Building Wealth for the Future: Essential Investing Tips for Long-Term Security

Are you concerned about your financial future and want to invest wisely but don’t know where to start? The truth is, investing is a long game that requires careful planning and strategy.

This article simplifies the complexities of long-term investing by offering actionable tips for securing your financial future. Let’s kickstart your journey towards more rewarding investments!

Key Takeaways

- Get your finances in order by paying off high – interest debt and creating an emergency fund before considering investing.

- Understand your time horizon and align your investment decisions with it, whether you have many years or a few until you need the funds.

- Choose an investment strategy that suits your risk tolerance and goals, and stick with it despite market fluctuations.

- Diversify your investments through mutual funds and ETFs to lower overall risk and protect against market volatility.

Preparing for Long-Term Investment

To prepare for long-term investment, it is important to first get your finances in order and understand your time horizon.

Get Your Finances in Order

Setting your financial house in order is the first critical step towards long-term investment. Start by clearing off any high-interest debt that can drain your finances, such as credit card balances or student loans.

Next, create an emergency fund to cover unexpected expenses; ideally, this should be equivalent to three to six months of living costs. Finally, allocate a certain portion of each paycheck for regular savings and only consider investing once these foundational steps are taken care of.

This structured approach ensures you have a stable monetary base before stepping into unpredictable market territories.

Understand Your Time Horizon

Recognizing your time horizon plays a pivotal role in successful long-term investing. It’s about figuring out how many years or decades you plan to invest before needing the money back.

This could be for major financial goals such as retirement savings, buying a house, funding your child’s education, or even starting a business.

Your time horizon directly influences your investment decisions and risk tolerance. If you have more years ahead of you for investing, it might make sense to take on higher-risk investments like stocks or growth funds.

On the other hand, if you’re closer to needing the funds – say five years away from retirement – safer options like bonds may be more appropriate. Navigating these decisions will help align your asset allocation with your specific time horizon and personal finance objectives.

Pick a Strategy and Stick with It

Choosing an investment strategy and maintaining it consistently forms the bedrock of successful long-term investing. Navigating financial markets requires a firm decision on your preferred approach, be it active investing, passive investing, or a blend of both.

This choice must align with your risk tolerance, financial goals, and time horizon for investment returns. Over time, market volatility may tempt you to alter your approach. Resist hasty decisions based on short-term market conditions or popular trends.

Long-term investings’ power lies in steadfast commitment to your chosen strategy despite market fluctuations.

