Decoding Tax Strategies for Remote Social Media Professionals

Introduction

The digital revolution, coupled with recent global events, has given rise to a new workforce: remote workers. Among these, social media professionals stand out, seamlessly connecting brands to consumers, curating digital narratives, and driving online engagements—all from the comfort of their homes or co-working spaces. As enticing as this newfound freedom is, it introduces a myriad of tax implications that traditional on-site employees might never encounter.

For remote social media workers, understanding these tax nuances is paramount. The boundary-blurring nature of remote work can lead to questions about tax jurisdictions, eligible deductions, and reporting requirements. Moreover, as the landscape of remote work continues to evolve, tax regulations are in flux, with governments worldwide trying to adapt to this growing sector.

This guide delves into the intricate world of taxation for remote social media professionals. Whether you’re a seasoned remote worker seeking clarity on tax deductions or a newbie wondering about state tax obligations, this comprehensive article aims to address your concerns.

Armed with this knowledge, you can confidently navigate the tax season, ensuring compliance, maximizing returns, and focusing on what you do best: creating compelling social media content.

1. Understanding the Basics of Remote Work Taxation

1.1. The Distinction Between Employee and Independent Contractor

The foundation of your tax obligations often rests on your employment status. Are you an employee of a company or an independent contractor? This distinction, while seemingly simple, can dramatically influence your tax responsibilities.

- How tax obligations differ based on employment status:

- Employees: If you’re an employee, your employer typically withholds federal and state taxes from your paycheck. They’ll also contribute to Social Security and Medicare on your behalf. Come tax season, you’ll receive a Form W-2 detailing your earnings and withholdings.

- Independent Contractors: As a contractor, you’re essentially self-employed. No taxes are withheld from your payments, and you’re responsible for your own Social Security and Medicare contributions. Clients will provide you with a Form 1099-NEC if they’ve paid you more than a certain amount during the year.

- Common misconceptions about contractor status:

- Just because you work remotely doesn’t automatically make you an independent contractor. The IRS determines your status based on factors like behavioral control (how the company controls what you do) and financial control (how you’re paid). It’s crucial to clarify your status with your employer or client to avoid tax surprises.

1.2. State Tax Implications for Remote Workers

Navigating state taxes becomes more intricate when you’re working remotely, especially if your employer is based in a different state than you.

- Understanding residency and source income:

- Residency plays a pivotal role in determining your state tax obligations. Typically, you’ll owe taxes in the state where you reside. However, some states also tax non-residents earning income within their borders (source income). If your employer is based in such a state, you might have tax obligations there as well.

- Potential double taxation issues and how to avoid them:

- In scenarios where you owe taxes to two states, many states offer a credit for taxes paid to another state to avoid double taxation. It’s essential to check the specific tax agreements between states and claim any credits you’re eligible for.

1.3. International Tax Considerations

For those venturing into international remote work, tax considerations become even more multifaceted.

- Tax implications for those working for foreign companies:

- Earning income from a foreign entity doesn’t exempt you from US taxes. US citizens and residents are taxed on their worldwide income. However, there are provisions like the Foreign Earned Income Exclusion, which might allow you to exclude a portion of your foreign earnings from taxable income.

- Understanding tax treaties and foreign earned income exclusions:

- The US has tax treaties with several countries that aim to avoid double taxation for its citizens. If you’re paying taxes to a foreign government, these treaties might provide credits or exclusions on your US tax return, ensuring you aren’t taxed twice on the same income.

Taxation intricacies can be daunting, especially when navigating the multi-faceted world of remote work. By understanding the foundational elements of remote work taxation, from employment status to state and international considerations, you can better prepare for your tax obligations and optimize your returns.

