Charting a Secure Retirement Path for Digital Media Experts

Introduction

The 21st century has ushered in a revolution in the way we work. With the rise of digital platforms and the omnipresent internet, remote work has become not just a possibility, but for many, a preferred mode of employment. Among the forerunners in this remote work revolution are social media professionals. Their world, intrinsically tied to the online realm, offers the flexibility of working from virtually anywhere.

However, with this newfound flexibility comes a unique set of challenges, especially when thinking about the future and planning for retirement. Traditional employees often have the luxury of employer-sponsored retirement plans, consistent income, and a structured path to savings. In contrast, remote social media professionals, many of whom operate as freelancers or contractors, have to carve their own path.

The importance of retirement planning cannot be overstated. It’s the process that ensures that the freedom and flexibility enjoyed today doesn’t lead to financial constraints tomorrow. For remote workers in the social media sector, understanding this landscape, the challenges, and the opportunities, is paramount.

This article dives deep into the world of retirement planning tailored specifically for these professionals, providing insights, strategies, and guidance to ensure a secure financial future.

1. The Unique Retirement Challenges Faced by Remote Workers

1.1. Inconsistent Income Streams

The life of a remote social media professional is often marked by waves of income. Some months might bring in lucrative projects, while others might be leaner. This cyclical nature of freelancing and project-based work poses a unique challenge when planning for retirement.

Consistent income provides a stable foundation for systematic savings. It allows for predictable contributions to retirement accounts and a clearer projection of future finances. However, the unpredictable income streams of freelancers can make this systematic approach challenging.

For instance, during a profitable month, a freelancer might be tempted to contribute more to their retirement fund. But if the next month brings fewer projects, they might need to dip into savings or even withdraw from their retirement account, negating the benefits of their earlier contributions.

1.2. Lack of Employer-Sponsored Retirement Benefits

Traditional employment often comes with a suite of benefits, including health insurance, paid leave, and crucially, employer-sponsored retirement benefits like the 401(k) match. These matches can significantly boost an employee’s retirement savings, offering essentially “free money” towards their future.

Remote social media professionals, especially those operating as independent contractors or freelancers, lack this employer cushion. Without a company matching their retirement contributions or guiding them through structured retirement plans, these professionals are on their own. This absence means they must be even more proactive and informed to ensure they’re setting aside enough for their golden years.

1.3. The Need for Self-Discipline and Proactiveness

Without the structured environment of traditional employment, remote workers need an extra dose of discipline and forward-thinking. With no HR department providing reminders about retirement contributions or annual benefits reviews, the onus falls squarely on the individual.

Cultivating a savings mindset is essential. This means resisting the temptation to splurge during profitable months and instead maintaining a consistent savings strategy. It also involves periodic financial reviews, ensuring that as one’s career progresses and financial needs evolve, their retirement strategy adapts in tandem.

Additionally, with the myriad of retirement account options available, remote social media professionals must take the initiative to educate themselves, select the right plans, and ensure they’re maximizing their contributions and benefits.

