Safeguarding Freelance Finances: The Role of Emergency Funds

Introduction

In today’s dynamic professional landscape, freelancing has emerged as a dominant force, offering individuals the allure of flexible hours, self-determined workflows, and the freedom to choose projects that align with their passions.

As of the last few years, millions have transitioned to freelancing, either by choice or as a response to the global shifts in employment structures. Yet, beneath the appeal of this autonomy lies a terrain riddled with financial unpredictability. Unlike traditional employment with its steady paychecks and safety nets, freelancing is marked by income ebbs and flows, making financial stability a constant challenge.

One of the cornerstones of financial prudence for freelancers is the establishment of an emergency fund. This fund serves as a buffer, shielding freelancers from the brunt of unexpected financial downturns. In a realm where the next paycheck is not always guaranteed, having a safety net is not just advisable—it’s imperative.

In this article, we delve into the critical importance of emergency funds in freelance work, providing insights and strategies to navigate the financial intricacies unique to the freelance domain.

The Unpredictable Nature of Freelance Income

Freelancing, by its very nature, is synonymous with unpredictability. Unlike salaried employees who can reasonably expect a consistent paycheck at regular intervals, freelancers must grapple with the reality of irregular income. This inconsistency can stem from various sources, each adding a layer of complexity to their financial planning.

Cyclical Income Streams

Every freelancer is familiar with the “feast or famine” cycle. There are months when work seems to pour in from every direction, followed by dry spells with little to no income. Several factors contribute to this cycle:

- Project-based work: Many freelancing gigs are project-based, meaning once a project concludes, there’s no guarantee of subsequent work from the same client.

- Seasonal demand: Certain freelancing fields, such as travel writing or holiday marketing, may see spikes in demand during specific times of the year and lulls during others.

Lack of Traditional Employment Benefits

Traditional employment often comes with a suite of benefits that go beyond the paycheck. Sick leaves, health benefits, paid vacations, and other perks are standard offerings. Freelancers, on the other hand, lack these safety nets:

- No paid leaves: If a freelancer falls ill or takes a vacation, there’s no income during that period. Every day not worked is a day not paid.

- Out-of-pocket expenses: From health insurance premiums to tools and software subscriptions, freelancers bear all costs directly, further straining their finances.

Economic Factors and Freelance Work

Freelancers are particularly vulnerable to broader economic shifts:

- Economic downturns: During recessions or economic crises, businesses often cut down on expenses, and freelancers, being external contractors, are among the first to feel the pinch.

- Industry-specific disruptions: Changes or disruptions in specific industries can directly impact freelancers specializing in those areas. For example, a significant algorithm change in a social media platform can affect social media marketers and content creators.

In the face of these challenges, a robust financial cushion becomes not just a tool for comfort but a necessity for survival. That’s where the emergency fund comes into play, offering a safety net during turbulent times.

What is an Emergency Fund and Why is it Crucial?