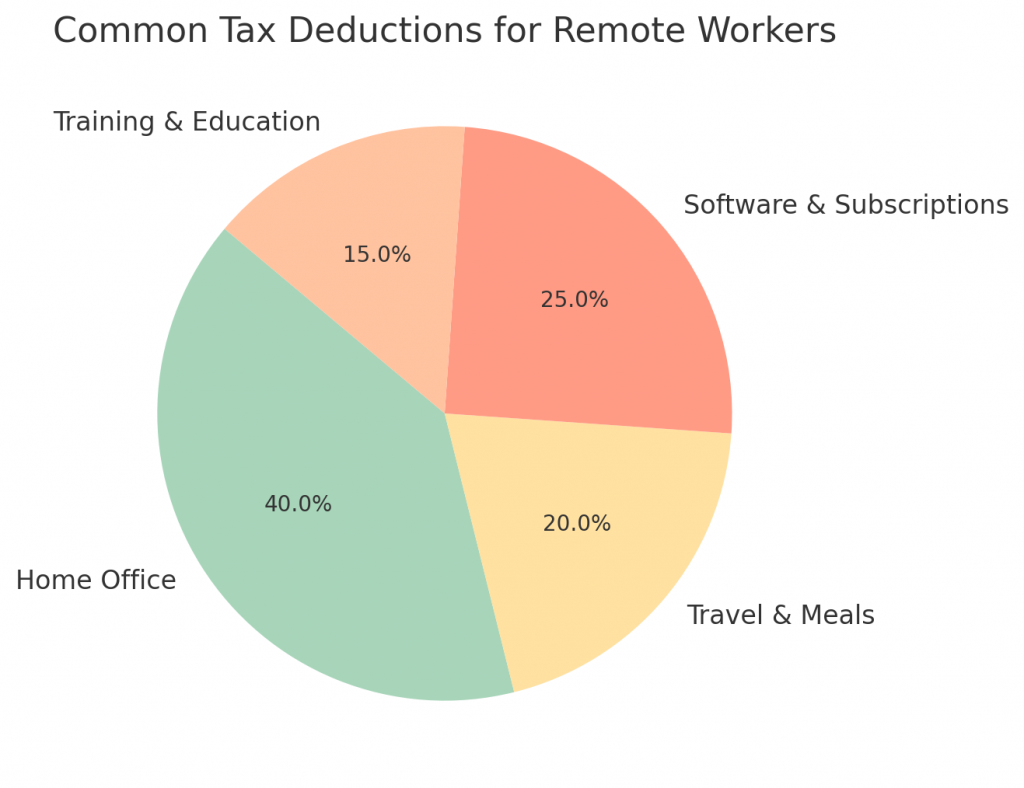

2. Deductions and Credits for Remote Social Media Professionals

2.1. Home Office Deductions

One of the most significant perks of remote work is the ability to design and operate from a personalized workspace. Fortunately, the IRS recognizes the costs associated with maintaining a home office and offers deductions to alleviate some of these expenses.

- Criteria for eligibility:

- Exclusivity: The space must be used exclusively for work. If you use your home office desk for both work and personal activities, it may not qualify.

- Primary place of business: The home office should be your main place for business activities. This means that even if you occasionally meet clients elsewhere, if you conduct most of your work from your home office, it’s eligible.

- Calculating and claiming the deduction:

- There are two methods to determine this deduction: the simplified option and the regular method.

- Simplified Option: Deduct $5 per square foot of your home office, up to a maximum of 300 square feet.

- Regular Method: Calculate the actual expenses of your home office, including mortgage interest, insurance, utilities, and repairs, and then determine the percentage of your home devoted to your office space.

- There are two methods to determine this deduction: the simplified option and the regular method.

2.2. Deductions for Tools and Software

In the realm of social media, staying at the forefront of technology is imperative. The tools and software you invest in not only enhance your efficiency but can also offer tax relief.

- Claiming expenses for social media management tools, design software, etc.:

- If you’ve purchased tools like Buffer, Hootsuite, Adobe Creative Cloud, or any other software essential for your work, these costs can be deducted. Remember to maintain records of all purchases and subscriptions.

- Understanding the line between personal and professional use:

- If you use software or tools for both personal and professional purposes, you can only deduct the portion used for business. For instance, if you use a graphic design tool 70% for work and 30% for personal projects, only 70% of the cost is deductible.