Understanding the Risks in Investing

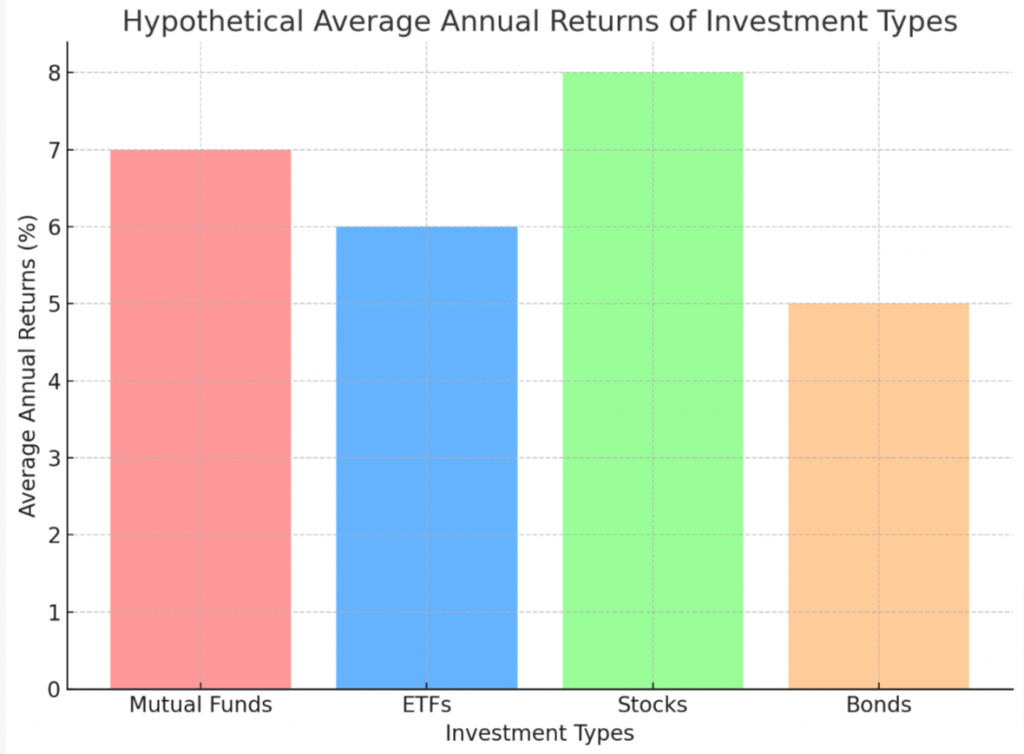

Diversification via mutual funds and ETFs helps mitigate the risks associated with investing, while being aware of potential investment risks is crucial for long-term financial security.

Diversification via Mutual Funds and ETFs

Investing in diversified assets can significantly decrease your investment risks. This is why mutual funds and exchange-traded funds (ETFs) are crucial tools in every long-term investing strategy. When using these financial instruments:

The Importance of Being Aware of Investment Risks

Understanding the risks associated with investing is crucial for long-term financial security. Different types of investments come with varying levels of risk, and it’s important to be aware of these risks before making any investment decisions.

By understanding the potential risks, investors can better assess their risk tolerance and make informed choices that align with their financial goals. Whether it’s market volatility, default risk, or fluctuating interest rates, being aware of these risks allows investors to take proactive measures to mitigate them and maximize their chances of success in the long run.

Cost Efficiency in Long-Term Investing

Consider the impact of fund expense ratios and financial advisory fees on your long-term investment returns.

Fund Expense Ratios

Fund expense ratios play a crucial role in long-term investing. These ratios represent the percentage of a fund’s assets that go towards covering operating expenses, including management fees and administrative costs.

It is important to carefully consider these expense ratios because even small differences can have a significant impact on your overall returns. Over time, these costs can compound and eat into your investment gains, reducing the value of your portfolio.

To optimize cost efficiency in long-term investing, it is wise to choose funds with low expense ratios and regularly review them to ensure they align with your investment goals. By keeping an eye on fund expense ratios, you can make informed decisions that help maximize your investment returns over the long term.

Financial Advisory Fees

Financial advisory fees play a crucial role in the cost efficiency of long-term investing. These fees, although seemingly small at first glance, can have a significant impact on overall returns over time.

It is important for investors to be aware of these costs and factor them into their investment decisions. By understanding and evaluating the financial advisory fees associated with different investment options, investors can make informed choices that align with their long-term goals and minimize unnecessary expenses.

Remember, even small costs can add up over time and affect the overall performance of your portfolio.

Long-Term Impact of Fees

Investing costs, such as expense ratios and advisory fees, can have a significant long-term impact on your overall investment returns. Even small fees can compound over time, eating into your portfolio’s growth potential.

It’s important to consider the cost efficiency of your investments to maximize your long-term financial security. Remember that asset allocation and diversification alone cannot eliminate the risk of losses, so it’s crucial to also pay attention to the fees associated with your investments.

Taking these costs into account before making any trades is an essential step in building a successful long-term investment strategy.

Regular Review of Your Investment Strategy

Regularly reviewing and adjusting your investment strategy is crucial for long-term financial security. The market is constantly changing, and it’s important to stay informed about any shifts that could impact your investments.

By regularly reviewing your investment strategy, you can ensure that it aligns with your goals and risk tolerance. This allows you to make any necessary adjustments to maximize returns and minimize potential losses.

Additionally, staying up-to-date with market conditions helps you take advantage of opportunities as they arise, ensuring that you are making the most informed decisions possible. Remember, holding onto investments during market dips and focusing on the long term is key for long-term success in building wealth.

Top Choices for Long-Term Investments

Investors seeking long-term financial security have several top choices for investments, including growth stocks, stock funds, bond funds, dividend stocks, value stocks, target-date funds, real estate, small-cap stocks, robo-advisor portfolios, and Roth IRAs.