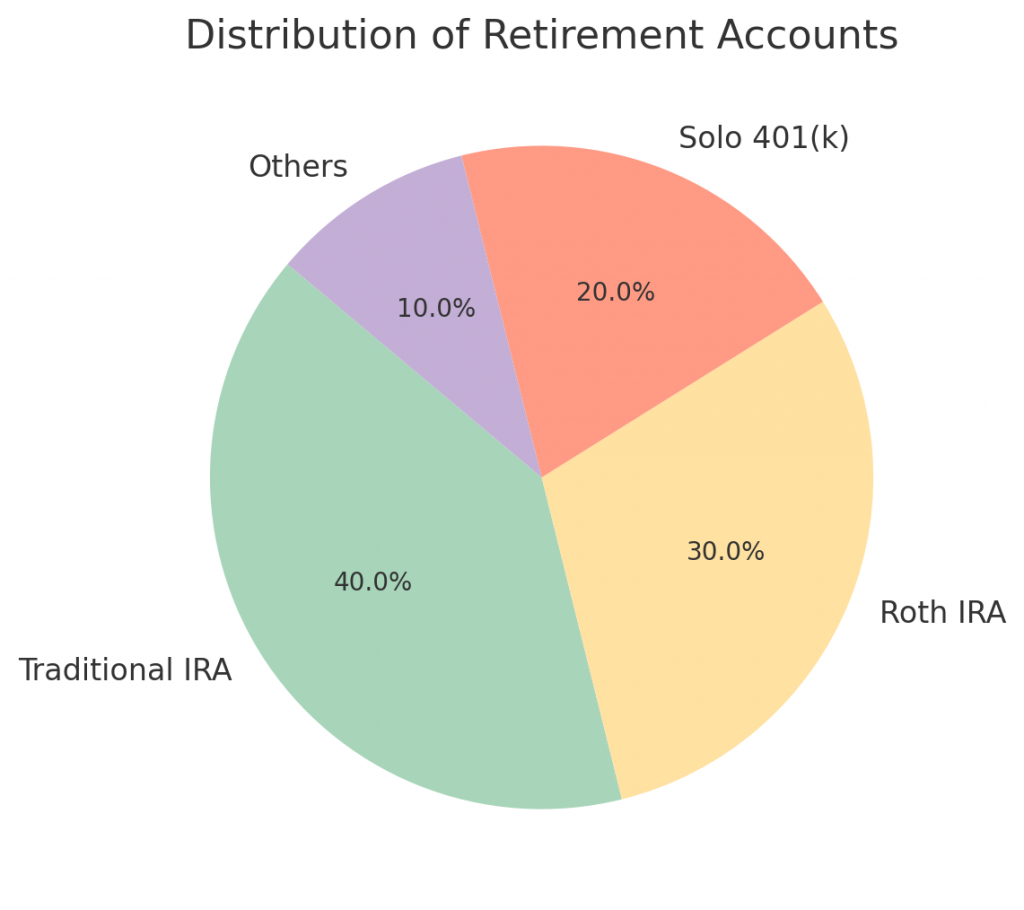

2. Understanding Different Retirement Account Options

2.1. Traditional and Roth IRAs

Individual Retirement Accounts (IRAs) are one of the most well-known retirement savings tools available. They provide a vehicle for individuals to set aside money for retirement, offering tax benefits to incentivize savings.

- Traditional IRA:

- Contributions to a Traditional IRA may be tax-deductible, meaning they can reduce your taxable income for the year you contribute. The money then grows tax-deferred until retirement, at which point withdrawals are taxed as regular income.

- This type of IRA is particularly beneficial for those who expect to be in a lower tax bracket during retirement compared to their working years.

- Roth IRA:

- Unlike its traditional counterpart, Roth IRA contributions are made with post-tax dollars. This means there’s no immediate tax deduction. However, the significant advantage is that the money grows tax-free, and withdrawals during retirement are also tax-free.

- Roth IRAs are ideal for those who anticipate being in a higher tax bracket during retirement or those who prefer tax-free withdrawals.

Both Traditional and Roth IRAs have annual contribution limits, which are subject to change and should be regularly checked. Furthermore, there are income limits for Roth IRA contributions, so high earners might be phased out from contributing directly.

2.2. Solo 401(k) Plans

For those remote social media professionals who operate as independent contractors or have their own businesses, the Solo 401(k) offers an excellent retirement savings option.

- Structure & Benefits:

- Similar to a standard 401(k) offered by employers, the Solo 401(k) allows individuals to contribute both as an employee and employer. This dual contribution structure can significantly increase the amount one can save annually.

- The plan also offers loan provisions, allowing participants to borrow from their account if needed.

- Contribution Limits:

- The Solo 401(k) typically has higher contribution limits than IRAs, given the dual contribution structure. As with other retirement accounts, these limits are periodically adjusted, so it’s vital to stay updated.

2.3. SEP-IRA

The Simplified Employee Pension (SEP) IRA is another tool tailored for freelancers, independent contractors, and small business owners.

- Structure & Benefits:

- A SEP-IRA allows employers (or self-employed individuals) to make contributions towards their employees’ (or their own) retirement. The contributions are tax-deductible for the business or individual, providing a significant tax benefit.

- The setup and maintenance of a SEP-IRA are relatively straightforward, making it a favorite for many small business owners and freelancers.

- Contribution Limits:

- One of the standout features of the SEP-IRA is its generous contribution limits, often much higher than Traditional or Roth IRAs. However, the contributions are solely employer-based; employees cannot contribute separately.