2.3. Educational and Training Deductions

The ever-evolving world of social media demands continuous upskilling. Fortunately, the IRS supports this endeavor by allowing deductions for educational expenses that enhance your job skills.

- Deductions for courses, webinars, and conferences:

- Whether it’s a course on the latest social media trends, a webinar on algorithm changes, or a conference featuring industry leaders, if it’s related to enhancing your professional skills, the associated costs (tuition, materials, travel) can be deducted.

- The ROI of continuous learning in freelancing:

- Beyond the immediate tax benefits, investing in education positions you as a knowledgeable professional in the field. This can lead to better client opportunities, higher rates, and a reputation as a trusted expert in the domain.

Managing finances as a remote social media professional involves juggling various expenses. By understanding the deductions available, from setting up a conducive workspace to investing in tools and education, you can significantly reduce your taxable income, ensuring you retain more of your hard-earned money.

3. Record-Keeping and Documentation

3.1. Importance of Meticulous Record-Keeping

In the domain of taxation, documentation is paramount. Proper record-keeping not only ensures smooth tax filing but also prepares you in the event of an audit.

- Why detailed records are crucial for remote workers:

- As remote social media professionals, your income and expenses might be scattered across various sources, clients, and tools. Detailed records ensure that no income goes unreported and no eligible deduction is overlooked. This systematic approach minimizes errors, reduces the likelihood of an audit, and ensures you’re capitalizing on all tax-saving opportunities.

- Potential tax audit triggers and how to avoid them:

- Discrepancies in reported income, excessive deductions, or large year-to-year fluctuations can raise red flags with the IRS. While audits are rare, they’re exhaustive and demanding. By maintaining thorough documentation of all transactions, invoices, and expenses, you can swiftly address any IRS queries and substantiate your claims.

3.2. Tools and Software for Tax Record-Keeping

Today’s digital landscape offers a plethora of tools designed to simplify the tedious task of financial record-keeping for freelancers.

- Overview of digital tools like QuickBooks, FreshBooks, and Wave:

- QuickBooks: This robust accounting software allows freelancers to track income, categorize expenses, and even calculate estimated taxes. Its intuitive dashboard offers real-time insights into your financial health.

- FreshBooks: Tailored for freelancers and small businesses, FreshBooks offers invoicing, expense tracking, and time tracking, ensuring all financial facets are addressed.

- Wave: A free alternative, Wave provides basic invoicing and accounting solutions, ideal for freelancers just starting their financial organization journey.

- Benefits of automating expense tracking and documentation:

- Automated tools not only save time but also enhance accuracy. By syncing bank accounts or using mobile apps to photograph and categorize receipts, you ensure real-time data entry, minimizing the risk of lost receipts or forgotten expenses.

3.3. Keeping Track of Payment Receipts

Every income, irrespective of its size, needs to be reported. Therefore, diligently tracking payment receipts is vital.

- Organizing and storing payment proofs:

- Create a systematic filing system, either digitally or physically, categorizing receipts by clients or projects. Tools like Dropbox or Google Drive can be used to store digital copies, while physical folders can organize hard copies.

- Digital versus physical record-keeping:

- While digital records offer convenience, accessibility, and space-saving benefits, some professionals prefer the tangibility of physical records. Choose a method that aligns with your comfort and ensures consistency in maintaining it.

Taxation, with its myriad rules and nuances, can be daunting. Yet, with disciplined record-keeping and the aid of modern tools, this task becomes manageable. As the adage goes, “The faintest ink is more powerful than the strongest memory.” By documenting every financial transaction, remote social media professionals can confidently face tax season, armed with accurate, detailed records, ready to maximize returns and minimize liabilities.

4. Quarterly Taxes and Estimated Payments

4.1. The Need for Paying Taxes Quarterly

The structure of the U.S. tax system is built on a “pay-as-you-go” principle. Instead of a once-a-year tax payment, the IRS expects regular contributions throughout the year, especially pertinent to freelancers and independent contractors.