Growth stocks

Growth stocks are considered top choices for long-term investments for financial security. These stocks belong to companies that are expected to experience significant growth in the future.

Investing in growth stocks can be rewarding, as these companies typically reinvest their earnings back into the business to fuel expansion and innovation. While they do come with higher risks compared to other investment options, such as value stocks or dividend stocks, growth stocks have the potential to generate substantial returns over time.

It is important to carefully research and assess each company’s growth prospects before making any investment decisions.

Stock funds

Stock funds are a popular choice for long-term investing because they offer the opportunity for capital appreciation over time. These funds pool money from multiple investors and invest in a diversified portfolio of stocks.

By investing in stock funds, you gain exposure to different companies across various sectors, which can help spread out your investment risk. It’s important to note that stock funds come with market volatility and fluctuations, so it’s crucial to have a long-term perspective and be prepared for potential short-term losses.

However, history has shown that over the long run, well-managed stock funds have the potential to generate significant returns.

Investing in stock funds also provides an opportunity for growth as these funds typically invest in companies with strong growth prospects. While past performance is not indicative of future results, it’s worth noting that historically, stocks have outperformed other asset classes like bonds or cash investments over extended periods.

Bond funds

Bond funds are a type of investment that provide exposure to fixed-income securities. They are often considered a conservative option for investors looking for stability and regular income.

Bond funds can offer diversification by holding a variety of bonds in their portfolio, including government bonds, corporate bonds, and municipal bonds. The performance of bond funds is influenced by factors such as interest rates, credit quality, and duration.

Investors in bond funds can receive regular income through the payment of interest.

Dividend stocks

Dividend stocks are a popular choice among long-term investors who value stability and regular cash payouts. These stocks belong to companies that are considered more mature and established, making them less volatile compared to growth stocks.

By investing in dividend stocks, you can receive annual payouts of around 3-4% on your investment. In fact, some companies even increase their dividends by 8-10% every year over long periods.

However, it’s important to note that dividend stocks can still experience significant fluctuations, especially during challenging market conditions. So if you’re looking for consistent income from your investments, dividend stocks might be worth considering.

Value stocks

Value stocks are an excellent choice for long-term investments when aiming to achieve financial security. These types of stocks are particularly appealing during periods of high market valuations and rising interest rates, as they offer defensive qualities.

Not only do value stocks perform well in these scenarios, but they also provide above-average returns with lower risk compared to other non-value stocks. Investors who prioritize long-term stability should consider including value stocks in their investment strategy, as they have the potential to deliver consistent growth over time.

Target-date funds

Target-date funds are an excellent choice for investors who prefer a hands-off approach to investing and want a more conservative portfolio as they get closer to retirement. These funds automatically adjust their asset allocation based on the target date, gradually shifting from higher stock exposure to more bond exposure as retirement approaches.

This shift helps manage risk by reducing volatility in the portfolio over time. However, it’s important to note that target-date funds do carry similar risks to stock and bond funds.

The level of risk depends on how far away the target date is, with higher stock exposure allocated for longer time horizons and more bond exposure as the target date draws near.

Real estate

Real estate is another option for long-term investments. Investing in real estate allows individuals to borrow money from banks and can offer potential tax benefits for property owners.

However, it’s important to note that real estate investing requires active management, especially when renting out the property. There are risks associated with lack of diversification and potential property problems that investors should be aware of before committing to this investment strategy.

Small-cap stocks

Small-cap stocks are considered top choices for long-term investments. These stocks represent companies with smaller market capitalization, but they have the potential for significant growth over time.

Investing in small-cap stocks can offer higher returns compared to larger, more established companies. Schwab offers a range of investment products, including small-cap stocks, which are considered top choices for long-term investments related to investing tips for long-term financial security.

With various trading and research tools provided by Schwab, investors can make informed decisions when investing in small-cap stocks.

Robo-advisor portfolio

Schwab offers a robo-advisor portfolio as part of their investment services. This portfolio includes a range of investment products, such as mutual funds, ETFs, stocks, options, bonds, and even cryptocurrency.