2.4. SIMPLE IRA

The Savings Incentive Match Plan for Employees (SIMPLE) IRA is designed for small businesses and offers both employer and employee contributions.

- Structure & Benefits:

- Employers are required to make contributions, either through a match or a non-elective contribution. Employees can also contribute, allowing for a combined approach to retirement savings.

- SIMPLE IRAs offer a straightforward setup, similar to SEP-IRAs, making them suitable for small businesses or freelancers with employees.

- Contribution Limits:

- While the contribution limits for SIMPLE IRAs are lower than SEP-IRAs or Solo 401(k)s, they still offer a decent amount, especially when considering both employer and employee contributions.

Selecting the right retirement account is a critical step in ensuring a comfortable retirement. By understanding the nuances, benefits, and limitations of each option, remote social media professionals can tailor their retirement strategy to their specific needs, optimizing savings and tax benefits.

3. Effective Strategies for Retirement Planning

3.1. Starting Early and the Magic of Compounding

The saying “time is money” holds especially true when it comes to retirement planning. The earlier you start saving, the more time your money has to grow, harnessing the power of compound interest.

- Understanding Compound Interest:

- Compound interest is the interest earned on both the principal amount and any accumulated interest from previous periods. Over time, this results in the exponential growth of your savings.

- For instance, if you start saving at 25 instead of 35, the difference in total savings by retirement age can be staggering, even if the monthly or annual contribution remains the same.

- The Benefits of Starting Early:

- Beyond the mathematical advantage of compound interest, starting early instills a discipline of saving. It becomes a habit, ensuring consistent contributions throughout one’s working life.

- Early starters can also afford to take more risks with their investments, potentially leading to higher returns. Over time, as retirement nears, they can shift to more conservative assets, having already secured significant growth.

3.2. Diversifying Investment Portfolios

“Diversification” is a term often thrown around in investment circles, but its importance cannot be overstated. Essentially, it means spreading your investments across various assets to reduce risk.

- The Need for Diversification:

- No investment is free from risk. By diversifying, you ensure that poor performance in one asset won’t decimate your entire portfolio. Instead, losses in one area can be offset by gains in another.

- Diversification Strategies for Retirement:

- Stocks: Consider a mix of large-cap, mid-cap, and small-cap stocks. International equities can also add another layer of diversification.

- Bonds: Government, municipal, and corporate bonds offer varying degrees of risk and return.

- Real Estate: Real estate investment trusts (REITs) or direct property investments can offer growth and income.

- Alternative Assets: Commodities, hedge funds, and even certain high-risk, high-reward equities can be considered for a small portion of the portfolio.

It’s essential to periodically review and adjust asset allocations based on market conditions, personal financial goals, and risk tolerance.

3.3. Periodic Portfolio Rebalancing

Even with a well-diversified portfolio, market fluctuations can shift your asset allocations over time. Periodic rebalancing ensures that your investments align with your intended strategy and risk profile.

- Understanding Rebalancing:

- Rebalancing involves adjusting your portfolio to bring your asset allocation back to your desired mix. This might mean selling high-performing assets and buying underperforming ones to maintain the intended balance.

- Benefits of Rebalancing:

- Risk Management: Regular rebalancing ensures that you’re not overexposed to a particular asset, thus managing risk.

- Potential for Better Returns: By selling assets that have performed well and buying those that haven’t, you’re essentially practicing the principle of “buy low, sell high.”

- Implementing a Rebalancing Strategy:

- Set a regular schedule, whether quarterly, semi-annually, or annually. Some opt for a threshold approach, rebalancing when an asset class deviates by a certain percentage from the target.

Retirement planning is not a one-size-fits-all approach. It requires understanding the financial landscape, being proactive, and making informed decisions. By starting early, diversifying investments, and regularly rebalancing, remote social media professionals can pave the way for a comfortable and financially secure retirement.

4. Tax Implications and Retirement

4.1. Tax Benefits of Retirement Accounts

One of the significant incentives for investing in retirement accounts is the tax benefits they offer. These benefits can play a pivotal role in maximizing your savings and ensuring a more sizable nest egg for retirement.