- Understanding the IRS’s pay-as-you-go system:

- This system ensures that taxpayers are consistently contributing towards their annual tax obligations. For regular employees, this happens through paycheck withholdings. However, for independent contractors and freelancers, where no such automatic withholdings occur, the responsibility falls squarely on the individual to make these periodic payments.

- Determining if you need to make estimated tax payments:

- If you expect to owe at least $1,000 in taxes after subtracting withholdings and credits, you likely need to make estimated tax payments. This becomes particularly relevant for full-time freelancers or those who’ve had a significant increase in freelance income during the year.

4.2. Calculating Estimated Payments

Ensuring accurate estimated payments is crucial. Overestimation ties up your funds, while underestimation can lead to penalties.

- Tools and formulas to estimate quarterly tax dues:

- The IRS provides Form 1040-ES for calculating estimated taxes. This form considers expected adjusted gross income, taxable income, deductions, and credits. Additionally, online tools and software like TurboTax’s TaxCaster or QuickBooks can provide estimated payment calculations.

- Adjusting estimates based on income fluctuations:

- The freelance world is inherently unpredictable. If you experience a significant change in income during the year, it’s essential to adjust your estimated payments accordingly. This ensures you’re neither overpaying nor underpaying your due taxes.

4.3. Penalties for Underpayment and How to Avoid Them

The IRS imposes penalties for underpaying estimated taxes, making it vital to ensure accurate and timely payments.

- Consequences of not paying adequate taxes throughout the year:

- If you don’t pay enough taxes through estimated payments or withholdings, you may be charged a penalty. This is essentially an interest charge for not paying taxes on time, and the rate is determined by the IRS.

- Strategies to ensure timely and adequate tax payments:

- Consistency: Regularly review and adjust your estimated payments, especially if there’s a significant change in income.

- Safe Harbor Rule: If you pay at least 90% of the current year’s tax liability or 100% of the previous year’s tax liability (110% if your adjusted gross income is over $150,000), you can typically avoid an underpayment penalty.

- Annualized Income Installment Method: If your income varies considerably throughout the year, this method allows you to calculate payments based on actual quarterly earnings, which might reduce or eliminate penalties.

Managing quarterly taxes is an integral aspect of a freelancer’s financial journey. By understanding the importance of periodic payments, accurately calculating dues, and employing strategies to avoid penalties, remote social media professionals can ensure they’re in good standing with the IRS, avoiding unnecessary fines and enjoying peace of mind.

5. Seeking Professional Tax Help

5.1. When to Consult a Tax Professional

While many remote social media workers manage their taxes independently, there are scenarios when seeking professional guidance is invaluable.

- Scenarios where hiring an accountant or tax advisor is beneficial:

- Complex Tax Situations: If you’re juggling multiple income streams, have investments, or are dealing with international taxation, the complexity may warrant professional input.

- Major Life Changes: Events like buying a home, getting married, or having children introduce new tax considerations.

- Facing an Audit: If you’ve received an audit notice from the IRS, it’s prudent to have a tax professional guide you through the process.

- Complex tax situations faced by remote social media workers:

- With diverse clients, varied payment structures, and the potential for international work, remote social media professionals often have intricate tax profiles. A tax professional can offer clarity, ensure compliance, and optimize deductions in such scenarios.

5.2. Finding a Tax Professional Familiar with Remote Work

Not all tax professionals are created equal. For remote workers, it’s essential to find someone familiar with the nuances of freelance and remote work taxation.

- Researching and vetting potential tax consultants:

- Look for professionals with experience in freelance or gig economy taxation. Platforms like the National Association of Enrolled Agents or the American Institute of CPAs can be starting points. Also, consider referrals from fellow remote workers or freelance communities.

- Importance of industry-specific tax knowledge:

- A tax professional familiar with remote work will understand the unique deductions, income streams, and challenges faced by remote social media professionals. This expertise ensures that you’re not leaving money on the table and are compliant with all tax obligations.

5.3. Tax Planning for Future Financial Health

Beyond immediate tax filing, a proactive approach to tax planning can set the stage for long-term financial stability and growth.