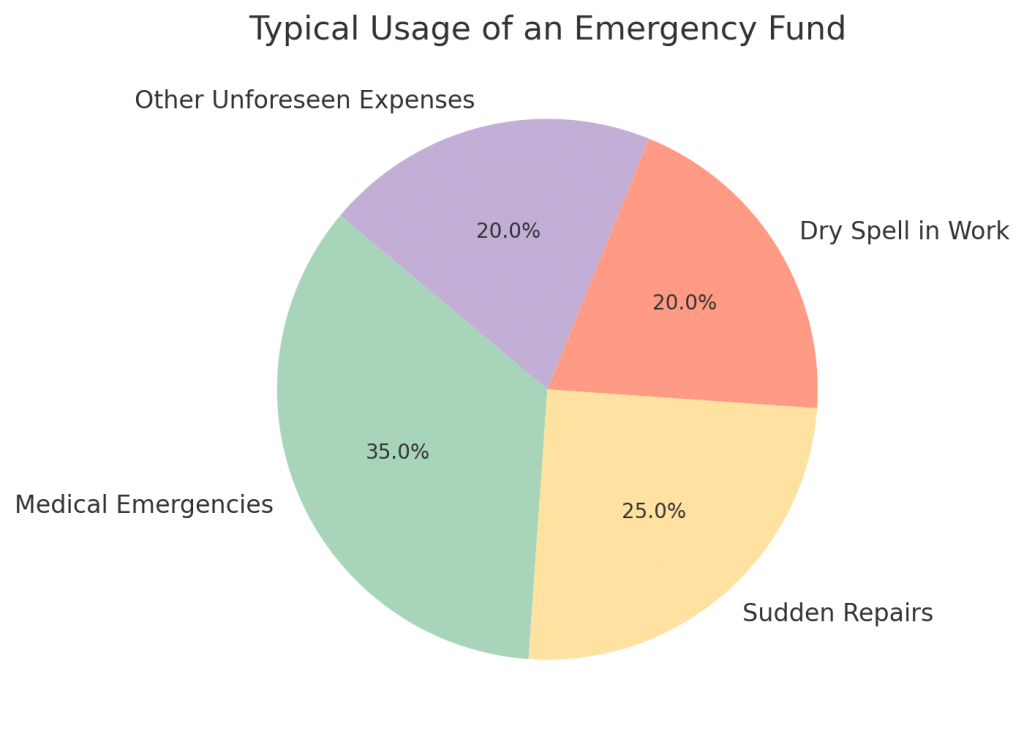

At its core, an emergency fund is a stash of money set aside to cover unexpected financial blows. These could range from medical emergencies to sudden car repairs, or, in the case of freelancers, an unexpected dry spell of work. This fund acts as a financial buffer, ensuring that when life throws curveballs, you’re not immediately plunged into debt or forced to make rash decisions.

Definition and Purpose of an Emergency Fund

An emergency fund is more than just a savings account; it’s a purpose-driven financial cushion. While savings might be for planned future expenses, such as a vacation or a new laptop, an emergency fund is exclusively for unforeseen financial setbacks.

- Immediate access: Unlike long-term investments, money in an emergency fund should be easily accessible, ensuring you can quickly cover unexpected expenses without liquidating assets or incurring penalties.

- Safety over growth: The primary purpose of an emergency fund isn’t to grow wealth but to provide stability. Therefore, these funds are typically kept in low-risk, easily accessible accounts like savings accounts or money market accounts.

Peace of Mind for Freelancers

For freelancers, the significance of an emergency fund extends beyond just financial security:

- Mental well-being: Knowing there’s a safety net can drastically reduce stress and anxiety, especially during lean months.

- Freedom to choose: With a financial buffer, freelancers can afford to be more selective in the projects they take on, prioritizing fulfilling work over the immediate need for cash.

- Investing in growth: An emergency fund can also provide the security to invest in professional growth, such as courses or certifications, without the fear of draining essential resources.

Mitigating the Impact of Unexpected Expenses

Life is rife with unpredictabilities, and freelancers, with their unique financial structures, can often feel the brunt more acutely:

- Medical emergencies: Without the cushion of employer-sponsored health insurance, medical emergencies can be financially draining.

- Equipment failures: For many freelancers, their tools, whether it’s a laptop, camera, or specialized software, are their lifelines. Any malfunction or need for sudden replacement can disrupt work and income.

- Client payment delays: Late payments or disputes can lead to cash flow challenges, making it difficult to cover immediate expenses.

In all these scenarios, an emergency fund steps in as a financial guardian, ensuring that setbacks don’t spiral into catastrophes. For freelancers, it’s not just a recommended financial practice; it’s a lifeline.

How Much Should Freelancers Save?

The golden question that often arises when discussing emergency funds is: “How much is enough?” The answer, while rooted in general financial wisdom, requires personal tailoring to each freelancer’s unique situation.

General Recommendations

Financial experts often offer a ballpark figure when discussing emergency funds, suggesting savings that can cover:

- Three to six months’ worth of expenses: This range is recommended for salaried individuals with a steady income.

- Six to twelve months for freelancers: Given the unpredictable nature of freelance income, a more extended buffer is advised.

These figures provide a foundational guideline, but it’s essential to delve deeper and consider individual factors.

Tailoring to the Freelancer’s Specific Situation

Several variables can influence the ideal size of an emergency fund:

- Fixed monthly expenses: These include rent or mortgage payments, utilities, insurance premiums, and any other recurring costs.

- Dependents: Freelancers with families or dependents might need a more substantial emergency fund than those without.

- Health considerations: Those with chronic health issues or without health insurance might need a more significant buffer to cover potential medical emergencies.

- Industry volatility: Freelancers in industries prone to significant fluctuations might consider saving more.

Adjusting the Fund Over Time

An emergency fund isn’t a static entity. As life changes, so should the fund:

- Annual reviews: At least once a year, freelancers should revisit their emergency fund, adjusting for any changes in expenses or financial situations.

- After using the fund: If a portion of the fund is used during an emergency, efforts should be made to replenish it as soon as possible.