- Traditional Retirement Accounts:

- Contributions to traditional retirement accounts, like a Traditional IRA or a 401(k), are made with pre-tax dollars. This means you can deduct these contributions from your taxable income, reducing your tax bill for the year.

- However, when you withdraw from these accounts in retirement, those distributions are taxed as regular income.

- Roth Accounts:

- Roth accounts, like Roth IRAs, work the opposite way. Contributions are made with post-tax dollars, meaning there’s no immediate tax benefit. However, these contributions grow tax-free, and withdrawals in retirement are also tax-free.

- Tax-Deferred Growth:

- Both traditional and Roth accounts offer tax-deferred growth. This means the dividends, interest, and capital gains within the account aren’t subject to taxes annually, allowing for more substantial compound growth.

4.2. Planning for Required Minimum Distributions (RMDs)

Once you reach a certain age, the IRS mandates that you start taking withdrawals from your retirement accounts. These are called Required Minimum Distributions or RMDs.

- Understanding RMDs:

- RMDs apply to most retirement accounts, including Traditional IRAs, SEP-IRAs, and 401(k)s. Roth IRAs are exempt from RMDs.

- The amount you must withdraw is calculated based on your age and account balance. Not taking these distributions or taking less than required can result in hefty penalties.

- Strategies to Minimize Tax Burden:

- Since RMDs from traditional accounts are taxable, they can push you into a higher tax bracket. To manage this, consider strategies like:

- Making qualified charitable distributions, which count towards RMDs but aren’t taxable.

- Converting a portion of your traditional account to a Roth account, reducing future RMD amounts.

- Since RMDs from traditional accounts are taxable, they can push you into a higher tax bracket. To manage this, consider strategies like:

4.3. Roth Conversions and Their Benefits

For those with significant savings in traditional retirement accounts, Roth conversions can offer substantial long-term tax benefits.

- The Conversion Process:

- A Roth conversion involves transferring a portion (or all) of your traditional retirement account to a Roth account. This amount is taxable in the year of conversion.

- Benefits of Roth Conversions:

- While the immediate tax hit can be substantial, the long-term benefits include tax-free growth and tax-free withdrawals. Moreover, since Roth accounts aren’t subject to RMDs, you have more control over your distributions in retirement.

- Roth conversions can be particularly beneficial in years where your income is lower, and you’re in a lower tax bracket.

Taxation plays a vital role in retirement planning. By understanding the tax implications of your retirement accounts and making informed decisions, you can optimize your savings, reduce your tax burden, and ensure a smoother financial journey into retirement.

5. Seeking Professional Financial Advice

5.1. The Role of Financial Advisors in Retirement Planning

While self-education is invaluable, the complex world of retirement planning can sometimes benefit from professional guidance. Financial advisors can offer personalized strategies, insights, and expertise that can greatly enhance your retirement preparation.

- Benefits of a Financial Advisor:

- Personalized Planning: Everyone’s financial situation and goals are unique. An advisor can tailor your retirement plan based on your specific needs, risk tolerance, and objectives.

- Expertise: The financial landscape, especially related to retirement, is continually evolving. Advisors stay updated with the latest trends, regulations, and opportunities, ensuring your strategy remains optimized.

- Holistic Approach: Beyond just retirement, financial advisors look at your entire financial picture, from debts to other investments, ensuring all aspects are working in harmony.

5.2. Choosing the Right Financial Advisor

With many professionals offering financial advice, selecting the right one for your needs is crucial.

- Credentials Matter:

- Look for advisors with reputable certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These credentials indicate a certain level of expertise and ethical standards.

- Understand Fee Structures:

- Advisors can be compensated in various ways: fee-only, fee-based, or commission-based. Fee-only advisors are often preferred as their compensation is not tied to product sales, reducing potential conflicts of interest.

- Check References and Reviews:

- Like any service, reviews, and references can provide insights into an advisor’s competence, integrity, and customer service.

- Compatibility:

- Your relationship with your financial advisor is deeply personal. Ensure you’re comfortable with them, trust their advice, and can communicate openly.

5.3. Leveraging Digital Tools and Robo-Advisors

In the digital age, technology offers another avenue for retirement planning.

- Robo-Advisors:

- These are digital platforms that provide automated, algorithm-driven financial planning services with minimal human intervention. They’re typically low-cost and offer a simple entry point for those new to investing.