With their robo-advisor platform, Schwab provides investors with various trading and research tools to help them make informed decisions. Plus, they offer different contact options for customer support through phone numbers dedicated to specific services.

The robo-advisor portfolio is just one component of Schwab’s long-term investment options that also include brokerage accounts, retirement accounts (IRAs), and education and custodial accounts.

Roth IRA

A Roth IRA is one of the top choices for long-term investments. With a Roth IRA, you contribute after-tax money, meaning you won’t be taxed on your earnings when you withdraw them in retirement.

This makes it an attractive option for those who expect their tax rate to be higher in retirement. It’s important to understand that there are contribution limits and income restrictions for a Roth IRA, so make sure to check if you’re eligible.

Additionally, market volatility and system availability may cause delays in accessing your account or executing trades for a Roth IRA. So, consider these factors before incorporating a Roth IRA into your investment strategy.

Essential Rules for Long-Term Investing

Understand the risks of your investments, pick a strategy you can stick with, know your time horizon, and make sure your investments are diversified. These rules are crucial for long-term financial security.

Understand the risks of your investments

Understanding the risks associated with your investments is vital for long-term financial security. It is important to remember that asset allocation and diversification cannot completely eliminate the risk of investment losses.

Past performance should not be seen as a guarantee for future success. Additionally, delays in accessing your account or executing trades may occur due to market volatility and system availability.

Therefore, before making any investment decisions, it is crucial to consider the potential costs involved and thoroughly evaluate the risks associated with each investment option you are considering.

Pick a strategy you can stick with

Choosing a long-term investment strategy is crucial for financial security. It’s important to pick a strategy that suits your goals and risk tolerance, but most importantly, one that you can stick with over time.

Consistency is key in investing because the market goes through ups and downs. Jumping from one strategy to another based on short-term market fluctuations can lead to poor returns and missed opportunities.

By staying committed to your chosen strategy, you give your investments the opportunity to grow steadily over the long term, maximizing your chances of achieving your financial goals.

Know your time horizon

Understanding your time horizon is crucial for successful long-term investing. Your time horizon refers to the length of time you have until you need to access the funds you have invested.

It can be short-term, such as a few months or years, or long-term, such as several decades. Knowing your time horizon helps you determine which investment strategy is most appropriate for you.

If your time horizon is long-term, like many people saving for retirement, you may have a higher tolerance for risk and can afford to invest in assets that may experience more volatility but offer greater potential returns over the long run.

On the other hand, if your time horizon is shorter term and you will need the funds within a few years, it might be wise to prioritize investments that are more stable and less likely to experience significant fluctuations in value.

Make sure your investments are diversified

Diversification is a key factor for long-term investing success and essential for securing your financial future. By spreading your investments across different asset classes, such as stocks, bonds, real estate, and more, you can reduce the risk of losing all your money if one investment performs poorly.

Mutual funds and exchange-traded funds (ETFs) are excellent options to achieve diversification because they pool together various assets into a single investment vehicle. This broad exposure helps to protect against market volatility and enhances the potential for long-term growth.

Remember that diversifying your portfolio can help manage risk while still providing opportunities for substantial returns over time.

FAQs on Long-Term Investing

Long-term investing can be a complex topic, so it’s natural to have questions. Here are some frequently asked questions about long-term investing:

- How long is considered “long – term” when it comes to investing?

- What are the benefits of investing for the long term?

- What types of investments are suitable for long – term goals?

- How do I determine my risk tolerance for long – term investments?

- Should I continue to invest during market downturns?

- What is dollar-cost averaging and how does it work in long-term investing?

- How often should I review or adjust my long – term investment strategy?

- Can I use a robo-advisor for my long-term investment portfolio instead of a financial advisor?

Conclusion

In conclusion, investing for long-term financial security requires careful preparation and understanding of the risks involved. By getting your finances in order, choosing a strategy that suits your goals, and staying diversified, you can set yourself up for success.

Remember to regularly review your investments and be mindful of costs to maximize your returns over time. With these tips in mind, you’ll be on the right track towards achieving long-term financial security.