In essence, determining the size of an emergency fund is a balancing act between general financial advice and individual circumstances. By aligning the fund with personal needs and regularly revisiting it, freelancers can ensure they have a robust safety net tailored to their unique journey.

Tips for Building an Emergency Fund as a Freelancer

Building an emergency fund, especially one substantial enough to cover several months of expenses, can seem daunting. However, with strategic planning, discipline, and a step-by-step approach, this financial milestone is entirely achievable. Here are some actionable tips tailored for freelancers to steadily grow their emergency funds.

Starting Small

The journey to a robust emergency fund begins with a single step. Don’t be disheartened if you can’t set aside large sums immediately.

- Micro-savings: Begin by saving small, manageable amounts regularly. Over time, these small contributions can accumulate into a substantial sum.

- Setting realistic goals: Instead of aiming for a six-month buffer right away, start with a one-month goal. Once achieved, gradually raise the bar.

Setting Aside a Percentage of Every Payment

Consistency is key in building savings.

- Automated savings: Consider setting up an automatic transfer of a specific percentage from your primary account to your emergency fund every time you receive a payment.

- Gradual increments: Start by saving a small percentage of each payment. As you become more comfortable, increase this percentage.

Using Financial Tools and Apps

The digital age has ushered in an array of tools designed to aid financial planning.

- Round-up savings apps: Apps like Acorns or Qapital round up your purchases to the nearest dollar, investing the difference into savings.

- Budgeting tools: Platforms like Mint or YNAB can help freelancers track their income, expenses, and savings goals efficiently.

- High-yield savings accounts: Consider parking your emergency fund in an account that offers a higher interest rate, ensuring your money grows, albeit modestly, over time.

Regularly Reviewing and Adjusting Savings Goals

An emergency fund should evolve with your financial landscape.

- Periodic assessments: Every few months, assess your progress. If you consistently achieve your savings goals, consider challenging yourself a bit more.

- Account for changes: Adjust your emergency fund goals in response to significant life events, like moving to a new city, health changes, or family expansions.

Building an emergency fund as a freelancer is both an art and a science. It requires discipline, foresight, and a commitment to long-term financial security. By leveraging modern tools, setting clear goals, and maintaining a consistent approach, freelancers can ensure they have a robust buffer against life’s unpredictabilities.

Mistakes to Avoid with Emergency Funds

While understanding the importance of an emergency fund and working towards building one is commendable, there are pitfalls that freelancers should be wary of. Avoiding these common mistakes can ensure that your emergency fund serves its primary purpose effectively and remains a reliable safety net.

Commingling Funds

One of the fundamental principles of sound financial management is the separation of funds based on their purpose.

- Separate accounts: Your emergency fund should have its dedicated account, separate from your regular savings or checking accounts. This ensures clarity and prevents unintentional spending.

- Avoiding temptations: With a separate account, it’s easier to resist the temptation to dip into the emergency fund for non-urgent expenses.

Using the Fund for Non-Emergencies

The clue is in the name: an “emergency” fund is strictly for unforeseen, urgent expenses.

- Define ’emergency’: It’s crucial to set clear parameters on what qualifies as an emergency. A sudden medical bill or urgent car repair might qualify, but a tempting sale on your favorite online store might not.

- Delay impulse purchases: Before using the emergency fund, give yourself a cooling-off period (24-48 hours) to determine if the expense is truly urgent and unavoidable.

Not Reviewing or Replenishing the Fund

Building an emergency fund isn’t a one-time task. It requires ongoing attention and management.

- Post-emergency actions: After you’ve had to use some of the funds, prioritize replenishing it back to its intended level.

- Regular reviews: As previously mentioned, your financial situation and monthly expenses may evolve. Regularly review the amount in your emergency fund to ensure it’s still adequate.

In essence, an emergency fund’s effectiveness hinges not just on its size but also on how it’s managed. By sidestepping common pitfalls and treating the fund with the respect and attention it deserves, freelancers can ensure they have a steadfast financial ally in their corner, ready to assist whenever life throws a curveball.

Beyond the Emergency Fund: Other Financial Considerations for Freelancers

While an emergency fund is a cornerstone of financial stability for freelancers, it’s just one component of a holistic financial plan. To truly safeguard their financial future and make the most of their earnings, freelancers should consider a broader spectrum of financial strategies and tools. Here’s a closer look at other pivotal areas of financial planning that warrant attention.

Retirement Planning

Freelancers don’t have the luxury of employer-sponsored retirement plans, making it imperative to take proactive steps towards a secure retirement.