- Popular platforms include Betterment, Wealthfront, and Ellevest.

- Benefits and Limitations:

- Benefits: Cost-effective, straightforward, and accessible. They offer automatic portfolio rebalancing and tax optimization strategies.

- Limitations: While they’re improving, robo-advisors can sometimes lack the personalized touch and holistic approach a human advisor offers.

- Hybrid Approaches:

- Some platforms combine the best of both worlds, offering digital tools with the option of consulting with a human advisor. This approach can offer a balance of cost-effectiveness, automation, and personalized guidance.

In the realm of retirement planning, the path can sometimes seem intricate and daunting. However, with the right tools, knowledge, and professional guidance, remote social media professionals can navigate this journey with confidence. Whether you opt for a traditional financial advisor, embrace digital platforms, or combine the two, the key is to remain informed, proactive, and focused on your long-term goals.

Conclusion

The world of remote work, especially within the social media domain, offers unprecedented freedom and flexibility. Yet, with this freedom comes a heightened responsibility to secure one’s financial future. Retirement planning, while seemingly a distant concern, holds the key to ensuring that the flexibility enjoyed today translates into a comfortable and financially secure tomorrow.

For remote social media professionals, the journey to a well-funded retirement is paved with challenges, from inconsistent incomes to navigating the vast ocean of retirement account options. But, as this article has shown, it’s also a journey brimming with opportunities. By harnessing the power of compound interest, diversifying investments, understanding tax implications, and leveraging both human expertise and digital tools, a rewarding retirement is within reach.

In the evolving digital landscape, the tools and strategies for retirement planning will continue to change. Yet, the fundamental principles remain the same: start early, invest wisely, and seek guidance when needed. As remote work continues to redefine the traditional workspace, it’s imperative for professionals in the realm of social media to redefine their approach to retirement. With foresight, discipline, and a commitment to long-term planning, the golden years can indeed be golden.

Additional Resources

Books on Retirement Planning:

- “The Bogleheads’ Guide to Retirement Planning” by Taylor Larimore, Mel Lindauer, Richard A. Ferri, and Laura F. Dogu:

- A comprehensive guide on retirement planning based on the investment philosophy of John Bogle, the founder of Vanguard. This book covers a wide range of topics, from saving strategies to tax considerations.

- “How to Make Your Money Last: The Indispensable Retirement Guide” by Jane Bryant Quinn:

- Quinn offers actionable advice on how to turn retirement savings into a steady paycheck that will last a lifetime.

- “Retire Inspired: It’s Not an Age, It’s a Financial Number” by Chris Hogan:

- A motivational approach to retirement planning, emphasizing the importance of setting clear goals and working towards them.

Online Tools and Calculators:

- Retirement Calculators:

- Tools like the AARP Retirement Calculator and Vanguard’s Retirement Nest Egg Calculator help estimate how much you need to save for retirement based on various factors.

- Robo-Advisors and Investment Platforms:

- Platforms like Betterment and Wealthfront offer automated investment services, making it easier for beginners to start their retirement planning journey.

Podcasts and Webinars:

- “The Retirement and IRA Show”:

- Hosted by Jim Saulnier and Chris Stein, this podcast delves into the intricacies of IRAs, tax planning, and retirement strategies.

- “Retirement Answer Man” by Roger Whitney:

- Whitney, a certified financial planner, answers listener questions and discusses various retirement-related topics in an engaging manner.

Professional Associations and Non-Profits:

- National Association of Personal Financial Advisors (NAPFA):

- A leading professional organization of fee-only financial advisors. They offer resources, events, and a directory to find qualified advisors in your area.

- The Employee Benefit Research Institute (EBRI):

- A non-profit that conducts research on retirement, health benefits, and other critical financial topics. Their reports and studies provide valuable insights for anyone planning their retirement.

While this article has aimed to provide a comprehensive overview of retirement planning for remote social media professionals, the journey to financial security is lifelong and ever-evolving.

As such, it’s beneficial to continue educating oneself, staying updated with the latest trends, and leveraging available resources. Whether it’s through books, online tools, podcasts, or professional associations, the more informed you are, the better equipped you’ll be to make sound financial decisions for a secure future.