- Proactive tax strategies for long-term financial stability:

- Consider tax-advantaged retirement accounts tailored for freelancers, like SEP-IRAs or solo 401(k)s. Additionally, explore strategies like income splitting or establishing an S-corporation to optimize tax liability.

- The benefits of year-round tax planning:

- Tax planning isn’t a once-a-year activity. Regular consultations with a tax professional can offer insights into financial decisions, from investments to business expansions, ensuring every step aligns with your long-term financial goals.

Taxes, while often viewed as a cumbersome obligation, are integral to a freelancer’s financial journey. By recognizing when to seek professional help, selecting the right expert, and adopting a proactive approach to tax planning, remote social media professionals can transform this obligation into an opportunity—a chance to optimize financial health, ensure compliance, and lay the foundation for a prosperous, secure future.

Conclusion

The realm of remote work, especially in social media, has blossomed into a significant sector of the modern workforce. With this rise comes the accompanying labyrinth of tax obligations. While the complexities might seem daunting initially, understanding them is paramount for any remote professional looking to optimize their financial health.

For social media professionals, the blend of creative and analytical tasks already demands a lot of their attention. Navigating the intricacies of taxation shouldn’t be an added burden. By understanding the basics of remote work taxation, capitalizing on eligible deductions, maintaining meticulous records, and seeking professional help when needed, these professionals can confidently face tax season.

In essence, taxation is more than just an annual obligation; it’s a reflection of a remote worker’s financial journey. By being proactive, informed, and strategic, social media professionals can ensure this journey is not only compliant but also optimized for maximum financial growth and stability.

In a world where digital platforms and remote engagements are continually evolving, staying informed about tax obligations is a constant. But with the right knowledge, tools, and professionals by your side, this challenge transforms into a manageable, even empowering, aspect of your freelance journey. As you curate content and narratives for the digital world, ensure you’re also crafting a compelling financial story for yourself—one of success, stability, and growth.

Additional Resources

Platforms and Tools Tailored for Tax Management:

- TurboTax Self-Employed: Specifically designed for freelancers and independent contractors, this platform provides tailored insights to ensure every deduction and credit is maximized. It also offers a quarterly tax estimation feature, ensuring you’re always prepared for your next payment.

- H&R Block Premium: Catering to freelancers, contractors, and investors, this software offers personalized tax guidance, especially beneficial for those with multiple income streams or complex deductions.

- TaxAct Freelancer: A budget-friendly option, TaxAct offers comprehensive coverage of freelance-specific IRS forms and schedules, ensuring a thorough and compliant tax filing.

Recommended Books on Taxation for Remote Workers:

- “Taxes for Dummies” by Eric Tyson and Margaret Atkins Munro: This comprehensive guide provides an easy-to-understand overview of the U.S. tax system, with specific insights beneficial for remote workers and freelancers.

- “The Freelancer’s Bible” by Sara Horowitz: While not solely focused on taxes, this book offers invaluable financial and business insights for freelancers, including tax planning and optimization strategies.

Online Courses on Tax Management for Freelancers:

- Udemy’s “Tax & Adjusting Entry Year-End Accounting Excel Worksheet”: This course offers freelancers a deep dive into managing annual tax obligations, with Excel worksheet templates to streamline the process.

- Skillshare’s “Freelance Taxation Basics”: A beginner-friendly overview of the U.S. tax system, this course provides freelancers with foundational knowledge to navigate their tax obligations confidently.

Freelance Communities and Forums:

- Freelancers Union: Beyond advocacy and networking, the Freelancers Union offers extensive resources on financial management, including webinars, articles, and tools tailored for freelance tax planning.

- Reddit’s r/freelance: Engage with a community of seasoned and novice freelancers, sharing experiences, seeking advice, and discussing the unique tax challenges of the freelance world.

As the landscape of remote work and freelancing continues to evolve, it’s paramount to stay updated and informed. These resources, spanning platforms, books, courses, and communities, are curated to empower remote social media professionals with the tools, knowledge, and networks they need to navigate their tax journey confidently. Embracing these resources can transform the daunting realm of taxation into an opportunity for growth, optimization, and financial empowerment.