can have a significant impact on remote workers in the social media profession. Here are some important things to know:

- Tax rates: State and local tax rates vary across different locations, so it’s essential to understand the specific rates that apply to your area.

- Nexus rules: Remote workers may need to pay taxes in the states where their clients or customers are located. This is determined by nexus rules, which establish a connection between a business and a particular state for tax purposes.

- Residency requirements: Each state has its own criteria for determining residency status, which can affect how much you owe in taxes. Make sure to familiarize yourself with the rules of your state of residence.

- Apportionment rules: If you work remotely for a company based in another state, you may need to pay taxes proportionally based on the amount of time you spend working in each state.

- Credits and deductions: Some states offer tax credits or deductions for remote workers, such as credits for home office expenses or deductions for travel expenses related to work.

- Compliance requirements: State tax laws require individuals to file income tax returns if they meet certain income thresholds. It’s important to stay up-to-date with these requirements and timely file your taxes.

Navigating tax complications as a digital nomad

As a digital nomad, navigating tax complications can be challenging. Since you work remotely and travel frequently, it’s important to understand how different states and countries handle taxes for individuals like you.

Keep in mind that tax laws vary depending on your location and the duration of your stay. To ensure compliance with tax regulations, consider working with a tax professional who specializes in remote workers or international taxation.

They can help you navigate the complexities of filing taxes as a digital nomad and take advantage of any available deductions or credits while staying compliant with local laws. Stay organized by keeping track of your income and expenses throughout the year, including any travel-related costs or business-related purchases to make tax season smoother.

Effective Tax Strategies for Social Media Professionals

Keep track of all work-related expenses, utilize tax software for easier filing, and pay taxes quarterly to avoid year-end surprises.

Keeping track of all work-related expenses

To effectively manage your taxes as a social media professional, it is crucial to keep a detailed record of all work-related expenses. This will help you accurately report your income and maximize your deductions. Here are some key points to remember:

- Keep itemized receipts for all business purchases, including office supplies, software costs, advertising expenses, and professional development materials.

- Maintain a separate bank account or credit card dedicated solely to your business expenses. This will make it easier to track and categorize your transactions.

- Use accounting software or apps specifically designed for self – employed individuals to streamline expense tracking and generate reports for tax purposes.

- Don’t forget to include any mileage related to business travel in your expense records. You can use apps or a mileage logbook to track this information accurately.

- If you work from home, keep records of household bills such as utilities and internet costs. These can be used to calculate the percentage of your home that is used for business (for the home office deduction).

- Regularly review your expense records throughout the year to ensure accuracy and identify any missed deductions.

Using tax software for easier filing

Tax software is a game-changer for social media professionals when it comes to filing taxes. This convenient tool helps simplify the process and ensures accuracy in filing. By using tax software, you can easily redeem deductions specific to your line of work and file your taxes electronically.

Not only does this save you time, but it also eliminates the need for complicated paperwork and calculations. In fact, Bonsai Tax software claims that users typically save an impressive $5,600 from their tax bill.

So if you want a stress-free and efficient way to handle your taxes as a social media professional, consider utilizing tax software for easier filing.

Paying taxes quarterly to avoid year-end surprises

Social media professionals can benefit greatly from paying their taxes quarterly instead of waiting until the end of the year. By making regular payments throughout the year, they can avoid any unexpected tax burdens and potential financial strain.

Quarterly tax payments help these professionals stay on top of their obligations to the IRS and manage their cash flow effectively. This proactive approach allows social media professionals to budget for their tax expenses, preventing any last-minute surprises or penalties for underpayment.

It’s a smart strategy that ensures smooth financial operations and peace of mind throughout the year.

Additional Tips for Tax Season

Save all your receipts for any purchases related to your social media business and consider seeking help from a tax professional if you need assistance navigating the complexities of tax season.

Read on to learn more about how to maximize your tax deductions as a social media professional.

Saving receipts for all purchases

Saving receipts for all purchases is essential for social media professionals to maximize their tax deductions and accurately report their business expenses. This practice not only helps in tracking expenses but also provides evidence to support deduction claims in case of an audit.

By keeping itemized receipts and detailed records of work-related expenses, social media professionals can ensure that they claim all eligible deductions, such as advertising and marketing costs, office supplies and equipment, travel expenses, and business-related education and training. Additionally, saving receipts allows for easy reference when calculating the net profit or loss from their business, ensuring accurate reporting on their tax return.

Seeking help from a tax professional if needed

Hiring a tax professional can provide valuable assistance for social media professionals when it comes to optimizing their income tax deductions strategy and ensuring compliance with tax laws.

With their expertise, these professionals can help navigate the complexities of tax regulations specific to influencers and content creators. They can also provide guidance on record-keeping requirements, quarterly estimated taxes, and any special considerations for remote workers or digital nomads.

By seeking the help of a tax professional, social media professionals can have peace of mind knowing that their taxes are being handled accurately and efficiently while maximizing their allowable deductions.

Conclusion

In conclusion, social media professionals need to be aware of their tax responsibilities and take advantage of the numerous deductions available to them. By keeping track of expenses, using tax software for filing, and paying taxes quarterly, influencers can effectively manage their taxes and avoid surprises at year-end.

Seeking help from a tax professional when needed is also a smart strategy for maximizing deductions and ensuring compliance with IRS regulations. Stay informed about the latest tax laws and make sure to save all receipts to ensure accurate reporting come tax time.