- Self-directed retirement plans: Consider options like the Solo 401(k), SEP IRA, or SIMPLE IRA, tailored for self-employed individuals.

- Consistent contributions: Just as with the emergency fund, regular contributions, even if small, can lead to substantial growth over time, thanks to compound interest.

Health Insurance and Medical Costs

Without employer-sponsored health benefits, freelancers must navigate the often complex world of health insurance independently.

- Researching options: Explore health insurance marketplaces, professional associations, or group plans for freelancers.

- Health Savings Accounts (HSAs): If eligible, consider using an HSA to set aside pre-tax money for medical expenses. Not only does this offer tax benefits, but HSAs can also be invested, allowing for potential growth.

Investing and Growing Wealth

Once the foundational elements like an emergency fund and retirement savings are in place, freelancers can look towards wealth accumulation.

- Diversification: Spread investments across different asset classes (stocks, bonds, real estate) to mitigate risks.

- Robo-advisors: For those new to investing, robo-advisors can provide a hands-off approach, automating investments based on your risk tolerance and goals.

- Continuous learning: The financial world is vast and ever-evolving. Consider dedicating time to learn about different investment strategies, asset classes, and financial trends.

In conclusion, while the unpredictability of freelance income presents unique challenges, it also offers unparalleled opportunities for financial growth and security. By looking beyond just immediate needs and planning for the future, freelancers can not only weather financial storms but also chart a course towards lasting prosperity. Whether it’s the security of an emergency fund, the promise of a comfortable retirement, or the thrill of investment returns, a holistic approach to finances can turn the freelance journey into a fulfilling and financially rewarding adventure.

Conclusion

The world of freelancing, with its flexibility and freedom, is undeniably attractive. Yet, it comes intertwined with financial challenges that traditional employment often shields one from. Amidst the ebb and flow of freelance income, the emergency fund stands as a beacon of stability, ensuring that unexpected expenses don’t lead to financial turmoil.

But the journey doesn’t end at building this fund. It’s a foundational step in a broader narrative of financial prudence. As freelancers navigate the seas of self-employment, it’s essential to equip oneself with multiple financial tools, from retirement plans to investment strategies. Each tool, each strategy, adds a layer of security and growth potential to a freelancer’s financial portfolio.

In a landscape where the next paycheck isn’t always guaranteed, preparation becomes the key to prosperity. An emergency fund is more than just a safety net; it’s a testament to a freelancer’s commitment to their craft and their future. It signifies the understanding that while freelancing might be unpredictable, financial stability need not be.

In closing, every freelancer, whether just starting or well-entrenched in their field, must recognize the profound importance of financial planning. By prioritizing financial security alongside professional growth, freelancers can ensure that they’re not just surviving in their chosen field, but thriving, ready to face whatever challenges or opportunities come their way.

Additional Resources

For those freelancers inspired to dive deeper into the world of financial planning and management, a plethora of resources awaits. These tools and references can further enhance understanding, provide actionable strategies, and offer support in the ongoing journey towards financial stability and growth.

Books:

- “The Money Book for Freelancers, Part-Timers, and the Self-Employed” by Joseph D’Agnese and Denise Kiernan: A comprehensive guide addressing the unique financial challenges faced by freelancers.

- “You Need a Budget” by Jesse Mecham: While not exclusively for freelancers, this book offers a fresh perspective on budgeting that can be incredibly beneficial for managing irregular income.

Websites:

- Freelancers Union: A supportive community offering advice on various aspects of freelancing, including financial planning.

- Bogleheads: Rooted in the investment philosophy of John Bogle, the founder of Vanguard, this community provides insights into smart investment strategies.

Courses:

- “Financial Planning for Freelancers” on Udemy: A tailored course addressing the nuances of financial planning specifically for the self-employed.

- “Master Your Money” on Skillshare: A holistic look at personal finance, from budgeting to investing.

Apps:

- PocketGuard: An app that helps freelancers keep track of their finances, offering insights into spending patterns and potential savings.

- Honeydue: Particularly useful for freelancers with partners, this app allows couples to manage their finances collaboratively.

In the vast and sometimes overwhelming world of personal finance, these resources can serve as guiding lights. They offer both foundational knowledge and advanced strategies, catering to freelancers at every stage of their financial journey.

Remember, the path to financial stability and prosperity is a continuous learning process. By leveraging these resources and remaining committed to financial education, freelancers can confidently navigate the intricacies of their unique financial landscape.